Inflation is No Longer a Concern

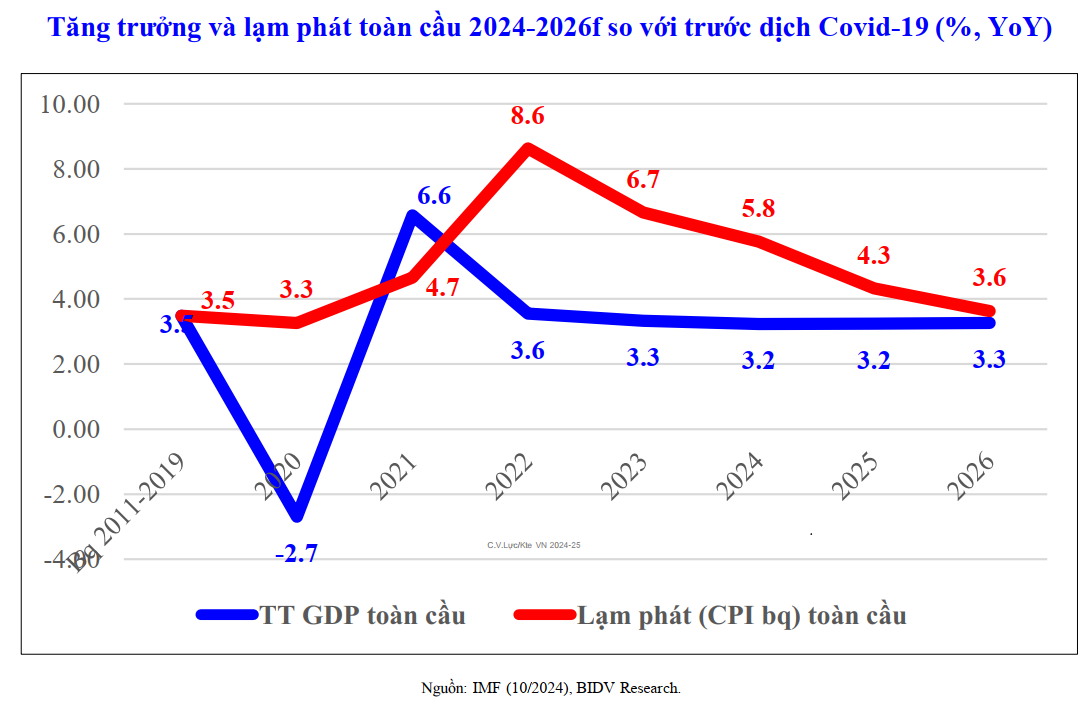

Looking back at the past three years (2022-2024), the global economy has been stagnant, with the positive aspect being that we avoided a recession as initially predicted.

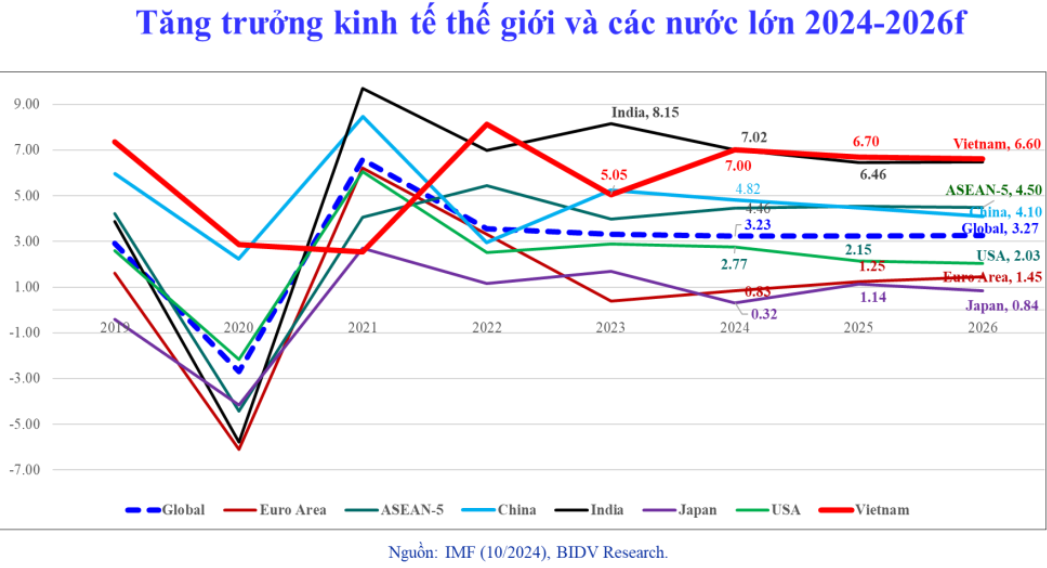

The economic growth trajectory of the world and several individual economies shows that global growth in 2024 is expected to match last year’s at 3.23%, while Vietnam’s growth is projected to be around 6.6%. According to senior economist Can Van Luc, “If we don’t do anything and there’s no revolution, we can still maintain a growth rate of 6.5-6.7%. But if we are determined to bring about change, we can achieve more than 7%.”

|

Parallel to economic growth is the issue of inflation. According to Mr. Luc’s statistics and forecasts, except for 2020 when the global economy contracted due to COVID-19, the average growth rate for the period 2019 to 2026 is 3-3.2%, which is significantly lower than the inflation rate. This indicates that the world economy is facing more challenges and uncertainties. However, Vietnam maintaining a 7% growth rate is a remarkable achievement, he noted.

|

Currently, the world has passed the peak of inflation, and from now until the end of 2026, the prices of basic commodities such as energy, food, and metals are expected to remain relatively stable. Oil prices are projected to fluctuate around $75-80 per barrel, not too high, and they could even drop to $70 if countries start utilizing nuclear energy or other non-fossil fuel sources, as Europe and the US have been doing recently.

