Market liquidity increased compared to the previous session, with the VN-Index matching volume reaching over 501 million shares, equivalent to a value of more than 11.8 trillion VND; HNX-Index reached over 44.6 million shares, equivalent to a value of more than 840 billion VND.

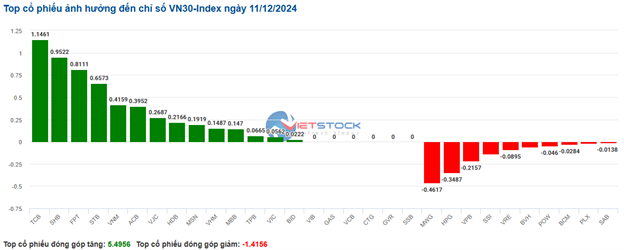

VN-Index opened the afternoon session with a continued lackluster performance as selling pressure increased, causing the index to plunge and close in the red. In terms of impact, VCB, GVR, MWG, and LPB were the most negative stocks, taking away more than 2.4 points from the index. On the other hand, FPT, SHB, KDC, and HDB were the most positive stocks, but their impact was not significant.

| Top 10 stocks with the highest impact on Dec 11, 2024 |

Similarly, HNX-Index also witnessed a lackluster performance, with the index negatively impacted by VIF (-3.95%), NVB (-2.25%), DHT (-2.7%), and IDC (-1.05%)…

|

Source: VietstockFinance

|

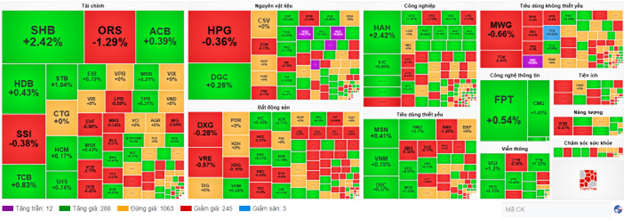

The utilities sector witnessed a sharp decline of 0.99%, mainly due to POW (-1.98%), REE (-1.19%), GAS (-0.43%), and QTP (-2.03%). This was followed by the non-essential consumer goods sector and the industrial sector, which decreased by 0.68% and 0.66%, respectively. On the other hand, the information technology sector witnessed the strongest recovery in the market, reaching 0.67%, with green signals from FPT (+0.67%), CMG (+0.71%), ITD (+1.53%), CMT (+4.35%), and VTB (+0.47%). The telecommunications and essential consumer goods sectors also witnessed recoveries, increasing by 0.59% and 0.42%, respectively.

In terms of foreign investors’ transactions, they continued to net sell over 295 billion VND on the HOSE exchange, focusing on VRE (129.19 billion), MWG (71.37 billion), PVD (39.95 billion), and DGC (34.9 billion). On the HNX exchange, foreign investors net sold over 58 billion VND, focusing on PVS (48.73 billion), MBS (4.6 billion), SHS (3.6 billion), and IDC (3.31 billion).

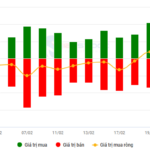

| Foreign investors’ net buying and selling activities |

Morning session: Back to the starting point

The market traded rather gloomily, with the VN-Index slowly sliding back to the starting point by the end of the morning session. At the midday break, the VN-Index stood at 1,271.76 points, down slightly by 0.02%; while the HNX-Index decreased by 0.21% to 228.75 points. The number of declining stocks gradually outnumbered advancing stocks, with 306 losers and 274 gainers.

The trading volume of the VN-Index reached over 262 million units, equivalent to a value of nearly 6.7 trillion VND. The HNX-Index recorded a trading volume of over 23 million units, with a value of nearly 485 billion VND.

FPT, TCB, and VNM were the main pillars contributing positively to the VN-Index, adding more than 1 point to the index. On the other hand, VCB was the stock that hindered the upward momentum the most, causing the index to lose nearly 1 point. The remaining stocks had an insignificant impact.

The market traded rather “boringly” as most sectors fluctuated within a narrow range of less than 1%. Except for the telecommunications group, which temporarily led with a slightly higher increase, mainly contributed by VGI (+1.2%), FOX (+0.93%), and YEG (+1.77%).

