I. MARKET ANALYSIS OF STOCKS AS OF 04/02/2025

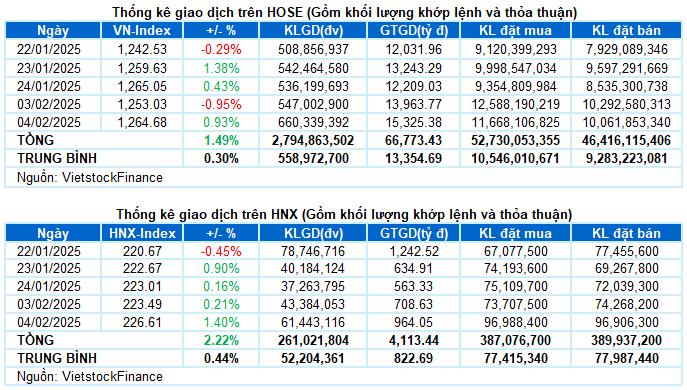

– The main indices gained during the trading session on 04/02. The VN-Index closed up 0.93%, to 1,264.68 points; HNX-Index increased by 1.4%, reaching 226.61 points.

– Matching volume on HOSE exceeded 584 million units, a 15.6% increase compared to the previous session. On the HNX exchange, matching volume surged by 40.6%, reaching more than 60 million units.

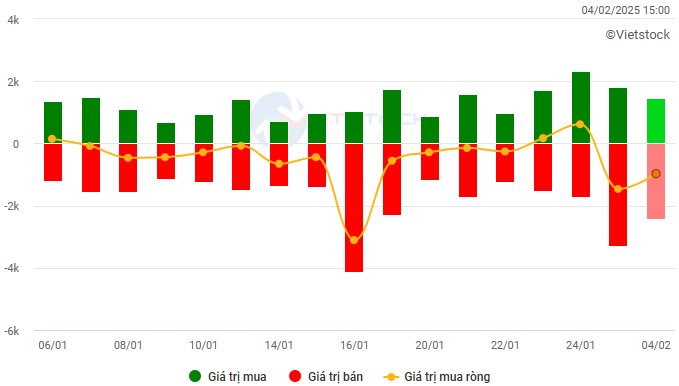

– Foreign investors continued to sell a net on the HOSE exchange with a value of nearly VND 942 billion and sold a net of more than VND 13 billion on the HNX exchange.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

Net trading value by stock code. Unit: VND billion

– The VN-Index recovered quite quickly after a sharp drop yesterday. The green returned on a large scale, accompanied by improved liquidity, indicating that investor sentiment stabilized quite well. However, selling pressure from foreign investors has not shown any signs of cooling down. At the close, the VN-Index stood at 1,264.68 points, up 11.65 points from the previous session.

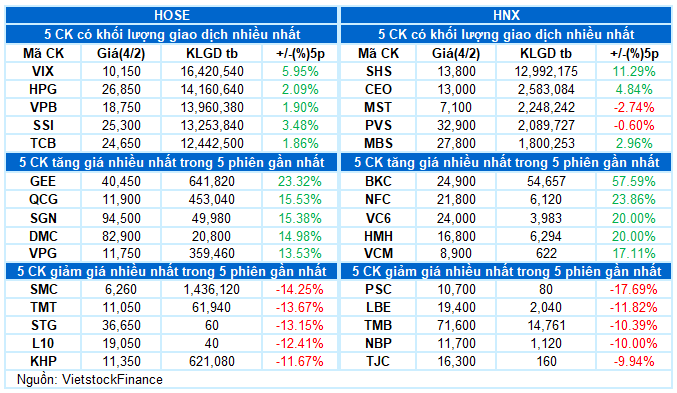

– In terms of impact, CTG led on the positive side, contributing nearly 2 points to the increase. This was followed by HPG, TCB, and MBB, which also helped push the VN-Index up by nearly 2 points. Meanwhile, with dominant buying pressure, there were no notable names on the negative side. The top 10 stocks with the worst impact on the index took away a mere 0.8 points.

