Mr. Nguyen Thanh Tien

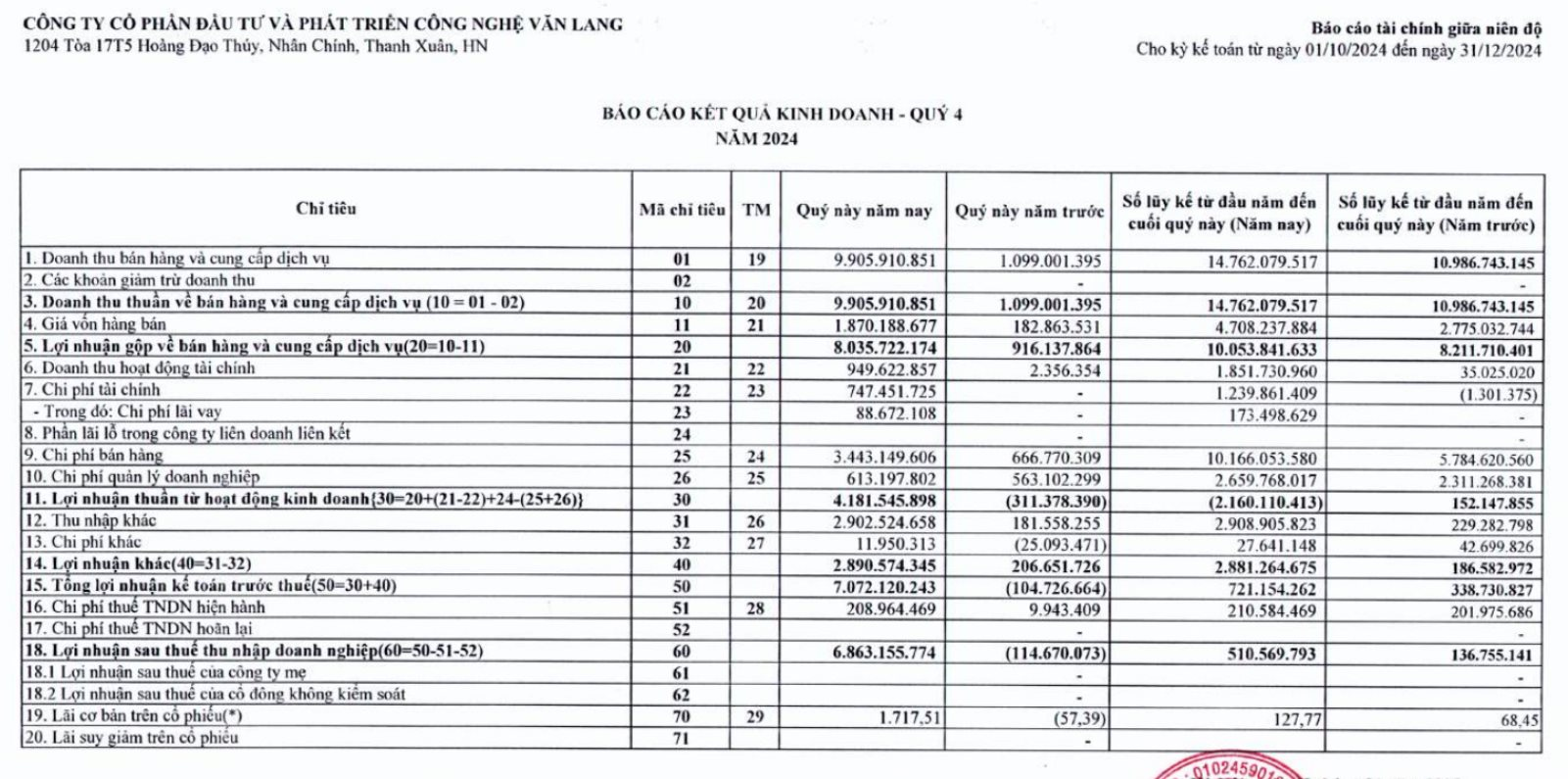

Van Lang Technology Investment and Development Joint Stock Company (VLA) recently announced its Q4/2024 financial report, with revenue for the quarter reaching over 9.9 billion VND, nine times higher than the same period last year. Gross profit reached over 8 billion VND, also nine times higher year-over-year, after deducting cost of goods sold.

