Kicking off the new year of 2025, the foreign CEO of Nam Long Investment Joint Stock Company (stock code NLG), Mr. Lucas Ignatius Loh Jen Yuh (Lucas Loh), penned a heartfelt letter to the company’s employees. The letter revealed that 2025 marks the fifth year of the company’s transformation: evolving from being known in the market as an affordable “just-right” investor expanding into multiple segments, towards becoming an integrated real estate group.

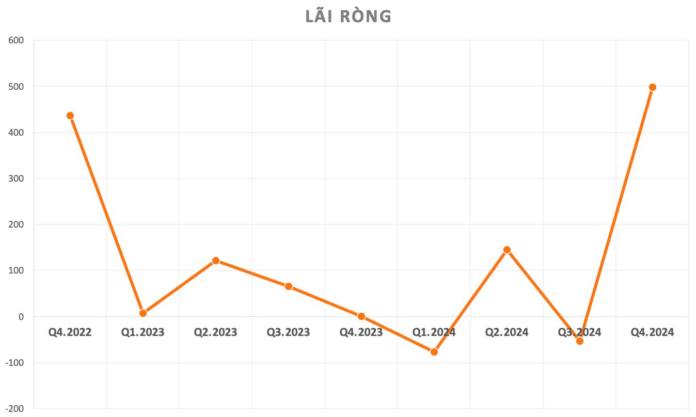

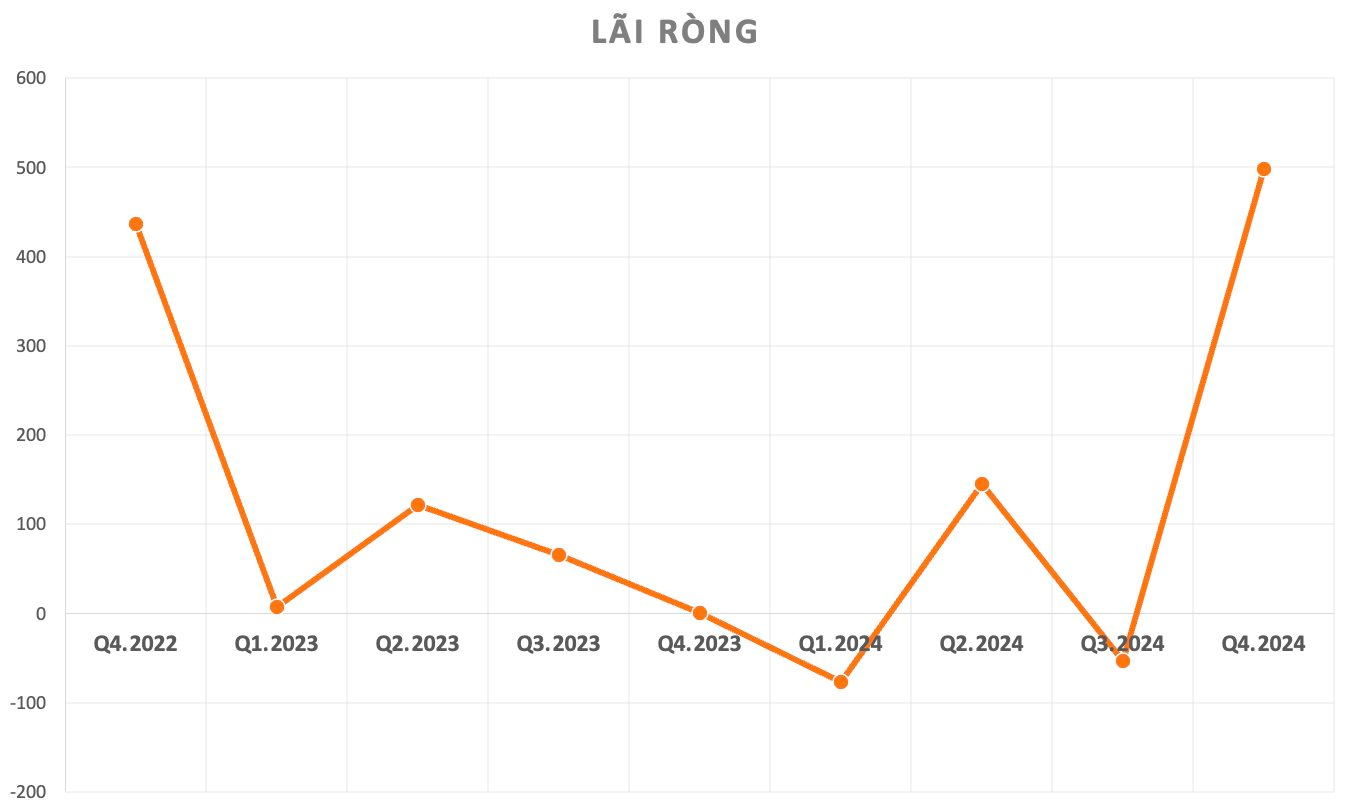

According to the CEO, 2024 was also the year Nam Long restructured its governance, placing project delivery at the heart of its operations. The letter informed that the successful handover of 1,400 out of a total of 1,700 apartments in the second phase of Akari City contributed to a profit surge in the final quarter (the previous quarter being Q3/2024, when Nam Long reported a loss).

Specifically, as per the Q4/2024 financial statements, the company recorded a net revenue of VND 6,368.5 billion, a 289% increase compared to the same period in 2023; gross profit rose by 293% to nearly VND 2,724.5 billion.

Not only did the company experience robust growth year-over-year, but the quarterly revenue also soared to nearly eight times that of the first three quarters of 2024, which stood at VND 827.5 billion.

After accounting for various taxes and fees, Nam Long reported a net profit of VND 1,327 billion, reflecting a 175% jump compared to the previous year and simultaneously doubling the profit of VND 54.5 billion achieved in the initial nine months of 2024.

The surge in revenue was primarily driven by the sales of residential and apartment units, accounting for 99% of the quarter’s total revenue. Nam Long’s substantial profit increase during the quarter was mainly attributed to the delivery of key projects, namely Akari and Can Tho.

For the full year 2024, Nam Long’s net revenue reached VND 7,196 billion, with a net profit of VND 1,382 billion, marking a respective increase of 126% and 73% compared to 2023.

Image: Nam Long witnessed a sudden surge in profit during Q4/2024.

As of December 31, 2024, Nam Long’s total assets stood at VND 30,308 billion. The company witnessed a significant surge of 114% in cash and cash equivalents, amounting to over VND 5,443 billion. The Nam Long CEO attributed this record cash flow primarily to the delivery of Akari, which brought in 45% of the contract value as per the payment schedule, and Can Tho, which yielded up to 95% of the contract value. Concurrently, presale values also rose by 40% compared to 2023, thanks to the real estate sector’s recovery and the popularity of genuinely affordable housing.