– The VN30-Index recovered nearly 12 points after a previous plunge, reaching 1,327.21 points. Buyers regained the upper hand with 22 gainers, 3 losers, and 5 stocks remaining unchanged. Among them, CTG, TPB, and STB topped the list with gains of over 2%. In contrast, the 3 stocks left behind in the red were VJC, VHM, and VNM.

Green covered all industry groups. The materials sector broke out the most today, rising by 1.78% thanks to the outstanding performance of stocks such as HPG (+1.7%), NKG (+4.78%), HSG (+1.7%), CSV (+3.26%), DGC (+1%), KSB (+4.7%), DCM (+1.91%), etc.

Following were the industry and finance groups, both up by 1.32%. With their large market capitalization, these two groups contributed the most to the index’s gain today. Notably, many stocks hit the daily limit-up with a bright purple color, such as CTD, QCG, SJE, L18; VND, APG, and OGC.

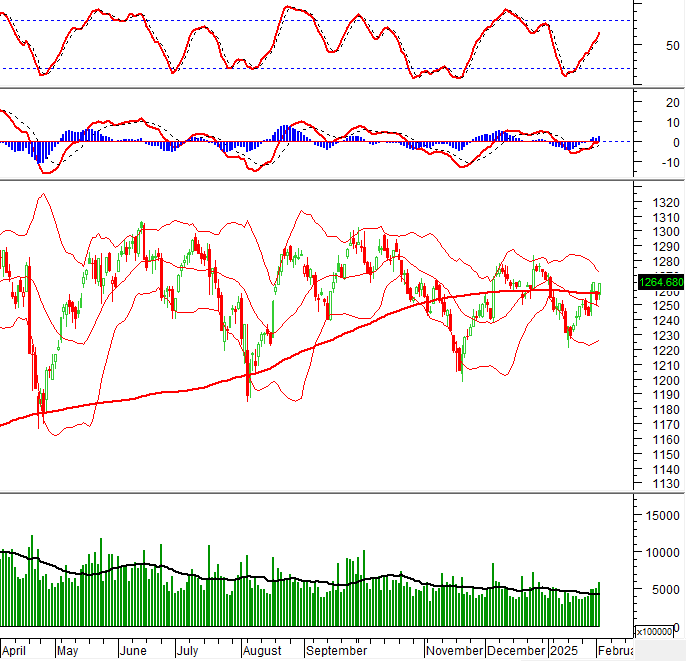

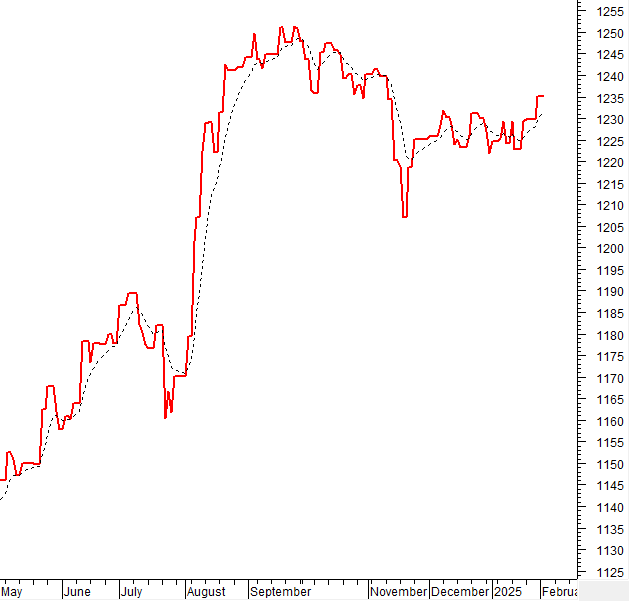

The VN-Index rebounded strongly after continuously fluctuating around the SMA 200-day mark in recent sessions. Moreover, the trading volume remained above the 20-day average, indicating positive signals in terms of participating cash flow. Currently, the Stochastic Oscillator indicator maintains a buying signal, and MACD also gives a similar signal while crossing above the zero threshold. This suggests that the short-term outlook will become even more optimistic.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – MACD Indicator Crosses Above the Zero Threshold