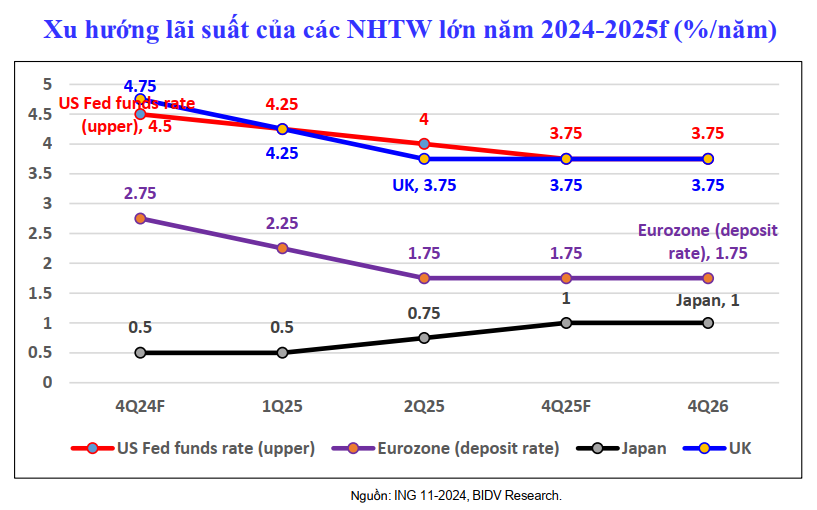

With inflation no longer a concern for the 2024-2025 period, economies are starting to lower interest rates. Mr. Luc predicts that the US and other major central banks worldwide will continue to cut interest rates until the end of 2026, possibly reaching 3.5-3.6%. As Vietnam deeply integrates into the global economy, we follow a similar path, deciding to reduce interest rates from March 2023. Since then, we have been lowering borrowing rates, and compared to the peak, they have decreased by an estimated three percentage points.

|

|

Mr. Luc assessed that the interest rates are quite favorable for the real estate market last year and this year. However, why aren’t people borrowing more to buy homes? The main reason is the high housing prices, he explained.

What is the Biggest Risk to the Economy?

Speaking about the biggest risk to the economy, Mr. Luc identified geopolitical risks as the primary concern, noting the complexity of the current situation, the increasing strategic competition between major powers, the fragmentation of trade, and the rise of protectionism. Additionally, election results in several countries, especially the US, with the return of President Donald Trump, could have significant implications. The second risk is inflation and interest rates, which, although decreasing, remain high. The third risk is the slow recovery in some countries (Japan, the UK, and China…), leading to a slight decrease in global growth in 2024-2025 compared to 2023, with a gradual improvement expected in 2026. The fourth risk pertains to energy and food security, as well as the ever-present threat of climate change.

However, Vietnam has excelled in maintaining political stability and achieving economic development. Evidently, our country’s economic growth is among the highest in the region this year, and it is projected to reach at least 6.8% next year, with inflation controlled at 3.5-4%. Maintaining low-interest rates, coupled with a per capita income that is 20% higher than pre-COVID-19 levels, sets a solid foundation for the safe and sustainable development of the real estate market in the coming time, Mr. Luc asserted.

Nonetheless, he noted a significant shift in consumer behavior, observing that people are becoming more cautious, intelligent, and frugal in their spending.

Mr. Can Van Luc sharing insights at the VRES 2024 Real Estate Conference on December 5, 2024.

|

Business Orders Recover but Profit Margins Narrow

Regarding exports, Mr. Luc forecasted a positive recovery, with export growth for the year reaching about 15%, compared to a negative 4.4% last year. Vietnam’s trade balance has improved, with surpluses recorded in many markets, including the US, ASEAN, South Korea, the EU, and Japan. However, we have a trade deficit with China, as our imports from this market increased by nearly 32%, the highest among major markets. This indicates a shift in goods from China to Vietnam, destined for other markets, including the US. With Trump’s return to the presidency, Vietnam needs to pay close attention to this issue.

On another note, Mr. Luc assessed that businesses are experiencing a good recovery in terms of orders, but these are short-term orders ranging from six to twelve months, and foreign partners are not allowing price increases, which is narrowing profit margins for Vietnamese enterprises.

Another issue is the labor shortage in many sectors, such as textiles, footwear, and wood processing, despite Vietnam having a large workforce. As a result, businesses will have to accept the “gather firewood for three years and burn it in one hour” approach to prepare their workforce. The lesson learned from the recent past is that once businesses lay off workers during difficult times, it becomes challenging to re-employ them.

