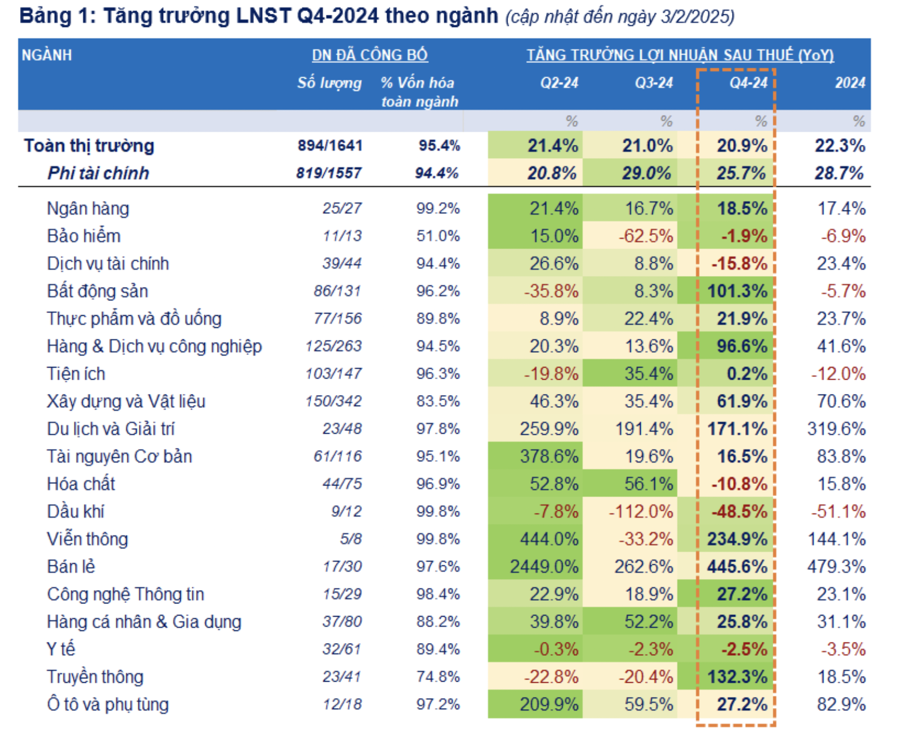

As of February 3, 2025, 894 listed companies representing 95.4% of the total market capitalization have announced their Q4 2024 financial results, according to FiinTrade data. For the quarter, the market’s after-tax profit increased by 20.9% year-on-year, maintaining a stable growth rate for the fourth consecutive quarter.

The Non-Financial group continued its leading role, but its growth rate showed signs of slowing down, increasing by 25.7% in Q4 compared to 29% in Q3. In contrast, the Financial group regained momentum with a growth rate of 16.7% year-on-year, higher than the previous quarter (+14.9%) thanks to the performance of banks and insurance companies.

Several industries witnessed breakthrough growth in Q4 2024, positively contributing to the overall expansion. These included Real Estate, Retail, Aviation, Personal Goods, Telecommunications, Information Technology, and Rubber. On the other hand, some sectors continued to face challenges, such as Securities, Oil and Gas, Utilities, Dairy, Plastics, Chemicals, and Coal.

In the Real Estate sector, the surge in after-tax profits, which increased by 101.3%, was largely attributed to VHM’s remarkable growth of 1482.3%. This was a result of accelerated deliveries at the Royal Island mega-project in Hai Phong, along with contributions from other companies such as KDH, PDR, DXG, NLG, and VPI.

However, due to the specific nature of revenue recognition in the Real Estate industry (revenue is only accounted for upon project delivery), this high growth rate does not reflect a genuine recovery for the entire sector. In fact, as of the end of 2024, the balance of “buyers’ advance payments,” considered readily available funds to ensure future revenue for real estate enterprises, decreased by 8.2% compared to September 30, 2024. This followed an increase of 1.8% in Q3 and 5.7% in Q2.

This somewhat reflects a slowdown in sales and cash collection from customers, indicating that market demand remains weak, investor confidence has not fully recovered, and liquidity pressures persist.

For the full year 2024, the market’s after-tax profit increased by 22.3% year-on-year, driven mainly by the Non-Financial group (+28.7%), while the Financial group posted a more modest growth of (+17.5%). The economic recovery facilitated strong growth in many non-financial sectors during 2024, notably Retail (+479.3%), Tourism & Entertainment (+319.6%), and Telecommunications (+144.1%).

Where Do Binh Duong Province’s Property Buyers Come From?

The real estate market in Binh Duong Province has experienced a robust recovery in 2024 compared to 2023, with significant growth across all areas and most property types. In particular, Di An and Thuan An continue to stand out, attracting considerable investor attention due to their proximity to Ho Chi Minh City and their strong development potential in the future, according to Batdongsan.

The Land-Hungry Appetite of Malaysian Giant SkyWorld in Vietnam

“The renowned Malaysian property developer, SkyWorld, has recently expanded its reach by opening a sales office in Thu Thiem, Thu Duc City. With this strategic move, SkyWorld aims to introduce, promote, and sell its prestigious project, Curvo Residence, located in the heart of Kuala Lumpur, Malaysia. However, their foray into Vietnam is not solely focused on selling their homegrown projects but also on acquiring local land through Vietnamese enterprises, marking a significant step in their international expansion.”

The Billion-Dollar Infrastructure Projects Unlocking the Potential of Ho Chi Minh City’s Eastern District

In recent years, the East of Ho Chi Minh City has become the focal point for urban and economic infrastructure development. A series of major transportation projects, including the Tan Van Interchange, Ring Road 3, An Phu Interchange, and the expansion of Hanoi Highway, are being synchronously implemented, providing a significant boost to the area’s growth.

The Critical Bottleneck: Indochina Capital Chairman’s Emphatic Message on Unlocking Vietnam’s Real Estate Market Potential

Peter Ryder, Executive Chairman of Indochina Capital and Board Member of Indochina Kajima, firmly believes that infrastructure is the foundation for Vietnam’s future growth, both in the real estate sector and the economy as a whole. He emphasizes that infrastructure is also the most critical bottleneck currently restraining the industry’s development.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)