The company is currently holding over VND 17,993 billion in inventory, mainly comprised of the Izumi project (VND 8,685 billion), Waterpoint project (VND 6,428 billion), Can Tho project (VND 1,806 billion), and Akari project (VND 304 billion), among others.

Looking ahead to 2025, the company plans to launch sales for Izumi, Paragon, Can Tho, and Southgate projects.

As of the end of 2024, Nam Long’s total liabilities amounted to VND 15,742 billion, including VND 3,023.7 billion in short-term advance payments from buyers, VND 2,887 billion in short-term loans, and VND 4,074 billion in long-term loans and debt.

Masan-Owned Phuc Long: Brewing Up a Storm with Over $200,000 in Daily Revenue and a Network of 170+ Stores

According to the financial report of Masan Group Joint Stock Company (MSN), in 2024, Phuc Long recorded a revenue of VND 1,621 billion, up 5.6% compared to the same period last year. This corresponds to a daily revenue of over VND 4.4 billion for the popular tea brand.

The Money-Making Education Boom: A Wealth-Teaching Company Reports a Staggering 800% Surge in Q4 2024 Revenue, the Highest in Three Years.

The company allocated a substantial amount of 6.3 billion VND to invest in securities, specifically targeting stocks of prominent entities. These include BIDV, the Vietnam Rubber Industry Group, Vietnam Oil and Gas Technical Services Joint Stock Corporation, VIX Securities, and the Vietnam Livestock Corporation.

Record-Breaking Profits for Rubber Group Since 2012

The rubber price remained high in Q4, enabling the Vietnam Rubber Group (HOSE: GVR) to achieve its highest revenue and profits in over a decade.

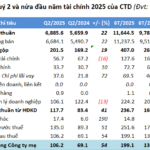

Coteccons Profits Soar to $85 Million in H1 of 2025 Fiscal Year

The first half of the 2025 financial year (July 1st to December 31st, 2024) saw the Construction Joint Stock Company Coteccons (HOSE: CTD) achieve impressive financial results. The company recorded a net profit of nearly VND 200 billion, a remarkable 47% increase compared to the same period last year, and successfully fulfilled 46% of its annual plan. Additionally, new contract wins amounted to VND 16.8 trillion, showcasing the company’s strong performance and promising future prospects.