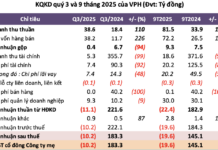

According to DKRA’s report, in 2024, the market witnessed a notable increase with 7,795 new condotel units, marking a 31% rise compared to the previous year and the highest level in the past four years. However, the majority of this supply came from the inventory of previous projects. Nonetheless, new supply still achieved an impressive 89% growth, mainly driven by a prominent project in Khanh Hoa.

The primary market for condotel transactions reached 3,088 units, 2.6 times higher than in 2023. However, buying power was concentrated in newly launched projects, while older projects experienced low liquidity or no transactions. Khanh Hoa and the Central region maintained their leading positions, accounting for 71% of the total supply and 79% of the country’s primary consumption.

Despite a slight 5% increase in primary market prices compared to the previous year, the market faced several challenges. Transactions were only present in projects with clear legal frameworks, developed by reputable investors, and with prices below VND 3 billion per unit. Supportive policies such as extended payment schedules, grace periods for principal payments, and interest rate subsidies continued to be implemented to stimulate demand.

Not only in Khanh Hoa but also in Da Nang and neighboring areas, significant growth was observed. The primary supply in these regions increased by 13% compared to 2023 but remained significantly lower than the pre-2019 phase. Notably, 87% of the supply came from inventory, while new supply, though tripled, was still concentrated in a single project in Da Nang. Primary transactions increased by 7.2 times, but overall demand remained weak, with transactions focused on specific projects.

Significant improvement in condotel supply and consumption compared to previous years. Source: DKRA

|

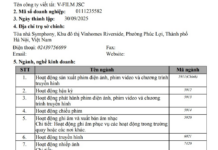

The shophouse and resort villa segments experienced the most subdued performance in four years.

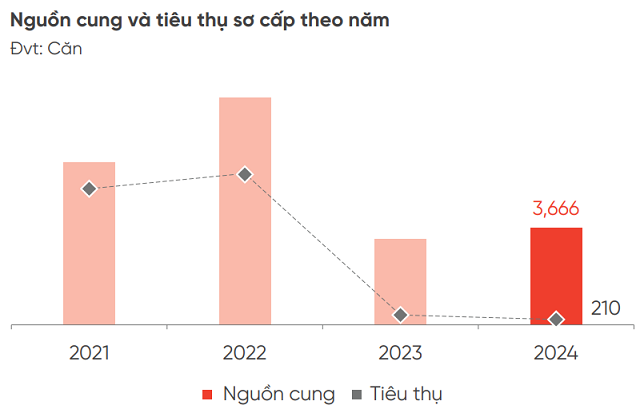

On the other hand, segments like shophouses and resort villas lacked positive signals. The shophouse supply reached 3,666 units, a slight increase from the previous year, but consumption dropped to 210 units, a 43% decrease and the lowest level in four years. While new supply also grew year-over-year, it remained concentrated in a single project in Khanh Hoa.

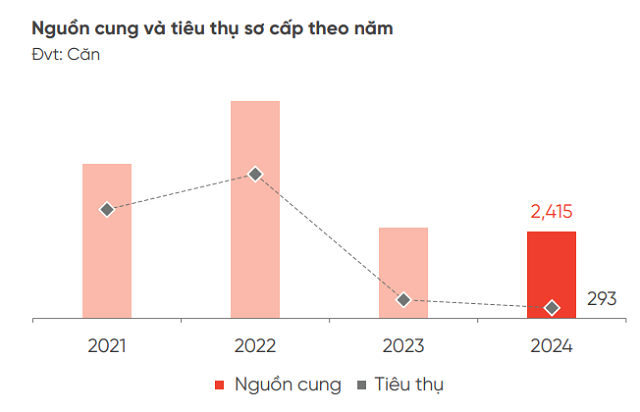

Resort villas witnessed 293 transactions, almost halving compared to the previous year. The primary supply of villas continued to decline by 5%, mainly in the Central and Southern regions, while numerous projects faced legal obstacles and had to halt development.

Despite the stability in selling prices across segments, supportive policies such as profit commitments, revenue sharing, interest rate subsidies, and fast-payment incentives fell short of expectations.

DKRA forecasts that in 2025, the vacation property market will not experience significant fluctuations. The condotel supply is expected to range between 2,500 and 3,000 units, concentrated in Ba Ria-Vung Tau and Quang Ninh. The resort villa segment is anticipated to witness a slight increase with 1,000-1,500 units, mainly in Hoa Binh and Ninh Thuan. Meanwhile, the shophouse segment is projected to supply 1,500-2,000 units, largely from Khanh Hoa.

Although there are signs of supply growth, market demand remains low as investor confidence has yet to be strengthened, and operational efficiency is not evident. Primary selling prices are expected to remain stable or increase slightly due to high input costs, while supportive policies on interest rates, extended payment schedules, and grace periods will likely continue.

Overall, the vacation property market in 2024 witnessed a localized recovery in certain areas of Khanh Hoa, Da Nang, and Quang Nam. However, the market still faces short-term challenges, particularly in legal, liquidity, and investor confidence issues. A comprehensive recovery will take time and require fundamental solutions to revive the market.

Continued decline in villa supply and consumption in 2024. Source: DKRA

|

Shophouse consumption plunges to a four-year low. Source: DKRA

|

– 14:12 21/01/2025