According to data compiled by VietstockFinance on 25 listed plastic companies on the stock exchanges (HOSE, HNX, and UPCoM), the fourth-quarter total revenue reached VND 16,689 billion, up 19% year-on-year. However, net profit decreased by 5%, reaching VND 608 billion.

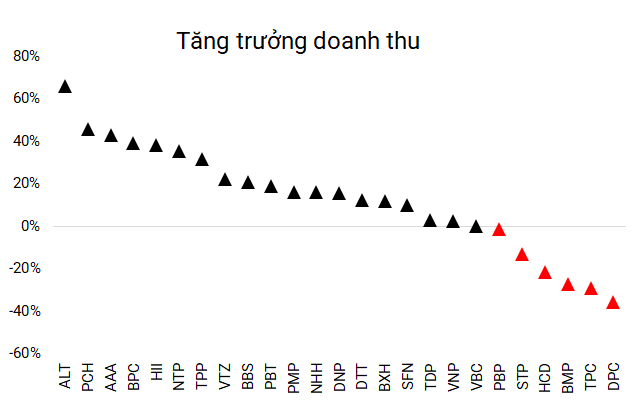

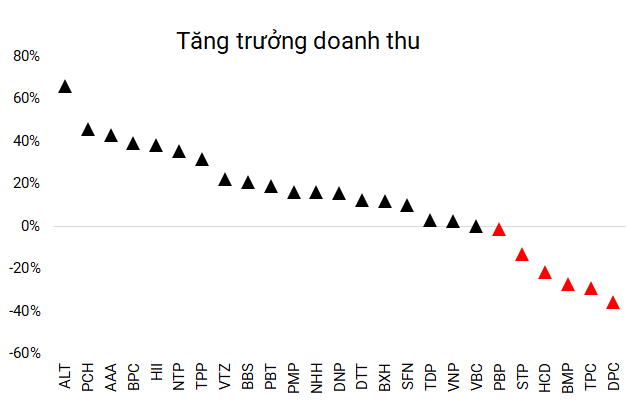

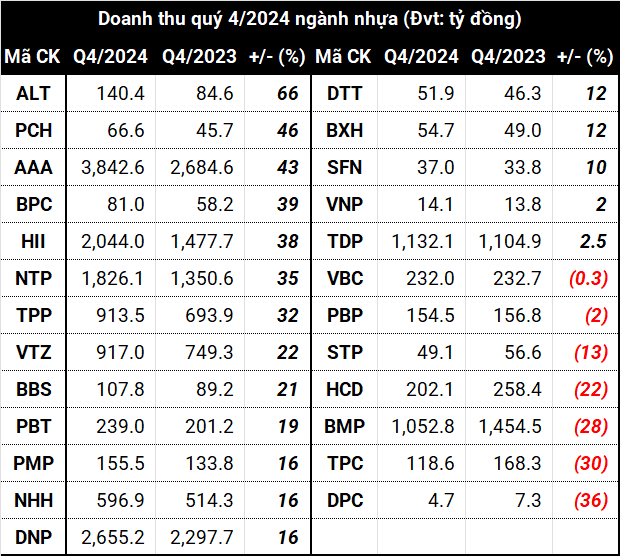

Revenue increased significantly, with the highest growth at 66%

The company with the highest revenue growth was Tan Binh Culture Joint Stock Company (HNX: ALT), with a 66% increase, reaching over VND 140 billion. This was achieved through their focus on the trading and plastic granules segments.

An Phat Holdings’ group, including An Phat Plastic and Green Environment Joint Stock Company (HOSE: AAA), An Tien Industries Joint Stock Company (HOSE: HII), and Hanoi Plastic Joint Stock Company (HOSE: NHH), all achieved strong double-digit growth. AAA’s revenue reached VND 3,843 billion, a 43% increase, with a significant contribution from HII’s 38% growth, surpassing VND 2,000 billion.

VICEM Bim Son Packaging Joint Stock Company (HNX: BPC) also impressed with a 39% growth rate, recording VND 81 billion in revenue.

