|

CSV’s Business Performance in Q4 and Full-Year 2024

Source: VietstockFinance

|

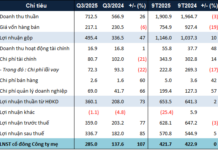

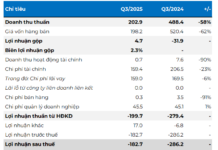

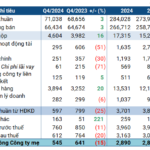

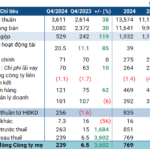

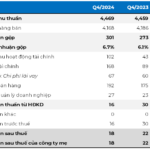

In Q4 2024, CSV reported revenue of VND 516 billion, a 20% increase year-over-year. Gross profit reached VND 134 billion, a 30% increase, with a gross profit margin improvement from 24% to 26%.

Other expenses saw significant increases, including a 49% rise in selling expenses and a 62% jump in administrative expenses. Despite this, the company still achieved a net profit of VND 73 billion, a 51% increase compared to the same period last year.

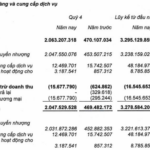

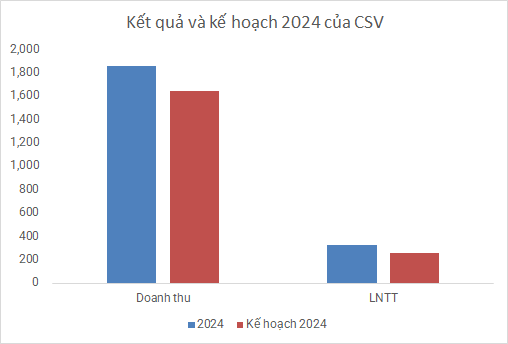

Similar to other Vinachem-affiliated companies such as BFC and HVT, CSV painted a bright picture for 2024. The company recorded nearly VND 1,900 billion in net revenue, a 17% increase from the previous year. Pre-tax profit and net profit increased by 14% and 16%, respectively, reaching VND 328 billion and VND 186 billion. CSV also surpassed its targets for revenue (13%) and pre-tax profit (26%) set for 2024.

Source: VietstockFinance

|

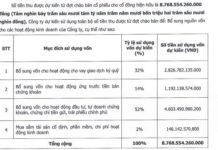

Despite the positive results, CSV remains cautious in its planning for 2025. According to a recently published resolution, the company aims for revenue of nearly VND 1,350 billion and after-tax profit of over VND 204 billion in 2025, representing respective decreases of 27% and 21% compared to 2024’s performance.

As of the end of 2024, CSV’s total assets increased slightly from the beginning of the year, reaching nearly VND 1,860 billion, with the majority being short-term assets (nearly VND 1,500 billion, a 12% increase). The company holds nearly VND 778 billion in cash and deposits, an over 20% increase from the beginning of the year. Inventories decreased by 8%, amounting to more than VND 336 billion.

On the liability side of the balance sheet, all payables are short-term, totaling VND 304 billion, a 6% increase. With the significant amount of cash on hand, there is no doubt about the company’s ability to service its debt. Short-term borrowings increased by 21% to over VND 122 billion, representing bank loans from the parent company.

– 07:00 25/01/2025

Delivering The Privia, KDH Achieves 2024 Profit Goals

Thanks to a surge in Q4 results, Khang Dien House Trading and Investment Joint Stock Company (HOSE: KDH) reported a 13% increase in consolidated net profit for 2024.

Ricons Profits Soar to Nearly VND 160 Billion in 2024, the Highest in Three Years

Impressive business results in the final quarter of 2024 propelled Ricons JSC’s annual profits to a three-year high, far surpassing expectations.