According to the company’s explanation, the 801% increase in revenue compared to the same period last year was mainly due to the significant rise in the number of students enrolling in the company’s courses during Q4.

In this quarter, VLA’s financial income also increased to 950 million VND, compared to just over 2.4 million VND in the same period last year. Other income increased by 14 times to nearly 2.9 billion VND.

Financial expenses amounted to 747 million VND, while there were no such expenses in the same period last year. Selling and management expenses also increased.

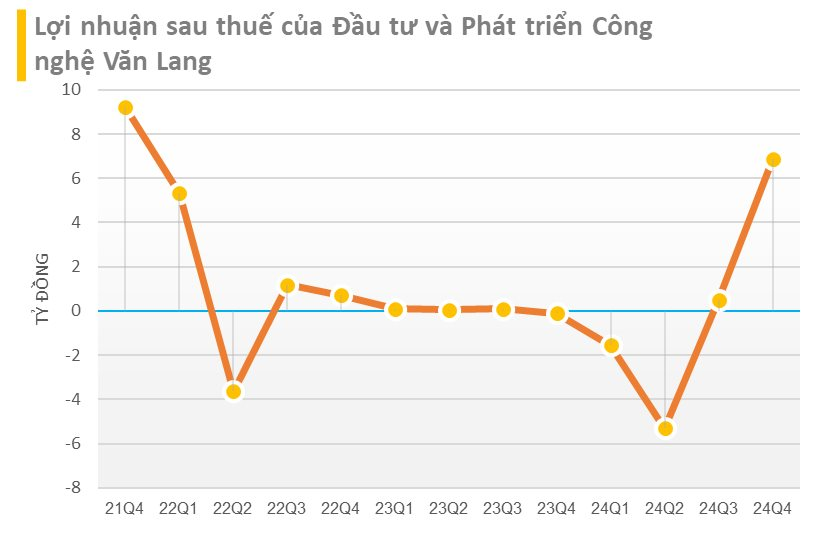

As a result, VLA reported a post-tax profit of nearly 6.9 billion VND in Q4/2024, compared to a loss of 115 million VND in the same period last year. This is the company’s highest profit since Q1/2022.

For the full year 2024, VLA recorded revenue of nearly 14.8 billion VND, up 34% year-over-year, and a post-tax profit of 511 million VND, 3.7 times higher than in 2023.

Previously, in August 2024, the Hanoi Stock Exchange (HNX) announced that it had placed VLA shares of Van Lang Technology Investment and Development Joint Stock Company on the list of stocks not eligible for margin trading. The reason for this decision was that the company’s post-tax profit for the first six months of the year and undistributed post-tax profit as of June 30, 2024, were negative.

As of December 31, 2024, VLA’s total assets stood at over 50 billion VND, an increase of nearly 5 billion VND from the beginning of the year. The company’s payables increased from 1.8 billion VND at the beginning of the year to over 6 billion VND. During the year, VLA incurred short-term financial lease liabilities and borrowings of 3.62 billion VND.

