Duong Quang Ngai is the owner of the Fami soy milk brand

|

VNDirect quoted the leadership of QNS as saying in the latest business update report that the information is as follows: In January 2024, QNS’s revenue increased by 83% compared to the same period last year, reaching VND 1,047 billion, mainly due to the Lunar New Year falling later this year (in February), so distributors have increased stockpiling in January.

The sugar and soy milk segments saw strong revenue growth of 186% and 21% respectively compared to the same period last year, thanks to a volume increase of 150% and 20% respectively. Therefore, the company’s pre-tax profit reached 230 billion VND, an increase of 190%.

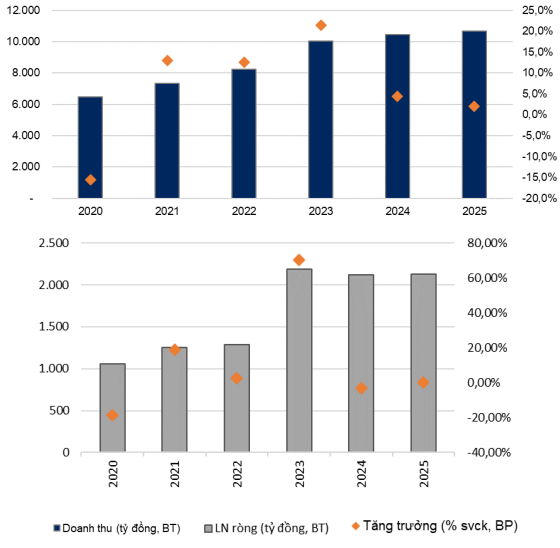

Prior to that, the company ended 2023 with a revenue of over 10 trillion VND and a net profit of nearly 2.2 trillion VND, an increase of 21% and 70% respectively compared to the previous year, and both are record figures to date. The main growth came from the sugar segment with a revenue increase of 105%, while the soy milk segment decreased by 7%.

*QNS’s 2023 revenue for the first time surpassed 10 trillion VND

| QNS’s business performance from 2007 to 2023 |

The company stated that in the context of the dairy industry’s declining consumption under the impact of weak purchasing power, QNS’s soy milk consumption is negatively affected by its main customers in rural areas, which are more sensitive to prices. In addition, traditional distribution channels (QNS’s main channels) are more affected by inflation compared to modern distribution channels.

However, the highlight is that QNS’s market share in the soy milk segment is gradually increasing in recent quarters thanks to marketing efforts. QNS currently holds about 80% market share of soy milk (in terms of production volume) in Vietnam.

In the future, QNS plans to launch a new soy milk product targeted at urban customers.

VNDirect forecasts that QNS’s soy milk revenue in 2024 will increase by 7.8% as purchasing power recovers, boosting the demand for milk of all kinds. Remarkably, in the second half of 2023, the company has locked in 70% of the soybean volume needed for production in 2024 at a price that is about 8% lower.

Regarding the sugar segment, although world sugar prices are cooling down, QNS’s leadership believes that domestic sugar prices will remain high in the first half of 2024.

Similarly, VNDirect predicts that domestic sugar prices will remain stable in the first half of 2024 in the context that most domestic sugar companies no longer have large inventories. In the long term, domestic sugar prices will adjust downward according to global sugar prices, but will still be higher than the average price from 2019-2021.

VNDirect forecasts that QNS’s sugar segment revenue in 2024 will increase slightly by 1.2% compared to the same period last year, mainly due to the increase in consumption volume, offsetting the price decline from the record high in 2023.

Therefore, QNS’s total revenue is expected to increase by 4.4% compared to the same period last year in 2024. In 2025, total revenue will increase slightly by 2.1%, thanks to a 3% increase in soy milk revenue and a 0.8% increase in sugar revenue.

Estimated net profit of QNS is expected to decrease by 3.3% compared to the same period last year in 2024 and remain flat in 2025, but still higher by 65% and 65.3% compared to the VND 1,287 billion level in 2022.

|

VNDirect’s business forecast for QNS

Source: VNDirect

|