Vietnamese Stock Market Ends Week on a Positive Note, Experts Predict Continued Uptrend

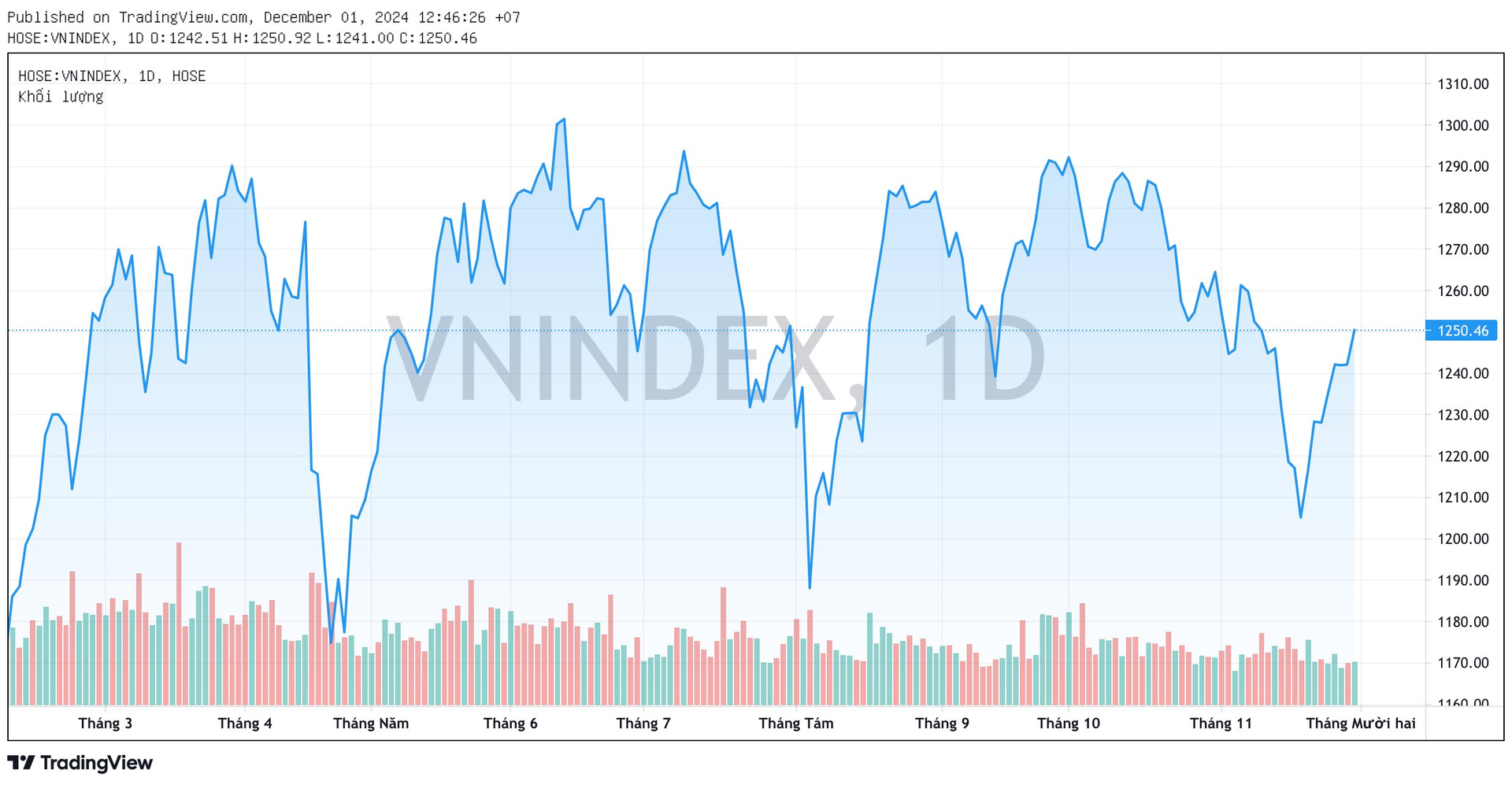

The Vietnamese stock market closed the trading week of November 25-29 on a positive note, recording a gain of over 22 points (+1.82%) compared to the previous week. The VN-Index ended at the 1,250-point level, and foreign investors net bought again, pouring over 1,100 billion VND, boosting investor confidence.