As for exchange rates, the market has witnessed significant fluctuations, but the State Bank has flexibly managed the situation using various tools to stabilize the rates. The Vietnamese dong is expected to appreciate by about 3.5-4% against the US dollar for the whole year, which is acceptable and relatively low compared to other currencies in the region. Additionally, Vietnam has been on the watchlist for currency manipulation in the past, and we need to be prepared for the possibility of it happening again, Mr. Luc warned.

Regarding public investment, disbursement remains slow. The private sector grew by only about 7.1% in the first nine months, an increase of two percentage points compared to last year but only half of the pre-pandemic level. This indicates that people and private enterprises are still hesitant to invest heavily.

As for the stock market, Mr. Luc predicted an 11% growth for the year, with many “green” sectors and stocks surging by 50-60%. As of the end of November 2024, telecommunications stocks led the gains with a 238% increase, followed by industrial goods and services (75%), information technology (69%), and entertainment and tourism (41%). In contrast, real estate stocks have been “inactive.” This can be attributed to a lack of transparency, insufficient enterprise capacity, or investor reluctance to invest.

In terms of attracting foreign direct investment (FDI), the estimated inflow into Vietnam is expected to increase by at least 5-6% or, more optimistically, 7-8%. South Korea, Singapore, Japan, and Taiwan are the leading sources of FDI currently, but Mr. Luc hopes that the US will move up from its current 11th place to the top seven, following the comprehensive strategic partnership upgrade in September last year.

Concerning tourism, international arrivals for the first ten months of the year reached over 14.1 million, a remarkable 41% increase compared to the same period last year. However, revenue from tourism, accommodation, and catering services only increased by about 11%, indicating that visitors are spending more cautiously.

The expert also drew attention to Vietnam’s institutional and legal environment. The General Secretary mentioned two crucial goals, which Mr. Luc considered “revolutionary.” “First is the breakthrough in institutions, as we need to innovate in law-making and law enforcement. All obstacles will be promptly addressed. This is extremely important for the real estate market.

Second is the breakthrough in organizational apparatus, making it more streamlined, lean, with fewer intermediaries. As a result, enterprises will become more robust, healthy, and sustainable, and people will benefit. So, let’s prepare for a new mindset to seize new opportunities,” Mr. Luc concluded.

Real Estate Prospects in the New Context

In the new context, the real estate market is bolstered by institutional breakthroughs, revolutionary changes in organization and apparatus, economic growth, macroeconomic stability, improved infrastructure, and easier access to capital. The most challenging period regarding financial obligations is behind us, and supply and demand are moving towards a more balanced state, with real estate prices becoming more reasonable.

Mr. Luc suggested several solutions for real estate enterprises, including persistent and accurate recommendations, continued restructuring, risk management of cash flow and debt maturities, efforts to reduce and stabilize prices in some projects and segments, even with narrower profit margins, proactive approaches to take advantage of support packages, especially fiscal and tax support, credit and debt restructuring, resolutions of the Central Committee, the National Assembly, and the Government, diversification of capital sources, products, and partners, embracing the green transition and digital transformation, and preparation for the implementation of new laws (Land Law, Housing Law, Real Estate Business Law…) and resolutions of the National Assembly.

He also emphasized seizing opportunities arising from the upgraded relationships with the US, Japan, Australia, Malaysia, and other countries.

Tin Vũ

The Profit Update for Q4 2024: A Market Surge with Real Estate Leading the Charge

In Q4 2024, the market’s after-tax profit rose by 20.9% year-over-year, marking the fourth consecutive quarter of steady growth. Several industries witnessed remarkable growth spurts during this period, notably Real Estate and Retail, which significantly contributed to the overall positive performance.

Where Do Binh Duong Province’s Property Buyers Come From?

The real estate market in Binh Duong Province has experienced a robust recovery in 2024 compared to 2023, with significant growth across all areas and most property types. In particular, Di An and Thuan An continue to stand out, attracting considerable investor attention due to their proximity to Ho Chi Minh City and their strong development potential in the future, according to Batdongsan.

The Land-Hungry Appetite of Malaysian Giant SkyWorld in Vietnam

“The renowned Malaysian property developer, SkyWorld, has recently expanded its reach by opening a sales office in Thu Thiem, Thu Duc City. With this strategic move, SkyWorld aims to introduce, promote, and sell its prestigious project, Curvo Residence, located in the heart of Kuala Lumpur, Malaysia. However, their foray into Vietnam is not solely focused on selling their homegrown projects but also on acquiring local land through Vietnamese enterprises, marking a significant step in their international expansion.”

The Billion-Dollar Infrastructure Projects Unlocking the Potential of Ho Chi Minh City’s Eastern District

In recent years, the East of Ho Chi Minh City has become the focal point for urban and economic infrastructure development. A series of major transportation projects, including the Tan Van Interchange, Ring Road 3, An Phu Interchange, and the expansion of Hanoi Highway, are being synchronously implemented, providing a significant boost to the area’s growth.