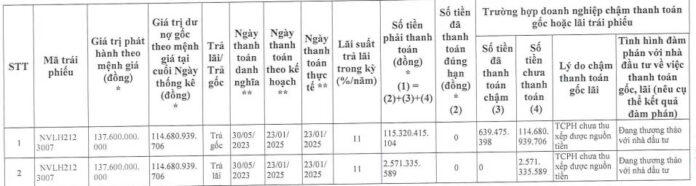

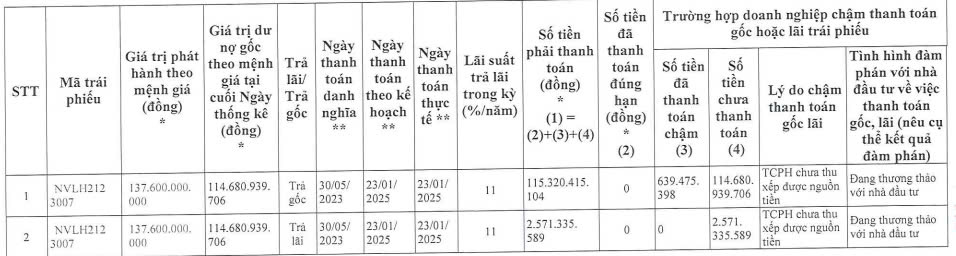

According to a recent announcement by the Hanoi Stock Exchange (HNX), Nova Real Estate Investment Group Joint Stock Company (Novaland, stock code: NVL, listed on HoSE) has disclosed information regarding its bond principal and interest payments.

As per the schedule, January 23, 2025, was the due date for Novaland to make principal and interest payments for the NVLH2123007 bond lot, totaling nearly VND 117.9 billion. This included over VND 115.3 billion in principal and nearly VND 2.6 billion in interest. However, Novaland has only managed to pay approximately VND 639.5 million thus far.

Consequently, the outstanding principal and interest amount for the NVLH2123007 bond lot that Novaland has yet to pay stands at nearly VND 117.3 billion. The company attributed this delay to a lack of arranged funding, as explained in their statement.

Novaland is currently in negotiations with investors regarding the settlement of the remaining debt for this bond lot.

Source: HNX

It is worth noting that the NVLH2123007 bond lot was issued by Novaland in 2021, with a total face value of VND 137.6 billion, and a maturity date of May 30, 2023, for principal payments.

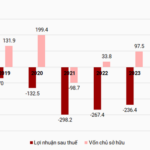

Novaland’s delayed bond payments come at a time when the company’s business performance has been less than favorable.

According to its consolidated financial statements for the fourth quarter of 2024, Novaland recorded a gross revenue of nearly VND 4,778.6 billion, marking a 135.9% increase compared to the same period in 2023.

The company’s gross profit surged to nearly VND 1,967.2 billion, a 3.9-fold increase year-over-year; however, its net profit reached VND 633.1 billion, a decrease of 51.9%.

Financial expenses were recorded at nearly negative VND 1,254.3 billion, compared to negative VND 251 billion in the same period last year. Selling expenses were also negative, at over VND 299.5 billion, reflecting a 101.7% increase in negativity. Meanwhile, administrative expenses were recorded at nearly negative VND 369.3 billion, showing an improvement of 18.7%.

After accounting for various taxes and fees, Novaland reported a net profit of over VND 25.6 billion for the fourth quarter of 2024, a significant decrease of 98.2% compared to the same period in 2023.

For the full year 2024, Novaland’s gross revenue stood at nearly VND 9,073.4 billion, a 90.7% increase compared to 2023. However, the company incurred a net loss of nearly VND 4,351.4 billion for the year, in contrast to a net profit of nearly VND 485.9 billion in 2023.

As of December 31, 2024, Novaland’s total assets were valued at nearly VND 238,181 billion, a slight decrease of 1.4% from the beginning of the year. This included nearly VND 4,607.6 billion in cash and cash equivalents, a 35% increase, and inventory of nearly VND 146,610.6 billion, a 5.5% increase, accounting for 61.6% of total assets.

As of the end of 2024, Novaland’s total liabilities were recorded at nearly VND 190,473.3 billion, a minor decrease of 2.9% compared to the start of the year.

The Stealthy Conglomerate’s Latest Acquisition: Vinhomes Ocean Park 2, Fueled by a 7,000 Billion VND Bond Issue at a Mere 3% Interest Annually

Prior to the issuance of the 1,000 billion VND bond, this company had mortgaged its contractual rights as collateral at a bank.

The Sun City’s Fate Post-Novaland

Sun City Real Estate Investment and Development Ltd. has been given the green light to develop a landmark project in An Khanh Ward, Thu Duc City. The project, boasting a staggering investment of over VND 10.5 trillion, encompasses a high-rise complex of residential, commercial, service, and office spaces. This venture stands out as a rare gem among the few projects in Ho Chi Minh City to secure investment approval this year.

Government Bonds Raise VND 20,760 Billion, Lively Secondary Trading

The government bond market recorded impressive results in November, with a successful auction raising 20,760 billion VND and a significant surge in secondary market transactions.

What Stocks Will Be Removed From the FTSE ETF and VNM ETF in the Q4 Review?

According to the latest report by SSI Research, the foreign ETF portfolio will undergo significant changes in the Q4 2024 reconstitution. The upcoming adjustments include the addition of promising new stocks and the rebalancing of existing holdings, setting the stage for a strategic shift in the portfolio’s composition.