Looking ahead to the next week, most experts are optimistic that the stock market will continue its upward momentum, advancing towards the 1,270-point level and further to the 1,300-point mark in the last month of the year. Additionally, this is an opportune time for investors to accumulate high-quality stocks for medium and long-term investment, as valuations are currently at attractive levels.

Stock Market Prepares to Ride the Wave

According to Mr. Bui Van Huy, Executive Director of Ho Chi Minh City Branch – DSC Securities Joint Stock Company, Chairman of 1IB Joint Stock Company, the positive momentum of the VN-Index last week occurred amid the US stock market reaching new highs and the strong adjustment of the Dollar Index. However, it is worth noting that Asian markets are relatively weak at the moment.

Furthermore, supportive policies and developments in the domestic arena have bolstered investor sentiment. The National Assembly has passed several important laws and addressed key issues for the country. This has been accompanied by a shift in foreign investors’ behavior from net selling to net buying.

Despite the recovery, the VN-Index still witnessed low liquidity, and the rally has not been broad-based. In the coming week, experts believe that the market may continue to recover early in the week, reaching the 1,260-point region. This will be a strong resistance level as bull traps have repeatedly formed in this region. As the market enters its third recovery phase, selling pressure is likely to increase in the latter half of the week. Short-term positions should refrain from chasing prices and consider taking profits if they benefited from previous bottom-fishing strategies.

Mr. Huy expects liquidity to improve in the new year as liquidity bottlenecks in other investment channels are addressed.

Mr. Bui Van Huy, Executive Director of Ho Chi Minh City Branch – DSC Securities Joint Stock Company, Chairman of 1IB Joint Stock Company

Regarding the stock market’s performance in December, this month has typically offered attractive returns over the past decade, except for 2014 and 2018 when the market declined. However, it’s important to note that November is usually a strong month for the market, but this year, it ended in negative territory. Historically, the period around the new year has witnessed market rallies, and Mr. Huy expresses optimism about the prospects for the coming year.

Concerning foreign investors’ activities, the cessation of net selling by foreign investors can be attributed to the easing of inter-market pressures and the passing of the peak in capital outflows. “However, we must acknowledge a sad reality: as foreign investors gradually sell, their ownership ratio in the Vietnamese stock market has reached historical lows. To attract more capital from this group, the Vietnamese stock market needs more concrete and compelling investment narratives,” the expert emphasized.

As we approach the new year, Mr. Huy offers five investment themes to consider: the economy’s recovery trajectory, public investment acceleration, market upgrade expectations, and anticipated changes in laws and administrative procedures. Consequently, the Banking, Steel, Securities, and select manufacturing sectors with sustainable profit recovery are recommended for priority inclusion in 2025 portfolios.

Numerous Catalysts for the Stock Market in December and Early Next Year

Mr. Dinh Quang Hinh, Head of Macroeconomics and Market Strategy, VNDIRECT’s Analysis Division, attributes the market’s recovery to positive macroeconomic news both domestically and internationally.

Specifically, currency pressure eased last week as the DXY index retreated to around 106 after the Japanese Yen strengthened on expectations that the Bank of Japan would raise interest rates in upcoming meetings due to Japan’s inflation surpassing the 2% target.

Meanwhile, the interbank interest rate dropped below 5% following supportive moves by the State Bank of Vietnam. Moreover, credit growth reached 11.12% as of November 22, bolstering expectations for the full year’s credit growth to reach 14-15%. This bodes well for the prospects of bank stocks in the final quarter of the year.

