A Rollercoaster of Emotions

Vietnam has been touted as a top destination for foreign businesses moving their investments out of the Chinese market. Its strategic location in the supply chain and open economic and political landscape make it an attractive alternative. The northern region, in particular, boasts a strategic position, connecting to China’s southern economic corridor, including Shanghai, Hong Kong, and Guangdong. Additionally, the northern provinces offer more land availability and lower industrial park (IP) land prices.

|

According to DXS-FERI, industrial real estate rents continued to rise in 2024, with a 6-8% increase compared to 2023. The average rent was 132 USD/m2 in the north and 185 USD/m2 in the south. |

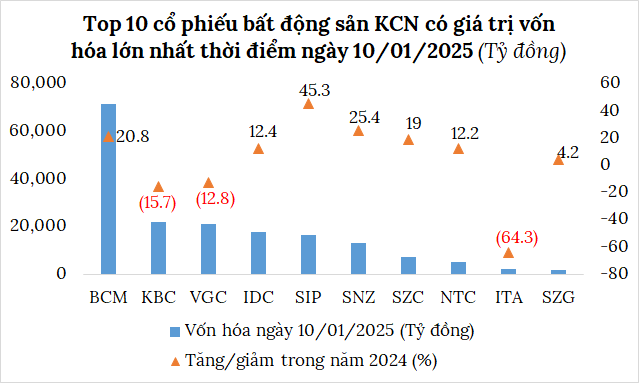

In the stock market, the VN-Index ended 2024 with a gain of over 12% from the beginning of the year. While the real estate industry saw a nearly 2% decline, the industrial real estate segment bucked the trend with a nearly 13.4% increase. This indicates that despite the lackluster performance of the overall real estate sector, industrial real estate remained a bright spot.

According to VietstockFinance, among the top 10 industrial real estate companies with the largest market capitalization, the shares of Saigon Investment Corporation VRG (HOSE: SIP) showed the strongest growth in 2024, surging by more than 45%.

SIP is one of the few industrial real estate companies permitted to provide electricity and water services within the IPs it operates. This business segment also accounts for the majority of SIP‘s revenue structure (around 90%).

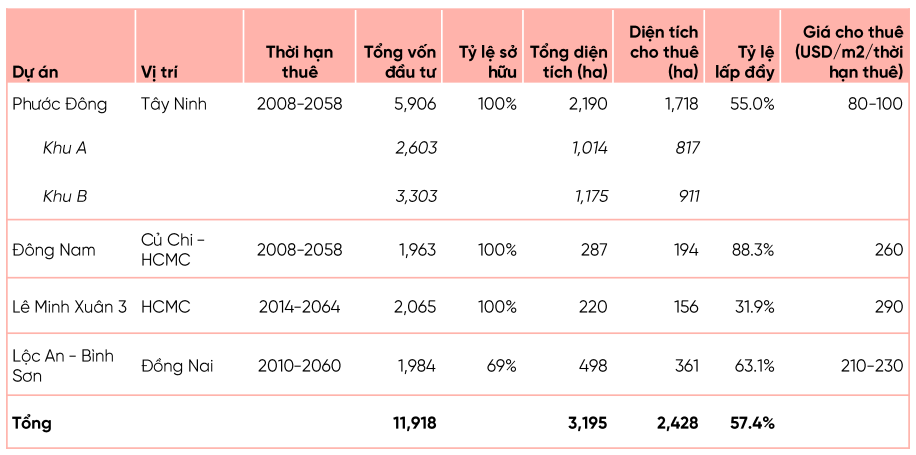

SIP currently leases and operates four IPs, spanning over 5,300 hectares. In 2024-2025, SIP plans to lease out 48 hectares and 52 hectares of industrial land, respectively. The Phuoc Dong IP and Loc An – Binh Son IP are expected to be the main contributors to this growth.

|

Portfolio of IPs operated by SIP

Source: VPBankS

|

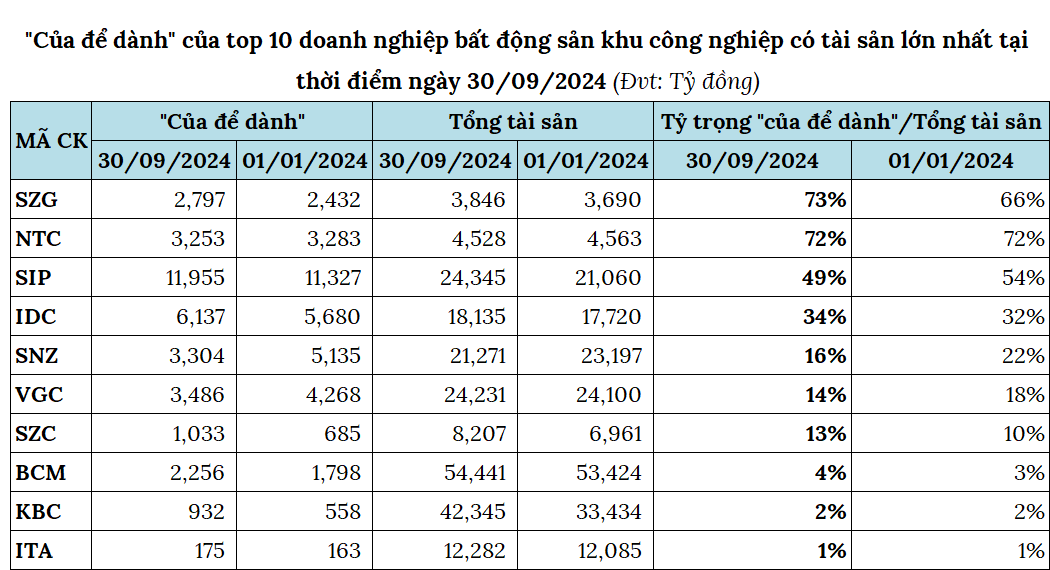

As of the end of Q3 2024, SIP‘s “reserved funds” were close to reaching the 12 trillion VND mark, accounting for nearly half of its total assets. In the long term, SIP has significant potential for a leap in business performance as the company shifts its recognition method from allocation over the lease term to a one-time recognition, following the trend among industrial real estate enterprises. This could be a reason for SIP‘s appeal to investors and its status as the hottest stock of the past year.