Other large enterprises, such as Tien Phong Plastic Joint Stock Company (HNX: NTP) and Tan Phu Plastic Joint Stock Company (HNX: TPP), witnessed revenue increases of 35% and 32%, respectively. NTP’s revenue reached VND 1,826 billion, while TPP’s was VND 914 billion. These positive results were attributed to their successful market expansion and effective control of raw material input costs.

However, not all companies experienced positive outcomes. Despite both being in the construction plastics sector, Binh Minh Plastic Joint Stock Company (HOSE: BMP) and Tan Dai Hung Plastic Joint Stock Company (HOSE: TPC) faced revenue declines of 28% and 30%, respectively. BMP’s revenue fell to just over VND 1,000 billion, while TPC’s dropped to VND 119 billion.

HCD Investment Production and Trading Joint Stock Company (HOSE: HCD) also encountered challenges, with a nearly 22% decline in revenue to VND 202 billion. This was mainly due to the impact of global plastic raw material price fluctuations.

With a decrease of nearly 36%, Danang Plastic Joint Stock Company (UPCoM: DPC) recorded the lowest revenue in the past 20 years, amounting to only VND 4.7 billion.

Source: Author’s compilation

|

Source: Author’s compilation

|

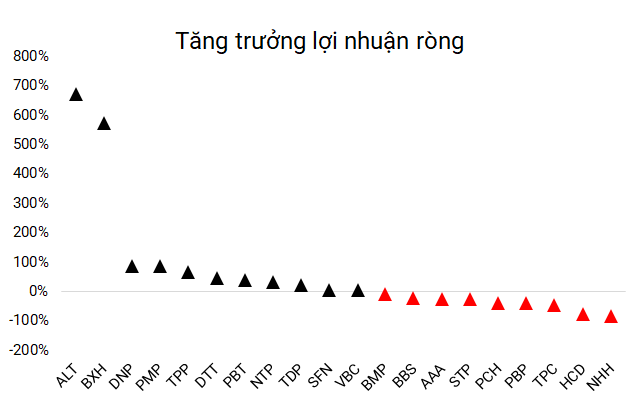

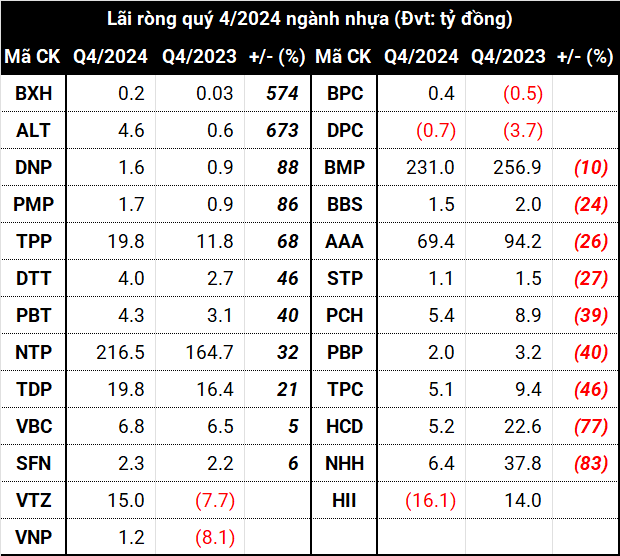

Profit polarization, An Phat Holdings group reports lower profits

Despite the increase in revenue, many companies experienced declines in net profit, and some even incurred losses. Hanoi Plastic Joint Stock Company (HOSE: NHH) was one of the companies with the sharpest declines, with an 83% drop to VND 6.4 billion. This was mainly due to losses from associated companies, and it was the second consecutive quarter that NHH’s profits remained at a very low level.

Although An Phat Plastic and Green Environment Joint Stock Company (AAA) achieved a 43% increase in revenue, their net profit still decreased by 26%, falling to nearly VND 70 billion. This was due to losses incurred by its subsidiaries.

In addition to NHH and AAA, another company within the An Phat group that reported a decline in profit was An Tien Industries Joint Stock Company (HOSE: HII). HII shifted from a profit of VND 13.7 billion in Q4/2023 to a loss of VND 16 billion in Q4/2024. The main reason for this downturn was the negative performance of its associated companies.

