Steel Industry to Witness Strongest Growth in 2025

VPBank Securities (VPBankS), in its 2025 investment strategy report published on December 16, 2024, forecasts that the steel industry will witness the strongest profit growth in 2025, as steel prices have been trading near bottom levels and consumption volume is expected to be supported by the domestic market. The industry’s profit is projected to increase by 44.1% year-over-year.

According to VPBankS, after a strong recovery in late September 2024, Vietnamese construction steel prices have only decreased by 1% while HRC prices dropped by 14% compared to the beginning of the year. Chinese construction steel prices have also declined by around 7% year-to-date. Moreover, the prices of raw materials such as coking coal and iron ore have witnessed even sharper adjustments. From the beginning of 2024 to the end of October, iron ore prices have fallen by 28% while coking coal prices have decreased by 37.6%. The primary reason for this is the persistently weak steel consumption in China.

Steel price movements over time. Source: VPBankS

On October 24, 2024, the Ministry of Industry and Trade announced the results of its final review of the application of anti-dumping measures on color-coated steel and galvanized steel products from China and South Korea in Vietnam (case code: ER01.AD04). Accordingly, the Ministry decided to extend the application of anti-dumping measures on these products for another five years (from October 24, 2024, to October 23, 2029). Galvanized steel imported from China is subject to a tax rate of 2.53-34.27%, while that from South Korea faces a rate of 4.95-19.25%. VPBankS considers this a positive factor for listed galvanizing enterprises, reducing competitive pressure from imported products in the domestic market.

In its 2025 strategy report released on December 19, 2024, MB Securities (MBS) expects that the increase in housing supply and public investment will be the key drivers of steel output growth in 2025, as legal obstacles in the real estate market are resolved through new related laws, and some projects will be expedited, such as the North-South Expressway and Long Thanh Airport…

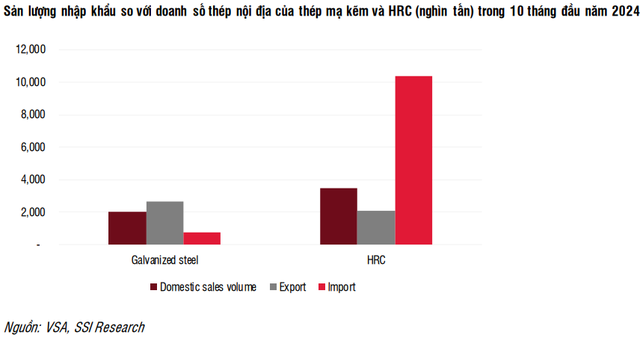

MBS anticipates that anti-dumping duties on hot-rolled steel (HRC) and HDG products may be applied in 2025, improving the market share of domestic manufacturers. The analytics unit forecasts that HPG’s market share in the HRC segment could reach 25% due to anti-dumping taxes imposed on steel from China and India. Regarding HDG, key companies like HSG and NKG are expected to account for nearly 40% of sales volume.

In terms of stocks, MBS assesses a positive outlook for the three leading codes, HPG, HSG, and NKG, considering that these stocks are currently undervalued compared to previous cycles. MBS projects that in 2025, HPG’s net profit may reach VND 17,995 billion (up 39% year-over-year); HSG is estimated to reach VND 869 billion (up 70% year-over-year); and NKG is projected to attain VND 656 billion (up 18% year-over-year).

Domestic Market as the Mainstay

In the report “Steel Industry Outlook 2025: Main Growth Driver from the Domestic Channel” released on December 31, 2024, SSI Research analysts evaluate that the domestic market will become the main growth driver for the Vietnamese steel industry, with an expected growth rate of 10%.

Two key factors supporting this forecast are the robust recovery of the real estate market, evidenced by the doubling of new apartment launches in 2023, along with accelerated public investment disbursement in the final year of the 2021-2025 term.

Notably, key infrastructure projects such as the North-South Expressway, the East-West routes, and major seaport projects like Can Gio (Ho Chi Minh City) and Nam Do Son (Hai Phong) will be crucial in driving steel demand.

SSI Research assesses that competition pressure from imported products is also expected to ease as the Ministry of Industry and Trade has initiated investigations into applying anti-dumping duties on galvanized steel imported from China and South Korea (June) and HRC imported from China and India (July).

According to SSI Research, the final results are expected to be announced in mid-2025, and preliminary results may be released earlier. This could help reduce competitive pressure on domestic enterprises.

In this context, Hoa Phat (HPG) stands out as the company with the brightest prospects. SSI Research forecasts a 28% profit growth for HPG in 2025, reaching VND 15,300 billion. Its market-leading position is reinforced as its market share in construction steel increased from 35% to 38% in 2024. Notably, the operation of the first blast furnace in Dung Quat from Q1/2025 will enable the company to maximize opportunities in the domestic market.

Hoa Sen (HSG) is also expected to significantly improve its business performance, with a projected profit increase of 37% to VND 700 billion in 2025, mainly due to stable gross profit margins and the recovery of the domestic market. Meanwhile, Nam Kim (NKG) is projected to maintain its performance due to its reliance on the export channel, which currently faces challenges.

A Revitalized Project Dung Quat 2: On Track for Success and Bolstering Hoa Phat’s Financial Fortunes

At the seminar, Hoa Phat’s CFO shared insights into the disbursement progress of the Dung Quat 2 project and the corporation’s long-term growth potential with the project’s commencement.