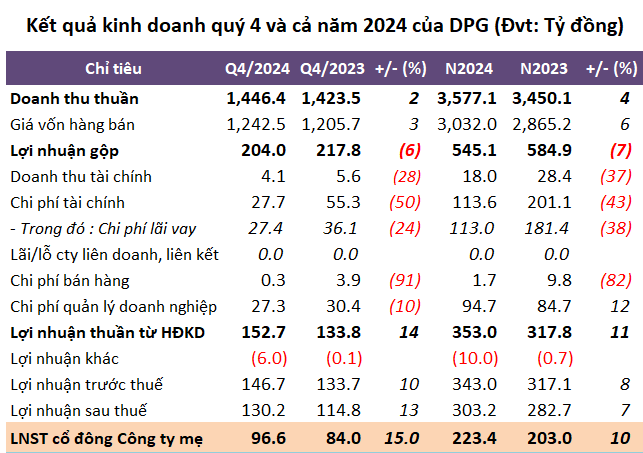

In Q4, Dat Phuong generated over VND 1,446 billion in net revenue, up 2% year-on-year, with the majority of its revenue coming from construction contracts totaling VND 1,251 billion. Due to a larger increase in cost of goods sold compared to revenue, gross profit decreased by 6% to VND 204 billion after deductions. The gross profit margin also decreased by 1 percentage point to 14%.

Total expenses amounted to VND 55 billion, a reduction of 38%, which was a positive aspect of the quarter, helping DPG achieve a net profit of nearly VND 97 billion, a 15% increase and the highest in the past seven quarters (from Q1/2023).

| DPG’s Financial Statements from Q1/2023 – Q3/2024 |

For the full year 2024, Dat Phuong recorded over VND 3,577 billion in net revenue, a 4% increase compared to 2023. The construction segment contributed nearly VND 3,035 billion, a 6% rise, while revenue from commercial electricity sales decreased by 9% to nearly VND 486 billion, and DPG had no revenue from real estate business (compared to VND 10 billion in the previous year). The company’s net profit for the year was over VND 223 billion, a 10% increase.

However, compared to the company’s targets for 2024, which were a revenue of over VND 4,566 billion and a net profit of over VND 254 billion, Dat Phuong achieved only 78% and 88% of these goals, respectively.

Source: VietstockFinance

|

As of December 31, 2024, Dat Phuong’s total assets were nearly VND 6,408 billion, a 4% decrease from the beginning of the year. The company had over VND 1,000 billion in cash and cash equivalents, a 29% reduction, accounting for 16% of total assets. Inventories amounted to VND 1,155 billion, a slight 1% increase.

The company’s total liabilities stood at over VND 3,796 billion, a 13% decrease from the start of the year, with financial borrowings of over VND 2,467 billion, a 3% reduction, making up 65% of total liabilities.

– 16:43 24/01/2025

The Forex Headwind: How Petrolimex Navigates a 15% Profit Plunge in Q4

Petrolimex (Vietnam National Petroleum Group, HOSE: PLX) experienced a significant decline in profits in Q4 due to volatile exchange rates. Despite this challenge, the Group achieved growth in its cumulative results, surpassing the plans approved by the 2024 General Meeting of Shareholders.

“FE Credit Races Back, VPBank’s Annual Profit Surges by an Impressive 85%”

Seizing the positive shifts in the economy during the year-end period, VPBank accelerated its breakthrough expansion of credit in strategic segments in the fourth quarter, contributing to an outstanding 85% year-on-year profit growth. The bank has been, and continues to, strengthen its foundation, expand its ecosystem, and create a solid launchpad for its sustainable growth strategy in the medium to long term.