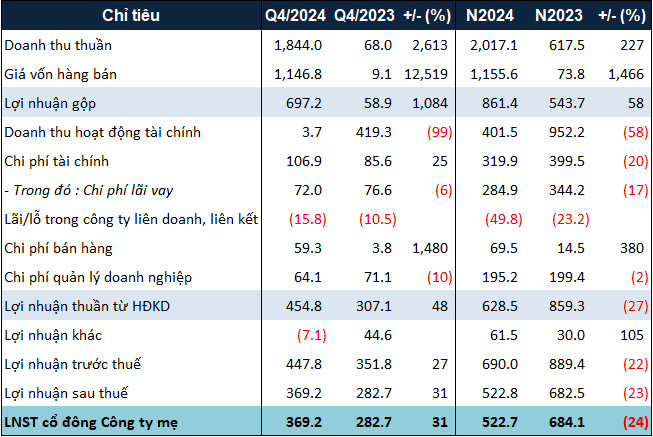

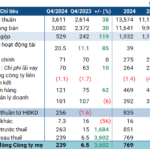

**PDR’s Q4 2024 Financial Results: A Comprehensive Overview**

In Q4 2024, PDR’s net revenue soared to over 1.8 trillion VND, a remarkable 27-fold increase from the previous year. This impressive growth was primarily driven by real estate transfer activities, contributing 99.6% to the company’s revenue. The company attributed this success mainly to the Bac Ha Thanh urban area project, known commercially as Quy Nhon Iconic.

On the other hand, PDR’s financial revenue for the quarter stood at nearly 4 billion VND, a 99% decrease due to a recorded profit of 415 billion VND from the transfer of a subsidiary in the same period last year.

Thanks to the momentum from the Bac Ha Thanh project, PDR’s net profit for Q4 reached over 369 billion VND, a 31% increase year-on-year. However, with setbacks in Q2 and Q3, the company’s full-year net profit for 2024 was 24% lower than the previous year, totaling nearly 523 billion VND.

Furthermore, with nearly 523 billion VND in net profit, PDR has achieved over 59% of its after-tax profit target of 880 billion VND set for 2024.

|

PDR’s 2024 Business Results. Unit: Billion VND

Source: VietstockFinance

|

On the balance sheet, PDR’s total assets as of December 31, 2024, exceeded 24.1 trillion VND, a 14% increase from the beginning of the year. The most notable increase was in short-term receivables, which grew by 89% to nearly 7.8 trillion VND. Of this, nearly 1.5 trillion VND was from customers purchasing the Bac Ha Thanh project.

The company’s payables decreased by 8% to nearly 8.4 trillion VND. This was mainly due to a significant reduction in PDR’s payable amount to Mr. Hoang Vo Anh Khoa, from over 1 trillion VND to just over 38 billion VND. Additionally, the company no longer recorded payables to three enterprises: CTCP Alpha Apus (100 billion VND at the beginning of the year), CTCP Dau Tu Bat Dong San BIDICI (nearly 761 billion VND), and Cong Ty TNHH Dau Tu Thuong Mai Van Tai Bien Minh Hai (over 160 billion VND).

Notably, while total payables decreased, PDR’s total borrowings increased by 72% to over 5.3 trillion VND. These borrowings were primarily bank loans to finance key projects such as Bac Ha Thanh and Thuan An 1 & 2.

Looking ahead, PDR shared that the Quy Nhon Iconic project will continue to be a highlight in the first half of 2025, with nearly 800 products from subsequent phases set to enter the market. Additionally, the Thuan An 1&2 complex housing area in Binh Duong is finalizing its legal procedures. Strategic projects such as Q1 Tower in Quy Nhon (Binh Dinh), the Nhu Nguyet commercial complex in Da Nang, Serenity Phuoc Hai in Ba Ria – Vung Tau, and the Con Dao complex resort are expected to contribute to revenue in the near future.

Ha Le

– 17:27 24/01/2025

The Highest Post-Tax Profit in 4 Years, Yet HQC Only Achieved 1/3 of its 2024 Plan

In 2024, Hoang Quan Trade Service Real Estate Consulting Joint Stock Company (HOSE: HQC) recorded a net profit of VND 33 billion, the highest since 2020. However, due to ambitious targets, the company only achieved 33% of its full-year after-tax profit goal.

Industrial Land Rental Revenue Plummets, KBC Loses Nearly 80% of 2024 Profits

In 2024, Kinh Bac City Development Holding Corporation (HOSE: KBC) experienced a less impressive performance compared to the previous year, with a 51% and 79% decline in revenue and profit, respectively. This was largely due to a significant 77% drop in land and industrial infrastructure leasing revenue. Consequently, the enterprise achieved only 12% of its profit plan.

The Poultry Baron: Dabaco’s Profitable Venture

Like the announced estimated profit results, the livestock giant Dabaco (HOSE: DBC) had its third-highest profitable year in its listed history, surging tens of times higher than the abysmal low of the previous year.