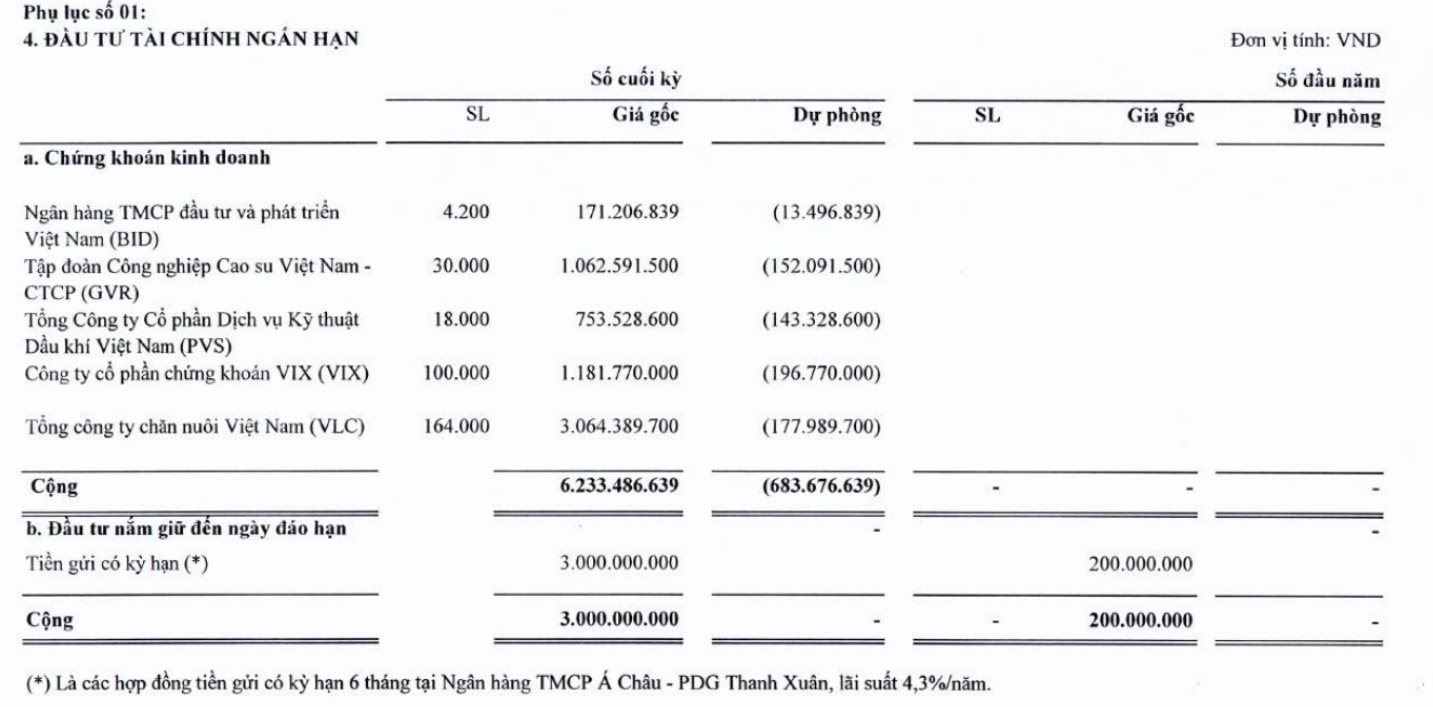

The company invested nearly 6.3 billion VND in securities, specifically in the stocks of BIDV, Vietnam Rubber Group, Vietnam Oil and Gas Technical Services Corporation, VIX Securities, and Vietnam Livestock Corporation.

As of the end of the year, all of these investments were subject to impairment provisions, with a total provision of nearly 684 million VND.

Van Lang was originally a subsidiary of the Vietnam Education Publishing House, established under Decision No. 1338/QD-TCNS dated November 15, 2007. In its early days, Van Lang focused on traditional publishing activities, printing, distribution, and trading of computers and educational equipment.

