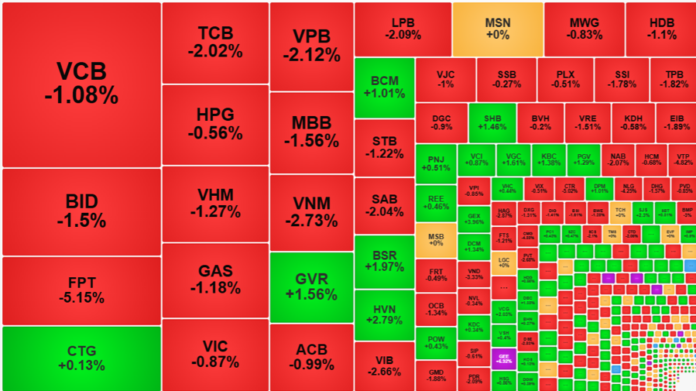

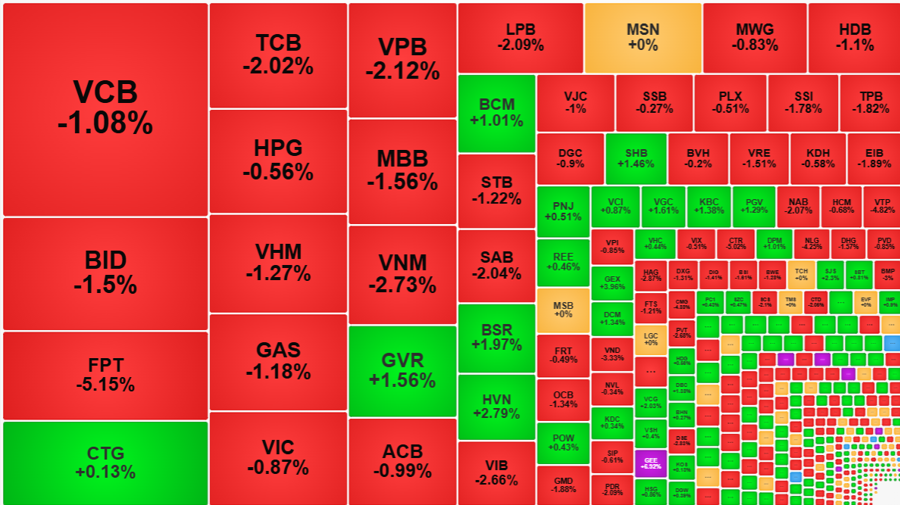

The VN-Index didn’t fare much better in the afternoon session, but many resilient stocks showed strength. The heavy sell-off of blue-chip stocks by foreign investors continued to weigh down the market, with the VN30-Index plunging to a 16-session low, led by FPT’s 5.15% loss.

The spotlight remained on FPT in the afternoon as bottom-fishers stepped in to curb the sharp decline witnessed in the morning session. However, the stock still faced significant pressure, with trading volume for the afternoon alone reaching nearly VND858.3 billion, accounting for 28.4% of the VN30 basket’s afternoon turnover.

Amid the massive sell-off, FPT extended its losses, falling an additional 1.15% in the afternoon session to close 5.15% below the reference price. This closing price was even lower than the morning’s low. Foreign investors offloaded over 2 million FPT shares, bringing their net sell figure for the day to VND508 billion (compared to a net sell of VND316.5 billion in the morning session alone).

FPT’s performance had a significant impact, particularly on the VN30-Index. The stock’s decline alone accounted for more than 7.9 points of the VN30-Index’s total loss of 22.13 points. As FPT currently holds the third position in terms of market capitalization on the VN-Index, its drop also had a substantial effect on the index, resulting in a nearly three-point loss.

