Eximbank’s Extraordinary General Meeting took place on the morning of February 26, 2025.

|

Supplementary Election of Three Supervisory Board Members

The Eximbank leadership proposed to the General Meeting to elect three additional Supervisory Board members, bringing the total number of Supervisory Board members to five. Currently, Eximbank’s Supervisory Board consists of two members, Ms. Doan Ho Lan and Ms. Pham Thi Mai Phuong.

Chairman of the Board of Directors, Nguyen Canh Anh, stated that during the Extraordinary General Meeting in November 2024, one Supervisory Board member was dismissed upon the proposal of a group of shareholders holding over 5% of the common shares. This left the Supervisory Board with only two members, which is insufficient according to the Law on Credit Institutions.

Therefore, the election of additional Supervisory Board members is necessary to ensure the bank’s operations and comply with the requirement to hold elections within 90 days of the number of Supervisory Board members falling below the required threshold.

According to the new provisions of the 2024 Law on Credit Institutions, the minimum number of Supervisory Board members in a bank is five. For credit institutions that still have three Supervisory Board members as per the previous regulations, this number can be maintained until the end of the term.

At the General Meeting, shareholders elected three candidates to the position of Supervisory Board members of Eximbank: Mr. Lam Nguyen Thien Nhon, Ms. Tran Thi Minh Ly, and Mr. Nguyen Tri Trung.

Mr. Lam Nguyen Thien Nhon (born in 1978) has extensive experience in the field of finance and banking, having held important positions at ABBank, Viet A Bank, EVN Finance, and NCB. Mr. Nhon joined Eximbank in March 2024 as the Director of the South West Ho Chi Minh City Region.

Mr. Nguyen Tri Trung (born in 1981) brings a wealth of experience from his work at ABBank, OceanBank, and SCB. He joined Eximbank in April 2023 as the Director of the Long Bien Branch, a position he continues to hold.

Ms. Tran Thi Minh Ly (born in 1978) has many years of experience in accounting and auditing. She joined Eximbank in 2008 and previously served as the Deputy Director of the Risk Management Block and Head of Operational Risk Management at Eximbank from August 2014 to May 2022.

In response to a shareholder’s question regarding the timing of the candidate announcement, Chairman Nguyen Canh Anh explained that the list of Supervisory Board candidates must be approved by the State Bank of Vietnam (SBV) before the election at the General Meeting.

Amendment to the Bank’s Charter

In addition to the election of Supervisory Board members, Eximbank presented to the shareholders for approval the amended Charter, as proposed on February 20, 2025, by a group of shareholders holding over 5% of the total shares.

According to the proposal dated February 20, 2025, the group of shareholders suggested amending and supplementing the Charter of organization and operation of the Bank to align with the new provisions of the 2024 Law on Credit Institutions and other relevant legal documents. The proposal also aimed to modify the current Charter to meet the practical needs of Eximbank’s governance and operations.

As a result, the amendment of the Bank’s Charter is no longer subject to the requirement of a 65% voting ratio for approval.

The following cases require the approval of shareholders representing more than 65% of the total voting rights of all shareholders present at the General Meeting or in the case of taking votes by written means:

First, the approval of a plan to change the chartered capital, a plan to offer shares for sale, including the type and number of shares to be offered.

Second, the approval of a plan to contribute capital, buy or sell shares, or capital contributions of Eximbank in other businesses or credit institutions, where the expected value of capital contribution, purchase price, or book value in case of sale of shares or capital contributions is equal to or greater than 20% of Eximbank’s chartered capital as stated in the latest audited financial statements.

Another issue that requires the approval of shareholders representing more than 65% of the total voting rights of all shareholders present at the General Meeting is the decision to split, merge, consolidate, change the legal form, dissolve, or request the court to initiate bankruptcy proceedings for Eximbank.

Except for the above-mentioned cases, the resolutions and decisions of the General Meeting shall be passed with the approval of shareholders representing more than 50% of the total voting rights of all shareholders present at the meeting or with the approval of shareholders representing more than 50% of the total voting rights of all shareholders in the case of taking votes by written means.

According to Chairman Nguyen Canh Anh, the amendment of the Charter is part of the previous roadmap. Immediately after the new Law on Credit Institutions came into effect, the Eximbank management set a specific goal to revise the Charter and supplement the necessary provisions to ensure compliance with the law.

Procedures for Relocating the Head Office to Hanoi are Pending SBV Approval

Regarding the relocation of the head office to Hanoi, Chairman Nguyen Canh Anh shared that following the Extraordinary General Meeting in November 2024, the Board of Directors of Eximbank established a committee to oversee the relocation process.

“Currently, Eximbank is in the process of finalizing a framework agreement for leasing the new location, and this information has been publicly disclosed on the Bank’s website. We are also in the process of selecting contractors and implementing related procedures for the relocation to Hanoi. Additionally, we have completed the necessary procedures with the relevant authorities and are awaiting approval from the State Bank of Vietnam”, added the Chairman of Eximbank.

Commenting on the basis for setting the 2025 business plan, Mr. Canh Anh mentioned that Eximbank has a tradition of facilitating import and export transactions, and the 33% increase in profit target for 2025 is attributed to the high demand in the international payment segment.

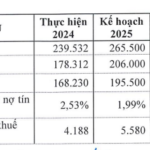

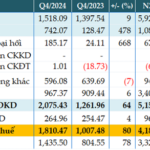

Previously, Eximbank announced its 2025 business plan with total assets targeted at VND 265,500 billion, an increase of 10.8% compared to 2024. Capital mobilization is expected to reach VND 206,000 billion, an increase of 15.5%, while credit balance is projected to be VND 195,500 billion, up 16.2%. The ratio of bad debts to total credit is expected to decrease from 2.53% in 2024 to 1.99% in 2025. Consolidated pre-tax profit is targeted at VND 5,580 billion, a 33.2% increase compared to 2024.

With a 33% Increase Plan, Eximbank Aims for a Profit of VND 5,580 Billion in 2025

– 14:19 26/02/2025

The Secret Behind Eximbank’s Record Pre-Tax Profit of Over VND 4,000 Billion

“With a strategic focus on diversifying its revenue streams and financial services offerings, Eximbank has carefully structured its lending portfolio to prioritize safety and efficiency. This approach has been instrumental in driving impressive business results for the bank, setting it on a path towards a remarkable year in 2024.”

DongA Bank: A Troubled Institution’s Forcible Handover and the End of Shareholder Power?

Prior to being placed under special control, DongA Bank’s institutional shareholders included: Bac Nam 79 Construction, owned by Vu “Nhom”, which held 10%; PNJ with 7.7% of the charter capital; Ho Chi Minh City Party Committee Office with 6.9%; Ky Hoa Tourism and Trading with 3.78%; An Binh Capital with 2.73%; and Nha Phu Nhuan with 2.14%.