Data from GVR’s Q4 2024 consolidated financial statements reveals impressive results, with revenue, profit, and gross profit margin all reaching high levels over the past several years. Revenue stood at 9,300 billion VND, a 23% increase from the previous year, primarily driven by the core business of natural rubber. There were also improvements in rubber products, wood processing, infrastructure, and real estate. Notably, gross profit nearly doubled, reaching over 3,000 billion VND, resulting in a gross profit margin of 33%, up from 21% in the same period last year.

In addition to higher rubber prices, this performance was supported by reduced borrowing costs, lower selling expenses, and significant profits from joint ventures and associates. As a result, net profit for the quarter reached nearly 2,000 billion VND, a 69% increase.

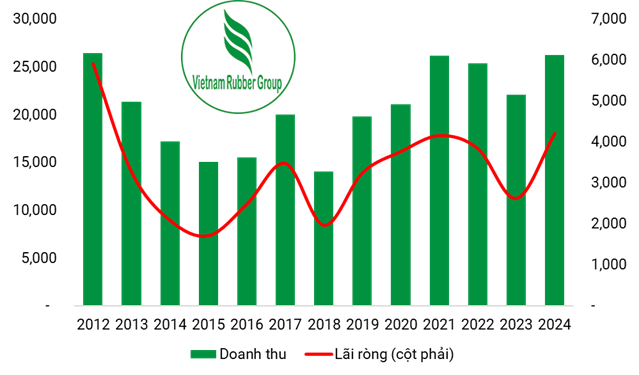

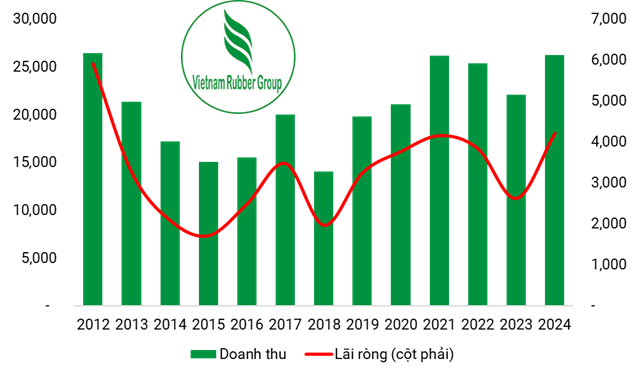

Vietnam’s rubber industry leader concluded its most successful year since 2012 – when rubber prices were at their peak – with revenue and profit exceeding 26,200 billion VND and 4,200 billion VND, respectively. This represents a 19% and 61% increase compared to the previous year.

|

GVR’s revenue and profit reach new heights after more than a decade (in billion VND)

Source: Author’s compilation

|

However, GVR’s success remains largely dependent on its primary business of rubber cultivation and extraction. At the 2024 year-end conference, Mr. Do Huu Huy, Vice Chairman of the Commission for the Management of State Capital at Enterprises, acknowledged the contributions of other sectors, such as industrial parks and hydropower, but noted their challenges regarding legal issues, climate change, and competition. Additionally, activities in rubber wood and rubber industry faced significant difficulties and were not effective.

As of the end of 2024, the Group continued to hold a substantial amount of assets in banks, with approximately 20,000 billion VND in term deposits and cash equivalents. This is notable when compared to the total short-term assets of over 27,700 billion VND. This strategy has provided stable interest income, with more than 1,000 billion VND earned in the past year.

Apart from financial success, GVR has made significant progress in its sustainable development strategy. The Group has obtained national and international sustainable forest management certificates for over 215,000 hectares of forest and implemented solutions to comply with the European Union’s Anti-Deforestation Regulations (EUDR). Currently, 34 member companies of GVR have developed sustainable forest management plans for a total area of approximately 287,000 hectares, of which 18 companies have achieved VFCS/PEFC-FM certification.

Regarding EUDR, a report by Phu Hung Securities (PHS) suggests that these policies are likely to disrupt and alter a portion of the natural rubber supply entering Europe. This development favors Vietnamese enterprises, particularly those well-prepared with sustainability certifications. According to the report, “The regulation will increase the demand for certified sources from producing units serving the European market, especially from the manufacturing powerhouse of China. This presents an opportunity for certified Vietnamese suppliers, as China currently accounts for 75%-80% of Vietnam’s rubber export value.”

Looking ahead to 2025, the natural rubber industry is expected to remain volatile due to supply shortages. Speaking at the Rubber Industry Workshop earlier this month, Ms. Arusha Das, Head of Pricing, Data, and Research at Helixtap, a global commodities data and information platform, attributed this pressure to the impact of climate change and geopolitical factors. In Southeast Asia, the world’s largest rubber-producing region, unusual weather patterns have caused an early leaf-falling season, significantly reducing output. Simultaneously, Côte d’Ivoire, a major rubber exporter in Africa, has imposed a ban on the export of cup lump (raw rubber), further limiting global supply.

Mr. Le Thanh Hung, Chairman of the Vietnam Rubber Association (VRA) and General Director of GVR, echoed these sentiments, stating that 2025 will be a challenging year due to climate change, emission reduction pressures, and the stringent requirements of EUDR. In the short term, rubber exporters are expected to increase sales before the regulations come into effect later this year.

Despite the challenges, the industry’s total export turnover is projected to reach 12.1 billion USD in 2025, representing a 10% increase from 2024.

Tu Kinh

– 18:18 31/01/2025