**Growth Potential**

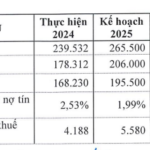

According to Eximbank’s Q4 2024 financial report, the bank has achieved remarkable growth. The bank reported a net interest income of VND 5,923 billion in 2024, a 29% increase from 2023. Pre-tax profit reached over VND 4,188 billion, a 54% increase from the previous year. Net profit after-tax stood at VND 3,326 billion, a 54% surge year-over-year.

Eximbank achieves record profits after 35 years.

|

The bank’s bright spot in terms of business results stems from restructuring its loan portfolio towards safety and efficiency, especially in the SME, individual, and production and business consumption segments.

Over the past year, Eximbank significantly increased interest rates on various terms and continued to launch multiple savings products, including the Customer Appreciation Program, Eximbank VIP Savings, Self-selected Term Savings, Birthday Joy with Eximbank, and Online Savings. The bank also introduced Visa Direct, a breakthrough service redefining cross-border financial transactions.

Additionally, Eximbank proactively diversified its revenue streams by generating income from non-credit activities such as payment services, foreign exchange and gold trading, and effective bad debt handling.

As of 2024, Eximbank’s total assets grew by 18.9%, reaching VND 239,532 billion. Credit balance increased by 19.72%. Net income from service activities surged by 110.1% compared to 2023, reaching VND 1,080 billion, while income from foreign exchange trading activities rose by 38.7%, amounting to VND 674 billion.

The bank’s financial report indicates its successful management of safety indicators in operations as mandated by the State Bank of Vietnam (SBV) amidst a complex economic landscape. The bank maintained its short-term capital ratio for medium and long-term loans at around 24%-25%, below the SBV’s maximum limit of 30%. The bank’s LDR ratio hovered around 82%-84%, compared to the SBV’s regulation of 85%, while its CAR ratio fluctuated between 12%-13%, surpassing the SBV’s minimum requirement of 8%.

Currently, instead of solely relying on deploying preferential credit packages, Eximbank has proactively restructured its asset and capital structure to enhance its NIM (net interest margin). This approach not only improves business efficiency and boosts profits but also mitigates risks and contributes to a stable financial environment for customers and the system.

**Focus on Export-Import Strategy**

Given its specialization in supporting export-import transactions, the bank’s profits reflect the high demand for financial services in international trade.

Eximbank has introduced numerous attractive products and services, such as Eximbank EBiz, a digital platform that enables SMEs to request online guarantee issuance anytime with advanced automation and optimized security, thereby reducing financial pressure.

To facilitate efficient operations for import-export enterprises in the context of a volatile global market, Eximbank launched a preferential USD lending rate program. Enterprises without prior credit relationships with Eximbank can enjoy an attractive interest rate of 3.7%/year, while existing borrowers are offered a rate of 3.8%/year.

With these focused solutions, Eximbank is well-positioned to support enterprises in enhancing their competitiveness, optimizing financial costs, and boosting import-export activities in the upcoming period.

**Embracing Technology as a Driving Force**

Since 2023, Eximbank has made significant investments in its technology infrastructure, aiming for a modern, green, safe, and secure system. The bank prioritized the implementation of digital projects across its entire system, standardized and optimized management and operational processes, and enhanced the quality of its services. In parallel, the bank applied innovative technology to redesign its products and services to meet market demands and customer expectations.

Eximbank is now actively engaged in the digital race, striving to offer a diverse range of high-quality financial products with a customer experience-centric approach and a focus on expanding its customer base.

The continuous launch of digital products and services, coupled with a robust enhancement of the customer experience, are the initial fruits of the bank’s intensified digital transformation strategy.

**Breakthrough Potential**

In 2024, the State Bank of Vietnam approved an increase in Eximbank’s charter capital to VND 18,688 billion, enabling the bank to strengthen its financial capacity, expand its scale of operations, and enhance its ability to meet international capital adequacy standards.

This was also the year Eximbank paid cash dividends after a decade and made a breakthrough decision to expand its presence nationwide.

After 35 years, with new thinking, new strategies, and new markets, Eximbank is shaping a new trajectory for its development. Through synchronized and flexible solutions, the bank is poised to seize opportunities, enhance its competitiveness, and foster transparency and efficiency.

– Minh Tai

– 09:28 12/02/2025

The Companies Smashing Profit Records in 2024

Vietnam Airlines, FPT, PNJ, Gelex, and Idico are among the top Vietnamese companies that have announced record-breaking profits for 2024. With impressive financial results, these businesses have showcased their resilience and growth amidst economic challenges. As they soar to new heights, they set a benchmark for success in the dynamic Vietnamese market.

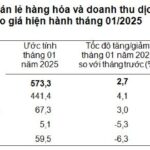

The Retail Sales and Consumer Service Revenue in the First Month Increase by 9.5% Year-on-Year

According to the General Statistics Office, the surge in domestic consumption during the Lunar New Year holiday, coupled with a robust recovery in tourism, significantly contributed to the growth of the trade and service sector. The total retail sales of goods and revenue of consumer services in January 2025 are estimated to have increased by 9.5% compared to the same period last year.

“TTC AgriS Reaps Results: On Track to Achieve Annual Profit Goals”

TTC AgriS (HoSE: SBT) has unveiled its impressive Q2 financial results for the 2024-2025 fiscal year, showcasing significant growth in both revenue and profit.