|

“Money from customers in advance” and “unearned revenue” are two indicators that investors refer to as the company’s “reserved funds,” as they will be recognized in the financial statements when the time comes. |

Following closely behind is the Joint Stock Company of Industrial Park Development (Sonadezi, UPCoM: SNZ), with a growth of over 25%. The shares of the giant Binh Duong IP – Becamex IDC (HOSE: BCM) and the Total IDC Corporation – Joint Stock Company (HNX: IDC) also increased by nearly 21% and over 12%, respectively, in 2024.

BCM currently operates seven IPs, spanning over 4,700 hectares, making it the largest IP investor in Binh Duong with a provincial market share of over 30% and a national share of about 5%. This Binh Duong IP powerhouse still has 847 hectares of commercial IP land and over 500 hectares of ready-to-lease IP land.

As of the end of Q3 2024, BCM‘s “reserved funds” stood at over 2,200 billion VND, accounting for 4% of its total assets.

Source: VietstockFinance

|

On the other hand, the shares of Tan Tao Investment and Industry Corporation (HOSE: ITA) witnessed the sharpest decline, plunging by over 64% in the past year. Meanwhile, the northern IP giant, Kinh Bac City Development Holding Corporation (HOSE: KBC), saw a nearly 16% drop, and the shares of the Total Viglacera Corporation – Joint Stock Company (HOSE: VGC) also decreased by almost 13%.

Source: VietstockFinance

|

Notably, ITA is one of the top 10 stocks with the largest decrease in value in 2024 and is currently under warning, control, restricted trading, and suspension of trading by the HOSE. As of November 11, 2024, ITA had submitted eight progress reports and requested that the HOSE remove its shares from the warning list. However, the HOSE has not yet issued an approval document. This could be a reason for the stock’s lack of appeal to investors. Making matters worse, on January 17, the HOSE announced that it would initiate the process of forcibly delisting ITA‘s shares.

ITA Receives “Forced Delisting” Verdict

ITA Share Price Movement in 2024

Riding the New Wave of FDI in the Semiconductor Sector

FDI inflows into Vietnam have maintained a growth trajectory over the years, thanks to the production shift trend and the country’s competitive advantages, including favorable investment policies, low labor costs, and a stable economy.

In 2024, total registered FDI reached over 38.2 billion USD, a 3% decrease compared to 2023. Among all sectors, real estate ranked second, with a total investment of over 6.3 billion USD, accounting for nearly 17% of the total registered investment and a 19% increase from the previous year.

The average occupancy rates in IPs in the north and south of Vietnam remained stable in 2024, with the north achieving 82% and the south reaching 91%.

Notably, in the 2023-2024 period, Vietnam demonstrated its potential to attract FDI in the semiconductor sector, with a significant increase in new investment projects in this field. Additionally, the escalating trade war between the US and China will serve as a catalyst for the continued shift of FDI to Vietnam. KBSV highly regards the IPs in the north due to their geographical proximity to China, which will be advantageous in attracting FDI in the semiconductor industry.

The supply of IP land is expected to continue increasing in 2025 and surge from 2026 onwards, following the implementation of the new land price framework. The predicted increase in supply is attributed to the gradual resolution of legal obstacles and the expansion of IP land through the conversion of rubber plantation areas.

In the 2021-2030 period, with high occupancy rates in the south, such as 93% in Binh Duong and 86% in Dong Nai, the main source of IP land supply in the southern region will come from the conversion of rubber plantations. This approach offers advantages in terms of large land areas, rapid site clearance, and low costs.

However, there are challenges in attracting FDI, including less favorable geographical locations, distant from major cities, airports, and seaports, as well as inadequate infrastructure, which increases investment costs. Additionally, the rising demand for rubber consumption could slow down the conversion process.

In 2024, the country approved 32 new IP investment projects, totaling over 10,400 hectares. The north led with 17 projects and nearly 3,600 hectares, followed by the south with 9 projects and 4,345 hectares, and the central region with 6 projects and nearly 2,476 hectares.

This positive development, along with more competitive rental rates in the region, will continue to attract FDI into Vietnam in the coming years.

– 10:00 26/01/2025

The Vietnamese Resilience: Bouncing Back Stronger from Global Upheaval

Vietnam is on the cusp of a golden era, poised to ride a new wave of foreign investment in the next seven to eight years, and become a regional manufacturing and logistics hub, according to Bruno Jaspaert, Chairman of the European Chamber of Commerce (EuroCham) in Vietnam.

The Critical Bottleneck: Indochina Capital Chairman’s Emphatic Message on Unlocking Vietnam’s Real Estate Market Potential

Peter Ryder, Executive Chairman of Indochina Capital and Board Member of Indochina Kajima, firmly believes that infrastructure is the foundation for Vietnam’s future growth, both in the real estate sector and the economy as a whole. He emphasizes that infrastructure is also the most critical bottleneck currently restraining the industry’s development.

Motivations for Achieving the 8% GDP Growth Target in 2025

The year 2025 is a pivotal “acceleration and breakthrough” period to achieve the goals set for the entire 2020-2025 term. Thus, the government aims to surpass an economic growth rate of 8% or 10% under favorable conditions to set the stage for double-digit growth in the subsequent phase.