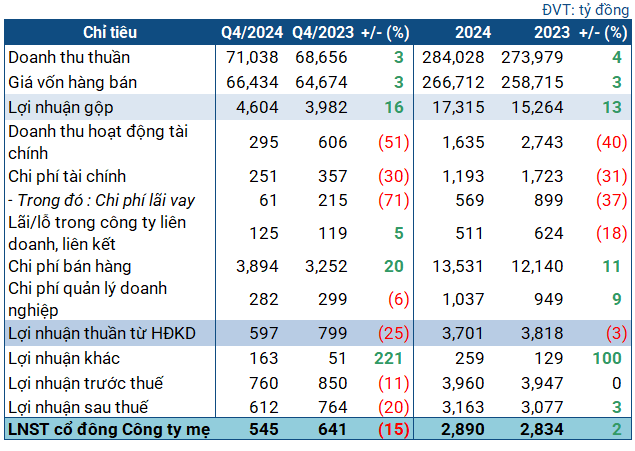

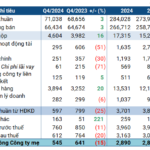

## Business Performance Indicators of Petrolimex in Q4 and Full-Year 2024

|

Petrolimex’s business performance indicators for Q4 and full-year 2024

Source: VietstockFinance

|

According to the consolidated financial statements for Q4 2024, Petrolimex recorded over 71 trillion VND in net revenue, a slight increase compared to the same period last year. After deducting the cost of goods sold, gross profit reached 4.6 trillion VND, a 16% growth.

However, financial revenue for the period decreased significantly by 51%, to 295 billion VND. Additionally, enterprise management expenses surged by 20%, reaching nearly 3.9 trillion VND. Despite an additional profit of 163 billion VND (compared to 51 billion VND in the previous period), Petrolimex’s net profit decreased by 15%, to 545 billion VND due to these two factors.

The company attributed the profit decline to the significant fluctuations in exchange rates during the last three months of the year. The increased volume of purchases from foreign suppliers resulted in higher foreign exchange losses compared to the previous year.

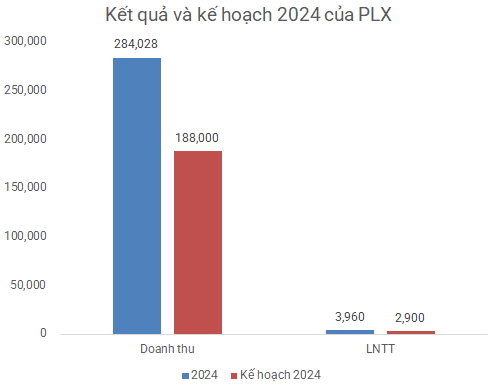

Overall, Petrolimex’s business performance for the full year remained relatively positive. The company achieved over 284 trillion VND in net revenue in 2024, a 4% increase. Net profit reached nearly 2.9 trillion VND, a 2% growth. Compared to the plan approved by the 2024 Annual General Meeting of Shareholders, the company exceeded revenue and after-tax profit targets by 51% and nearly 37%, respectively.

Source: VietstockFinance

|

As of the end of 2024, Petrolimex held over 81.4 trillion VND in assets, a slight increase from the beginning of the year. Of this, more than 60 trillion VND was in short-term assets, a 5% increase. Cash and cash equivalents held were over 30 trillion VND, a slight decrease. Inventories reached nearly 15.7 trillion VND, a 7% increase.

On the capital side, most of the company’s liabilities were short-term, totaling over 51 trillion VND. Short-term borrowings accounted for nearly 17.4 trillion VND, a 9% decrease. The quick ratio was below 1, but given the nature of the oil and gas industry with large inventory turnover, there are no concerns about the company’s ability to meet its debt obligations.

– 14:48 26/01/2025

Industrial Land Rental Revenue Plummets, KBC Loses Nearly 80% of 2024 Profits

In 2024, Kinh Bac City Development Holding Corporation (HOSE: KBC) experienced a less impressive performance compared to the previous year, with a 51% and 79% decline in revenue and profit, respectively. This was largely due to a significant 77% drop in land and industrial infrastructure leasing revenue. Consequently, the enterprise achieved only 12% of its profit plan.

Record-Breaking Profits for Rubber Group Since 2012

The rubber price surge in Q4 has led to impressive revenue and profit figures for the Vietnam Rubber Group (HOSE: GVR), with results showing the highest figures in over a decade.