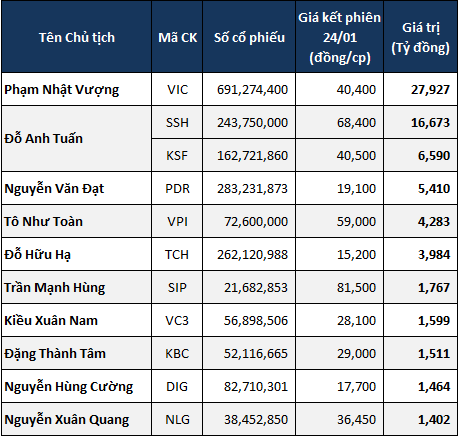

This article only considers the wealth of leaders who own shares in the companies they chair.

1.

Based on individual share ownership, Pham Nhat Vuong, Chairman of the Board of VinGroup (VIC), is currently the wealthiest real estate leader on the Vietnamese stock market.

With over 691 million shares valued at 40,400 VND each at the close of trading on January 24, Mr. Vuong’s wealth amounted to nearly VND 28 trillion on the eve of the Lunar New Year, 2025.

According to Forbes’ ranking as of January 24, 2025, Mr. Vuong was the 712th richest person in the world with a net worth of $4.1 billion.

2.

Ranking second in terms of wealth is Do Anh Tuan, Chairman of the Board of Sunshine Group JSC (HNX: KSF) and Sunshine Homes Development JSC (UPCoM: SSH).

Considering only his real estate holdings (nearly 244 million SSH shares and 163 million KSF shares), Mr. Tuan’s wealth exceeds VND 23 trillion. If we include his holdings in nearly 20 million shares of SCG Corporation (HNX: SCG) and nearly 18 million shares of Kien Long Commercial Joint Stock Bank (UPCoM: KLB), his total wealth is approximately VND 24.7 trillion.

3.

As the largest shareholder of Phat Dat Real Estate Development Joint Stock Company (HOSE: PDR) with over 283 million shares, Mr. Dat’s wealth on the stock market was recorded at more than VND 5 trillion at the close of trading on January 24, 2025.

4.

The soaring share price of Van Phu – INVEST Investment Joint Stock Company (HOSE: VPI) in the latter half of the year propelled its Chairman, To Nhu Toan, to sixth place on the list with 72.6 million VPI shares, equivalent to nearly VND 4.3 trillion.

This figure does not include the holdings of THG Holdings Investment Joint Stock Company, a related entity, or Mr. Toan’s family, who also hold a significant number of VPI shares.

5.

As the largest shareholder, holding over 39% of Hoang Huy Financial Services Investment Joint Stock Company (HOSE: TCH), the stock market wealth of Chairman Do Huu Ha stood at nearly VND 4 trillion at the end of January 24, 2025, ranking him fifth among real estate business leaders.

6.

The first real estate-industrial park business leader to appear on the list is Tran Manh Hung, Chairman of the Board of Saigon VRG Investment Joint Stock Company (HOSE: SIP). With SIP shares listed on the HOSE in 2023 and performing well in 2024, the total value of Mr. Hung’s nearly 21.7 million SIP shares exceeded VND 1.8 trillion on the eve of the Lunar New Year, 2025.

7.

With the upward trend of VC3 shares since the beginning of 2024, the nearly 57 million shares held by Kieu Xuan Nam, Chairman of Nam Mekong Group Joint Stock Company (HNX: VC3), were valued at nearly VND 1.6 trillion at the close of trading on January 24, 2025.

8.

After successfully transferring nearly 87 million KBC shares to a related company before the Lunar New Year, the “tycoon” of industrial park real estate, Dang Thanh Tam, Chairman of the Board of Kinh Bac City Development Holding Corporation (HOSE: KBC), currently holds over 52 million KBC shares, equivalent to 6.79% of the company’s capital. According to the market price at the close of trading on January 24, 2025, these shares were valued at more than VND 1.5 trillion.

In reality, Mr. Tam also owns over 10 million shares of Saigon Telecommunications Technology Joint Stock Company (HOSE: SGT) – the investor of Dai Dong – Hoan Son Industrial Park. The estimated value at the close of January 24 was nearly VND 200 billion. However, the main business of this company is still the wholesale of electronic and telecommunications equipment and components.

9.

After inheriting from his late father, the former Chairman Nguyen Thien Tuan, the current Chairman of the Board of DIG Investment and Construction Joint Stock Company (HOSE: DIG), Mr. Nguyen Hung Cuong, owns nearly 83 million shares, equivalent to 13.56% of the company’s capital. Despite the decline in the share price of DIG in 2024, due to the large number of shares held, Mr. Cuong’s total stock market wealth still amounted to nearly VND 1.5 trillion.

10.

NLG shares saw positive gains in the first days of 2025 after the company announced it had achieved its 2024 business plan. With over 38 million shares held, the total wealth of Nguyen Xuan Quang, Chairman of the Board of Nam Long Investment Joint Stock Company (HOSE: NLG), exceeded VND 1.4 trillion at the close of trading on January 24, 2025.

|

Top Wealthiest Leaders on the Stock Market at the End of the Year of the Dragon, 2024 (Share Price as of January 24, 2025)

Source: VietstockFinance

|

– 12:13 26/01/2025

“Vietnam: Shining Star in the $95 Billion ATP Stage of the Global Semiconductor Supply Chain”

The May 2024 report by the Semiconductor Industry Association (SIA) and BCG projects a significant growth for Vietnam in the Assembly, Testing, and Packaging (ATP) of chips, with its global market share expected to rise from 1% in 2022 to an impressive 8% by 2032.

The Vietnamese Stock Market Soars: A Surprising Rise to the Top in Asia

The Vietnamese stock market witnessed an unexpected surge in trading activity, with the VN-Index leading gains across Asia. This rally was characterized by a significant jump in trading volume and a return to net buying by foreign investors, setting the stage for a potential shift in market dynamics and investor sentiment.

The Ultimate Headline:

“The Big Shake-Up: Unveiling the Lucky Stocks for FTSE and VNM ETF’s Portfolio Restructuring”

As we approach the year-end portfolio restructuring, two large foreign ETFs, the FTSE Vietnam ETF and the VanEck Vietnam ETF (VNM ETF), with a combined NAV of nearly VND 18,000 billion, are expected to make significant adjustments to their investments.

Don’t Miss: “Trump 2.0: Opportunity or Challenge for Goods and Stocks in 2025?”

The US Presidential Election has concluded with Donald Trump reclaiming the White House. With his controversial policies from the previous term, there are expectations for significant global economic shifts. In light of this, Ho Chi Minh City Commodity Trading Joint Stock Company (HCT) hosted a unique offline event titled “Trump 2.0: Opportunities and Challenges for Commodities and Securities in 2025.” This pioneering program in Vietnam offered a comprehensive analysis of the top two investment channels: commodity derivatives and securities, providing insightful predictions for the upcoming year.