As we enter December, Mr. Hinh anticipates that the market’s overall trend will remain positive as risk factors such as currency rates and short-term liquidity tensions ease. This expectation stems from the Fed’s likely decision to cut policy rates further in their December meeting and the significant improvement in domestic USD supply towards the year’s end.

Typically, export-oriented businesses tend to sell foreign currency to commercial banks during this period to facilitate local purchases, pay year-end bonuses to employees, etc. This, coupled with sustained positive FDI disbursements and remittances flowing into the country during the festive season, will help alleviate currency rate pressures.

Consequently, the State Bank of Vietnam will be able to shift its focus to other objectives, such as supporting system liquidity and credit growth, with the ambitious goal of achieving 15% credit growth for the year. Should credit growth meet this target and channel more funds into the economy, it would provide a significant boost to the stock market in December and early next year.

Therefore, the expert suggests that investors take advantage of market corrections to increase their stock holdings and build their investment portfolios for the coming year, prioritizing sectors expected to report positive fourth-quarter results, including technology, logistics, exports (garments, seafood), and banking.

Mr. Dinh Quang Hinh, Head of Macroeconomics and Market Strategy, VNDIRECT’s Analysis Division

VN-Index Could Return to the 1,300-Point Level in December

Commenting on last week’s performance, Mr. Nguyen Anh Khoa, Head of Research, Agriseco Securities, expressed that the recovery reflected investors’ cautious sentiment, evidenced by consistently low trading volumes compared to the 20-session average.

Looking ahead, the Agriseco expert predicts that the market will maintain its upward momentum early next week, aiming for the 1,270-point level. Selling pressure may increase again at this level as economic data from both domestic and international sources is updated towards the week’s end.

Historically, since the establishment of the Vietnamese stock market in 2000, there have been 13 years of price increases in December and 11 years of decreases. The simple average return during this month is +1.67%. In the last ten years, from 2014 until now, the VN-Index has seen five years of increases and five years of decreases, with a simple average return of +0.69%. Due to the small sample size, these results are for reference only and do not hold statistical significance.

Regarding the outlook for December 2024, Mr. Khoa anticipates that the market will continue its upward trend and may return to the 1,300-point level. Internal economic strength indicators, such as credit growth and progress in public investment disbursement, could provide psychological support, given the uncertainties surrounding exchange rates, foreign investors’ activities, the trajectory of interest rate cuts, and Trump’s tax policies.

On the subject of foreign investors, they net bought nearly 1,100 billion VND on all three exchanges last week. While this may seem encouraging, considering their net selling of nearly 90,000 billion VND since the beginning of the year, the recent net buying is relatively small and does not signify a reversal in the overall trend. Nonetheless, in the short term, the reduced selling pressure and net buying by foreign investors have positively influenced market sentiment.

Following a period of adjustment due to negative news about exchange rates and foreign investors’ net selling, the market is regaining stability, albeit with low trading volumes, indicating investors’ cautious stance. Mr. Khoa expects the market to maintain this positive trajectory, with liquidity gradually improving in the last month of 2025.

Several factors are expected to support the market in the coming period, including a stable macroeconomic environment and easing currency rate pressures thanks to the foreign currency supply from the trade surplus, FDI disbursements, and remittances during the year-end period.

As the market forms a short-term bottom and recovers, capital inflows may return and spread to sectors with high profit growth expectations in the fourth quarter, such as Retail, and sectors expected to benefit from supply chain shifts and the new US trade policies under President Donald Trump, including Exports (garments, seafood), and Industrial Zones.

Additionally, this is an opportune time for investors to accumulate high-quality stocks for medium and long-term investment, taking advantage of the currently attractive valuations.

Bac Giang Approved for Six New Industrial Parks in 2024

In 2024, Bac Giang province witnessed the expansion and establishment of six new industrial parks (IPs), the highest number ever.