The advance payment rate in cash is 10% (equivalent to 1 share receiving 1,000 dong). The ex-dividend date is 11/03/2024, and the payment date is 27/03/2024. With over 10.8 million shares outstanding, SVC needs to allocate over 10.8 billion dong for this dividend payment.

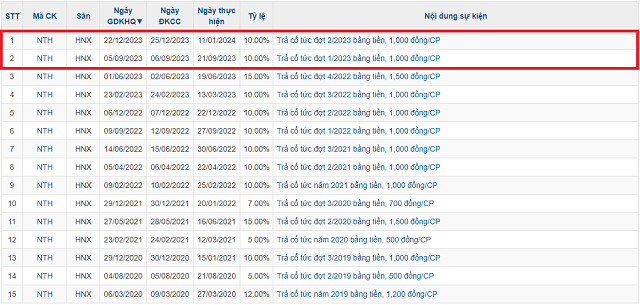

Prior to this, NTH had made 2 interim dividend payments in 2023 at a rate of 10% in cash, on September 21, 2023, and January 11, 2024. Therefore, the total dividend rate for these 3 payments is 30%, equivalent to over 32.4 billion dong, fulfilling the 2023 profit distribution plan.

|

Recent cash dividend payments by NTH

Source: VietstockFinance

|

In terms of business performance, in Q4 2023, NTH’s revenue reached 34 billion dong, a decrease of 9% compared to the same period. After deducting the cost of goods sold and other expenses, NTH’s after-tax profit was 16 billion dong, a decrease of 18% compared to the same period.

In line with the hydroelectric group’s situation last year, NTH said that unfavorable hydrological conditions led to a decrease in electricity output, resulting in lower profit compared to the same period.

For the whole year, NTH achieved 116 billion dong in revenue, a decrease of 14% compared to the previous year; after-tax profit was 55 billion dong, a decrease of 20%.

This company seemed to anticipate difficulties when setting modest targets at the 2023 shareholders’ meeting. Therefore, despite the decline in results, NTH still exceeded the revenue and profit targets for the year by 28% and 62% respectively.

| Recent business results of NTH |

In the stock market, NTH shares are trading around the historical peak. Closing at 54,000 dong/share on 19/02, an increase of nearly 15% in the past year. However, the average liquidity is relatively low, with only about 346 shares traded per day.

| NTH shares are trading around the historical peak since listing |