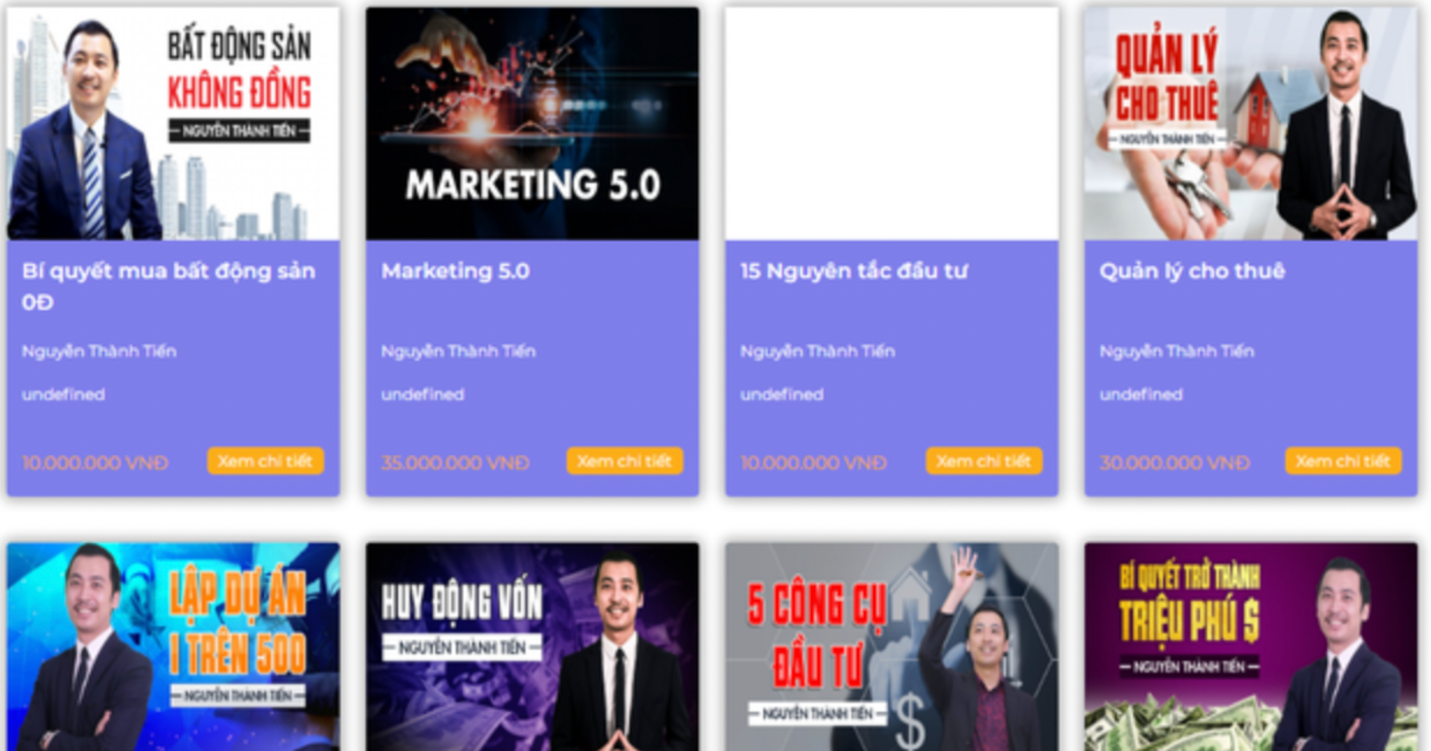

In 2020, when wealth guru Nguyen Thanh Tien became the Chairman of the Board of Directors, Van Lang gradually shifted its focus to training in thinking, selling, communication, leadership, time management, and public speaking skills.

By the end of 2024, Mr. Tien owned 9.08% of Van Lang’s shares. He is a well-known lecturer and the owner of a YouTube channel with 179,000 subscribers. The investment courses offered by Van Lang in 2023 included Investment Strategies, Investment Intelligence 5.0, Effective Capital Mobilization Secrets, and Business Intelligence.

Mr. Tien is also known as a speaker for many investment strategy, real estate sales, and negotiation courses, with 1.2 million followers. However, Van Lang, under Mr. Tien’s leadership, has not yet achieved significant success in this field.

For example, in 2022, Van Lang invested in a hotel in Quang Ninh province worth 18 billion VND. However, the company encountered difficulties in transferring the ownership of the asset, and the hotel business was severely affected by the pandemic, leading to operational challenges. The Board of Directors of Van Lang proposed a resolution to terminate the hotel purchase contract, recover the investment, and handle compensation procedures accordingly.

In 2024, in addition to maintaining its training activities and expanding its course offerings, such as investment and real estate strategies, business intelligence, and capital mobilization, the company aimed to focus on real estate, stock market, and other service investments to increase revenue.