The VN-Index rebounded strongly after continuously fluctuating around the SMA 200-day mark in recent sessions. Moreover, the trading volume has stayed above the 20-day average, indicating positive signals regarding the participating cash flow.

At present, the Stochastic Oscillator indicator maintains a buying signal, and MACD also conveys a similar signal while moving above the zero threshold. This suggests that the short-term outlook will become even more optimistic.

HNX-Index – Sustaining Above the Middle Line of Bollinger Bands

The HNX-Index continued its upward momentum since staying above the Middle Line of Bollinger Bands. At the same time, the index surpassed the SMA 50-day mark, indicating an increasingly optimistic situation. Trading volume exceeded the 20-day average, reflecting signs of cash flow returning to the market.

Presently, the Stochastic Oscillator and MACD indicators maintain buying signals. If this status quo is sustained, the optimistic outlook in the short term will persist.

Money Flow Analysis

Movement of Smart Money: The Negative Volume Index indicator of the VN-Index crossed above the EMA 20-day line. If this state continues in the next session, the risk of an unexpected downturn (thrust down) will be limited.

Foreign Capital Flow: Foreign investors continued to sell a net during the trading session on 04/02/2025. If foreign investors maintain this action in the coming sessions, the situation will be less optimistic.

III. MARKET STATISTICS AS OF 04/02/2025

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 17:15 04/02/2025

The Ultimate Trader’s Journal: Aiming for the December 2024 Peak

The VN-Index extended its upward momentum from the previous session, with trading volume surpassing the 20-day average. A more robust participation of funds in the upcoming sessions could propel the index towards its old peak of December 2024 (1,270-1,280 points). The Stochastic Oscillator and MACD indicators remain bullish, suggesting continued optimism in the short term.

Market Beat: Afternoon Recovery Efforts See VN-Index Gain Almost 2 Points

The market rallied strongly in the first half of the morning session, with green dominating the screens. However, the momentum stalled, and a correction set in, allowing red to creep in. By the end of the session, despite a significant 461 gainers, including 51 stocks hitting the ceiling, there were also 304 decliners, of which 4 touched the floor.

Market Beat: Foreigners Sell-Off, VN-Index Struggles in the First Trading Session of the Year of the Black Tiger

The market closed with the VN-Index down 12.02 points (-0.95%) to 1,253.03, while the HNX-Index climbed 0.48 points (+0.22%) to 223.49. The market breadth tilted in favor of gainers with 380 advancing stocks against 343 declining ones. Meanwhile, the large-cap VN30-Index painted a red picture, with 25 stocks declining, 4 advancing, and 1 stock closing flat.

“Vietstock Weekly: Sustaining the Uptrend”

The VN-Index extended its upward momentum, surpassing the 50-week SMA. However, trading volume remained below the 20-week average, indicating investors’ cautious sentiment. In the upcoming sessions, the index needs to firmly hold above this threshold with improved liquidity to sustain the upward trajectory.

Market Beat on Feb 7th: Hesitation Lingers, VN-Index Wobbles Around 1,275 Points

The market closed with positive gains, seeing the VN-Index rise by 3.72 points (+0.29%) to 1,275.2, while the HNX-Index climbed 0.36 points (+0.16%) to 229.49. The market breadth tilted in favor of bulls with 463 gainers and 310 losers. The large-cap basket, VN30, witnessed a similar trend with 17 gainers, 11 losers, and 2 stocks closing flat, ending the day on a greener note.