Investors reacted quite negatively during the first trading session of the Year of the Tiger, as Vietnamese markets reopened after a two-week Lunar New Year holiday marked by volatile global markets. The heaviest pressure was on FPT shares, as the impact of the global tech stock rout was finally felt.

FPT opened 3.52% lower and continued to plunge, hitting an intraday low of 4.56% around 10 am. It closed the morning session down 4.04%, the biggest intraday loss since November 2023. The blue-chip stock saw massive trading volume, with 1,016 billion VND in turnover, accounting for approximately 14.1% of the total matched orders on the HoSE.

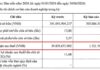

Notably, foreign investors dumped over 3.59 million FPT shares, representing 52.2% of the total trading volume. The net selling value amounted to 316.5 billion VND, equivalent to 36.6% of the total net selling on the HoSE.

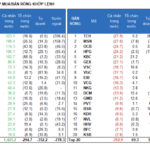

The sell-off in FPT weighed heavily on the VN-Index, with six out of the ten largest market cap stocks posting losses of 1% or more. FPT’s 4.04% decline alone shaved off 2.2 points from the index. Other major decliners included VCB (-0.76%), BID (-1%), VNM (-2.09%), VHM (-1.27%), VPB (-1.32%), GAS (-1.18%), TCB (-1.01%), MWG (-1.83%), and VIC (-0.99%). These ten stocks, all constituents of the VN30 index, contributed to a loss of about 7.1 points in the VN-Index’s overall decline of 9.57 points (-0.76%). The VN30-Index fell even more sharply, dropping 1.39% with 6 gainers and 24 losers.

However, the breadth of the HoSE improved towards the end of the session. The VN-Index ended with 156 gainers and 293 losers. At its intraday low around 10:20 am, there were only 116 gainers and 317 losers, indicating that bottom-fishing activities pushed some stocks higher and a few managed to turn positive.

Nevertheless, at the closing bell, 97 stocks on the HoSE still posted losses of more than 1%. A group of blue chips with high trading volume confirmed the strong selling pressure, including FPT, VNM, STB, SSI, MWG, TCB, VHM, and MBB, all of which traded over 100 billion VND in volume. Additionally, small-cap stocks with low liquidity also saw significant declines, such as DCL, VTP, CMG, CTR, NLG, TRC, and HAG, which fell by more than 3% each.

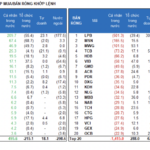

As expected, mid- and small-cap stocks showed better resilience. Only six stocks in the VN30 index finished in the green, with GVR (+2.95%), SHB (+1.46%), and POW (+0.87%) being the most notable gainers. Meanwhile, the HoSE closed with 82 stocks posting gains of more than 1%, mostly from the mid- and small-cap segment. However, their trading volume was relatively limited. Standouts included GEX (+3.71% with 215.7 billion VND in volume), HAH (+3.62% with 126.7 billion VND), VCG (+2.03% with 99.6 billion VND), BAF (+1.45% with 67.8 billion VND), HHV (+2.04% with 66.5 billion VND), and HSG (+1.15% with 55.2 billion VND). Together, these 82 strongest stocks accounted for less than 20% of the HoSE’s total trading value.

The second positive note was the continued effectiveness of bottom-fishing activities. Only about 9.5% of the stocks in the VN-Index closed at their intraday lows, and over 48% of the stocks recovered by 1% or more from their lowest levels. Thus, the majority of stocks found their bottom around mid-morning and started to rebound.

The HoSE’s matched order volume more than doubled compared to the last session before the holiday, reaching over 7,181 billion VND, the highest in 22 sessions. FPT contributed significantly to this volume, and bottom-fishing activities were observed in this stock, pushing its price off the lows. However, the recovery potential remains uncertain due to the substantial selling pressure.

After a two-week hiatus, foreign investors resumed trading on the Vietnamese market and ramped up their selling. FPT was just one part of the broader selling trend. The total selling value on the HoSE reached a record high of 1,823 billion VND, the highest since the morning session of October 31, 2023. The overall net selling on this exchange hit a ten-week high of 864.5 billion VND.

In addition to FPT, stocks that witnessed significant net selling included VNM (-154.7 billion VND), MWG (-61.9 billion VND), VHM (-50.1 billion VND), CTG (-46.9 billion VND), HPG (-29.8 billion VND), VND (-27.6 billion VND), CTR (-25.5 billion VND), and LPB (-21.7 billion VND). On the buying side, HAH (+22.8 billion VND) and MSN (+19 billion VND) were the most notable.

The Foreign Block Continues to Dump Tech Stocks, with Particularly Strong Sell-Offs in FPT

Liquidity across all three exchanges surged today, with a massive 15.7 trillion VND in matched orders. The foreign bloc remained a weak link, offloading another 985.6 billion VND, with 632.9 billion VND in matched orders alone.