The VN30-Index closed 1.65% lower, a worse performance compared to the morning session’s 1.39% decline. Statistics showed that 18 out of 30 stocks in the VN30 basket declined from their morning levels, while only nine managed to improve. Some of the top performers from the morning session also witnessed a pullback in the afternoon, with GVR falling to close 1.35% lower than its morning high, ultimately ending the day up by just 1.56%. Additionally, most of the largest caps weakened further: TCB fell over 1% from its morning level, closing down 2.02%. VCB, VPB, VNM, BID, CTG, and HPG also showed signs of fatigue.

Foreign investors sold VND1,277 trillion worth of stocks in the VN30 basket, with FPT accounting for VND508 billion of that amount. Their total sell figure for the basket reached VND2,338 billion, equivalent to 34.1% of the basket’s total trading value—an extraordinarily high proportion. Additionally, aside from FPT, they offloaded substantial amounts of other stocks, including VNM (-VND315.3 billion), MWG (-VND75.9 billion), CTG (-VND66.5 billion), VHM (-VND59.3 billion), VCB (-VND53.9 billion), VPB (-VND41 billion), BID (-VND33.9 billion), SSI (-VND30 billion), and HPG (-VND27.4 billion). On the HoSE exchange as a whole, they were net sellers to the tune of VND1,461.3 billion, with the majority of these sales being regular trades.

However, the market did witness some positive developments in the afternoon. While the decliners outnumbered the advancers, several stocks managed to hold their ground or recover. At the close, the VN-Index still had 166 gainers versus 308 losers, with 83 stocks rising by more than 1%. Naturally, small and mid-cap stocks continued to shine. GEX, HAH, VCG, KBC, and BAF traded in the hundreds of billions of VND and saw strong gains. The group of VGC, DPM, DBC, DCM, NKG, HVN, CSV, and BCG also held up well, despite lower trading volumes. Moreover, a slew of stocks hit their daily limit-up, including ADS, DAH, GEE, SGN, TNT, DLG, SHI, VPG, and QCG.

On the downside, while blue-chip stocks dominated the list of decliners in terms of liquidity, there were also some notable mid-cap stocks. Among the 308 losers on the VN-Index, 97 fell by more than 1%, led by blue chips such as FPT, VNM, STB, and SSI. Some mid-cap stocks that stood out included DXG, which fell 1.31% with a trading volume of VND175.6 billion; DIG, down 1.41% with a volume of VND164.3 billion; VND, declining 3.33% with a volume of VND160 billion; VTP, dropping 4.82% with a volume of VND114.8 billion; and PVT, falling 2.68% with a volume of VND105.4 billion.

On the bright side, many of the heavily traded decliners managed to trim their losses by the close, indicating a degree of recovery thanks to bottom-fishing demand.

In reality, the market is currently in the thick of Q4/2024 earnings season, so any external influences will be counterbalanced by positive internal news. The emergence of bottom-fishers suggests that some investors are still optimistic about the opportunities presented by the market’s external turbulence. Today’s matched trading volume on the two exchanges surged 16% from the previous session, reaching nearly VND13,488 billion—the highest level in the last 20 sessions. Notably, foreign investors’ purchases on the HoSE exchange accounted for only about 12.2% of the total trading volume.

The Red-Hot Market: FPT in the Eye of the Storm, Foreign Outflows Galore

The investor community reacted rather negatively on the first trading session of the Year of the Wood Snake, as Vietnamese markets reopened after a two-week Lunar New Year holiday amidst a volatile international backdrop. The tech-heavy NASDAQ composite index fell sharply, and this was reflected in the performance of FPT Corporation, which faced the brunt of the selling pressure. The stock tumbled as global tech stocks experienced a broad-based decline, with the impact of this trend finally catching up to the Vietnamese market.

The Foreign Block Continues to Dump Tech Stocks, with Particularly Strong Sell-Offs in FPT

Liquidity across all three exchanges surged today, with a massive 15.7 trillion VND in matched orders. The foreign bloc remained a weak link, offloading another 985.6 billion VND, with 632.9 billion VND in matched orders alone.