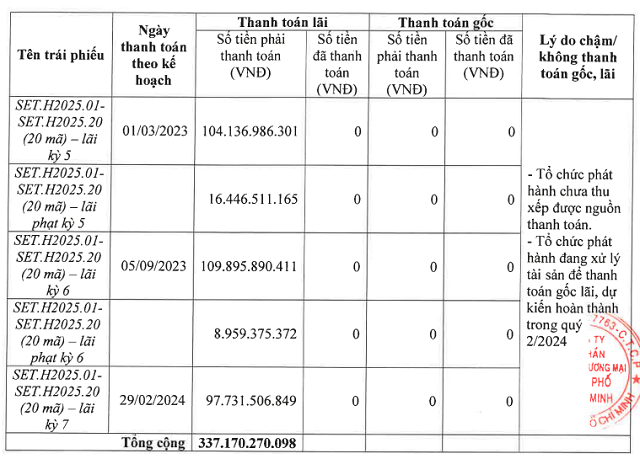

The CTCP Dịch vụ – Thương mại Thành phố Hồ Chí Minh (Setra) is required to pay about VND 311 billion to its creditors in installments on March 1, 2023, September 5, 2023, and February 29, 2024, according to the payment schedule. Additionally, a penalty interest of VND 25.4 billion has been incurred.

The company has stated that it is currently unable to arrange for payment and is in the process of liquidating assets to pay off the principal and interest. This process is expected to be completed in the second quarter of 2024. Setra has previously issued similar deferment notifications in February and September 2023 for the same reason.

Details of the payment amounts according to Setra’s schedule. Source: Setra

|

In September 2023, a batch of 20 bonds issued by Setra was determined by the Investigative Police Agency of the Ministry of Public Security to be related to the “Fraudulent Misappropriation of Assets” case at Vạn Thịnh Phát Group. Along with 5 other bonds created by related companies, the total amount misappropriated from creditors reached VND 30 trillion.

* Vạn Thịnh Phát case victims sought by Ministry of Public Security

The batch of bonds with an interest rate of 11% per annum, with a nominal value of VND 2 trillion, which Setra successfully issued in August 2020, is due to mature in August 2025 as planned.

In early 2023, Setra held meetings with creditors to inform them of the inability to pay interest, and stated that all bank accounts and other assets related to the Vạn Thịnh Phát case were sealed by the investigating agency. The company had to compile a list of assets to be sent to the authorities for permission to sell these assets in order to obtain funds for repayment to creditors.

In addition to the fraudulent bonds, Setra has issued 31 other bonds from STRCB2023001 to STRCB2023031 with a total value of VND 3.75 trillion. These bonds matured at the end of July 2023.

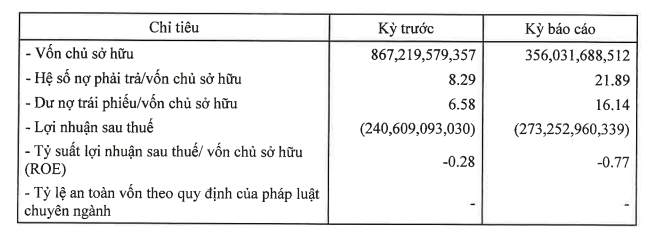

The business performance somewhat reflects the difficulty of this company in fulfilling its obligations to its “creditors”. In the report submitted to HNX, for the first half of 2023, Setra incurred a post-tax loss of VND 273 billion, higher than the loss of VND 240 billion in the same period last year.

At that time, the company’s total debt amounted to VND 7.8 trillion, with bond debt accounting for 73%, reaching VND 5.7 trillion, 22 times and 16 times the owner’s equity (VND 356 billion), respectively. The years 2022 and 2021 were no better for Setra, with losses of VND 478 billion and VND 460 billion, respectively.

Business results for the first half of 2023 of Setra. Source: Setra

|

Established in 1999, Setra’s main business area is real estate, ownership rights, and land use rights of owners, users, or tenants. The company is headquartered in Ben Nghe Ward, District 1, Ho Chi Minh City. The CEO is Mr. Tran Van Tuan.

|

The investigation into the Vạn Thịnh Phát case determined that from 2018 to 2020, the parties involved at Vạn Thịnh Phát Group, An Đông Investment Group, Quang Thuan Investment Trading Company, Ho Chi Minh City Investment and Trading Services Company, Sunny World Investment and Development Joint Stock Company, and other organizations engaged in fraudulent activities and violated legal regulations by creating 25 bond packages with codes: ADC-2018.09, ADC-2018.09.1, ADC-2019.01, QT-2018.12.1, SNWCH1823001, and 20 other codes from SET.H2025.01 to SET.H2025.20, with a total value of VND 30,081 billion, for sale to buyers (creditors), raising funds and misappropriating them. |

* Two real estate companies unable to repay bond interest on time