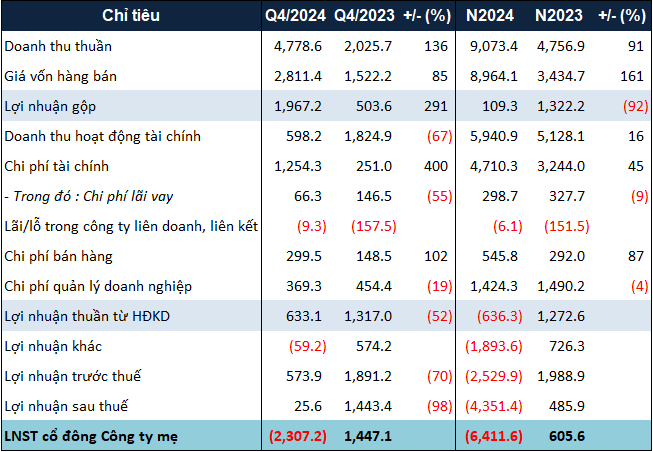

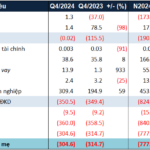

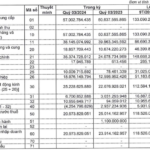

The consolidated BCTC for the fourth quarter of 2024 showed that NVL‘s net revenue and financial revenue for the full year 2024 increased by 91% and 16% respectively compared to the previous year, to over 9,000 billion VND and over 5,900 billion VND. Of this, net revenue from real estate transfers was nearly VND 8,400 billion, double that of 2023. Profit from lending was also more than 2.2 times higher than the previous year, at nearly VND 1,500 billion.

Revenue increased, but NVL‘s costs rose even higher. For example, the cost of goods sold was 2.6 times higher than the previous year, at nearly VND 9,000 billion. Financial expenses and selling expenses increased by 45% and 87%, respectively, to over VND 4,700 billion and VND 546 billion. Most notably, a loss of over VND 797 billion from the divestment of a subsidiary (Huynh Gia Huy Joint Stock Company) caused a significant increase in financial expenses.

As a result, the costs offset NVL‘s gains, leading to a net loss from business operations of over VND 636 billion.

But that’s not all. NVL‘s penalty payments in 2024 surged, causing the company to incur other losses of nearly VND 1,900 billion. This included over VND 1,600 billion in late tax payment penalties (over 35 times higher than the previous year); fines and compensation for breach of contract of over VND 580 billion (2.1 times higher); and additional administrative fines of over VND 16 billion.

Thus, for the 2024 fiscal year, NVL‘s net profit was negative VND 4,351 billion. Net profit after parent company tax was negative VND 6,400 billion for the year, marking the first time one of Vietnam’s real estate giants reported a loss.

|

Novaland’s 2024 Business Results. Unit: Billion VND

Source: VietstockFinance

|

On the balance sheet, NVL‘s total assets as of December 31, 2024, were nearly VND 238,200 billion, unchanged from the beginning of the year. Short-term cash holdings and inventory value continued to increase by 34% and 6%, respectively, to over VND 4,600 billion and over VND 146,600 billion. In contrast, total accounts receivable decreased by 13%, to over VND 70,700 billion.

On the other side of the balance sheet, payables decreased by 3%, to nearly VND 190,500 billion. However, total borrowings increased by 7%, to over VND 61,500 billion.

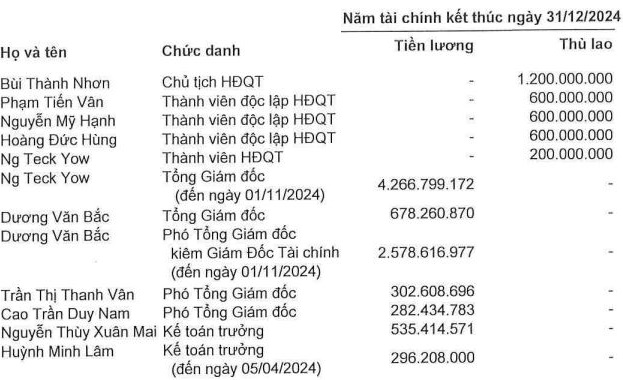

At the end of the year, the report showed that Chairman Bui Thanh Nhon did not receive a salary, but he earned a fee of VND 1.2 billion, the highest in the Board of Directors, and an increase from the previous year’s VND 1.1 billion. Mr. Ng Tech Yow, who served as CEO for a short time (resigning on November 1, 2024), received a salary of nearly VND 4.3 billion, corresponding to a monthly salary of nearly VND 430 million for the Malaysian former CEO.

|

Novaland’s Executive Compensation

Source: Novaland

|

– 09:53 25/01/2025

The Revenue Tune: LDG Struggles to Stay Afloat with a Second Year of Losses

With returned goods value surpassing revenue, LDG Joint Stock Investment Company (HOSE: LDG) suffered a net loss of nearly VND 778 billion in 2024.

The Failing Diagnostics Center: A Tale of Woes and Financial Turmoil

The latest financial report submitted to the Hanoi Stock Exchange (HNX) reveals that CityLab Company Limited continues to incur losses, with a deficit of nearly VND 3 billion in the first half of 2024. This marks a consistent trend of financial losses for the company, which has struggled with deficits of up to billions in previous years.