On a positive note, some companies outperformed expectations. VICEM Hai Phong Packaging Joint Stock Company (HNX: BXH) surprised with a net profit increase of 574%, reaching VND 170 million, thanks to their expansion into the cement market. However, this result was not enough to lift BXH out of a year of low profits since 2007.

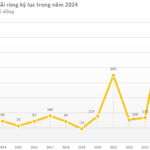

Similarly, Vietnam Thanh Plastic Production and Trading Joint Stock Company (HNX: VTZ) turned losses into profits, earning VND 15 billion. This remarkable turnaround was attributed to their strategy of diversifying distribution channels and reducing management expenses. As a result, their profit for the year reached its highest level since they began disclosing information in 2018.

Companies like Tien Phong Plastic Joint Stock Company (HNX: NTP) and Tan Phu Plastic Joint Stock Company (HNX: TPP) also witnessed improvements, with double-digit growth in net profit. NTP’s profit reached VND 216 billion (up 32%), while TPP’s was VND 20 billion (up 68%). These positive Q4 results contributed to record-high annual profits for both companies. NTP’s construction plastics segment particularly benefited from low PVC plastic granule prices. Phu My Fertilizer Packaging Joint Stock Company (HNX: PMP) even achieved an impressive 86% increase, earning over VND 1.7 billion.

Source: Author’s compilation

|

Source: Author’s compilation

|

Key reasons for the decline in profits

Despite the strong revenue growth across the industry, profits declined due to various factors such as fluctuations in plastic granule prices and high input costs, which squeezed margins for many businesses.

Some companies, like BBS, significantly increased their administrative expenses, impacting their bottom line. Others were affected by declining interest rates, resulting in lower financial revenue compared to the previous year. Additionally, losses from subsidiaries and associated companies dragged down profits for An Phat Holdings’ group (AAA, NHH, HII).

Construction plastics sector anticipates “double” advantages in 2025

In 2024, plastic pipe manufacturers like NTP and BMP continued to benefit from low PVC plastic granule prices. In a recent report, FPT Securities (FPTS) predicted that the price of PVC plastic granules would remain stable at a low level in 2025, averaging around USD 810/ton. There might be a slight increase in prices during the second half of the year, coinciding with an improvement in China’s real estate market.

Additionally, consumption volume is expected to increase by 6.5% year-on-year as market demand recovers, especially from Q2/2025 onwards, thanks to the synchronized and effective implementation of legal solutions for the domestic real estate market.

Assuming that the sales policies of these companies remain relatively stable throughout 2025, FPTS anticipates that the highest growth in production volume will occur in Q1/2025. This is mainly due to the low base effect of Q1/2024, when NTP temporarily halted promotional activities.

As a result, the gross profit margin for construction plastics companies is forecast to reach an average of approximately 36% in 2025, similar to the high level achieved in 2024, with the peak profit period expected in Q2.

Projection of consumption volume for BMP and NTP in 2025 – the two companies that account for over 50% market share in construction plastics. Source: FPTS

|

– 10:00 25/02/2025

The Ultimate Pork Profit Peak: Hog Farmers’ Sky-High Success in 2024

In 2024, pork prices surged, a stark contrast to the previous year’s downward trend. This fortuitous turn of events presented pork producers with a year of prosperous business, with many companies witnessing a multifold increase in profits.

The Businesses Smashing Profit Records in 2024

Vietnam Airlines, FPT, PNJ, Gelex, and Idico are among the top Vietnamese companies that have announced record-breaking profits for 2024. With impressive financial results, these businesses have showcased their resilience and growth amidst economic challenges. As they soar to new heights, they set a benchmark for success in the dynamic Vietnamese market.

The Ultimate Guide to Writing Compelling Copy for the Web: “Unveiling the Giant: How the Owner of Vietnam’s Largest Rare Earth Mine Reached New Heights with a Record-Breaking Profit, Surpassing Industry Giants”

The company’s net profit attributable to the parent company’s shareholders soared to VND 422 billion in Q4 2024, a staggering 9.5 times increase compared to the same period last year.