On the other hand, the utilities group was at the “bottom” with a decrease of 0.83%. Notably, POW (-1.19%), DNH (-9.77%), QTP (-1.35%), HNA (-3.02%), TMP (-6.83%), and DNW (-8.6%) witnessed considerable declines.

Foreign investors’ transactions were also not very positive as they net sold nearly 248 billion VND on the three exchanges. The largest net sell values were in MWG (-50.71%), DGC (-32.19%), and VRE (-26.98%). Conversely, TCB was the stock that foreign investors net bought the most in the morning session, but the value was quite modest, at just over 26 billion VND.

10:30 am: Real estate and financial sectors diverge, VN-Index fluctuates

The market struggled to break out strongly due to the lack of leadership from the financial and real estate sectors, causing the main indices to move in opposite directions and continue to fluctuate around the reference level. As of 10:30 am, the VN-Index slightly increased by 1.07 points, trading around 1,273 points. Meanwhile, the HNX-Index decreased by 0.16 points, trading around 229 points.

The breadth in the VN30 basket showed a divergent trend, with green signals slightly dominating. Specifically, TCB, SHB, FPT, and STB contributed 1.14 points, 0.95 points, 0.81 points, and 0.65 points to the index, respectively. On the contrary, MWG, HPG, VPB, and SSI faced selling pressure and took away more than 1 point from the VN30-Index.

The real estate sector witnessed a context of divergence, with green and red signals relatively balanced. The selling pressure was concentrated mainly in BCM, which decreased by 1.03%, DXS by 0.63%, KBC by 0.52%, and DXG by 0.56%… Additionally, commercial real estate stocks such as VRE also turned red, decreasing by 0.57%. On the other hand, only a few stocks managed to stay in the green territory, including VHM, VIC, DIG, and VC7, but their gains were modest, below 1%.

Following suit, the financial sector also weighed on the overall index as it exhibited strong divergence, although the number of gainers slightly outnumbered decliners. Specifically, stocks that maintained their upward momentum included SHB, which increased by 2.42%, ACB by 0.39%, TCB by 1.04%, and HDB by 0.64%… The remaining stocks were either standing still or turning red, such as ORS, SSI, CTG, and NAB, but their declines were not significant, below 1%.

The telecommunications services group continued to witness optimistic investor sentiment, increasing by 1.34% and providing support to the market. Buying interest was observed in stocks such as VGI, which rose by 1.31%, YEG by 2.13%, FOX by 1.65%, and TTN by 7.22%…

Compared to the beginning of the session, the fluctuating trend persisted, with green and red signals relatively balanced and interspersed. There were 288 advancing stocks and 245 declining stocks.

Source: VietstockFinance

|

Opening: Green signals from the beginning

At the beginning of the Dec 11 session, as of 9:30 am, the VN-Index showed green signals right from the start, reaching 1,275.6 points. Meanwhile, the HNX-Index witnessed a slight increase, maintaining the 229.58-point level.

Green signals temporarily dominated the VN30 basket, with 8 decliners, 20 gainers, and 2 stocks standing still. Among them, MSN, SHB, and STB were the stocks that increased the most. On the contrary, BVH, BCM, and MWG were the stocks that decreased the most.

The telecommunications services group was one of the most prominent sectors at the beginning of the morning session. Stocks that traded positively from the start included VGI, which increased by 1.96%, TTN by 7.22%, FOX by 2.06%, and YEG by 2.13%…

Along with this, the materials sector also contributed positively to the market’s performance this morning. Notably, stocks such as HPG increased by 0.18%, NTP by 1.1%, NKG by 0.51%, PLC by 1.39%, and TVN by 2.53%…

Market Beat on Feb 24th: VN-Index Surges Past 1,300 Points as Trading Volume Improves

The market closed with strong gains, as the VN-Index rose by 7.81 points (+0.6%), finishing at 1,304.56; while the HNX-Index climbed 0.92 points (+0.39%) to close at 238.49. The market breadth was relatively balanced, with 377 gainers and 373 losers. The large-cap stocks in the VN30 basket painted a positive picture, as 21 stocks advanced, 6 declined, and 3 remained unchanged, tilting the basket towards a green close.

The Market Beat – 28/02: Foreigners’ Robust Sell-off Continues in the Final Trading Session of February

The market closed with slight losses, as the VN-Index dipped by 2.44 points (-0.19%) to end the day at 1,305.36. Similarly, the HNX-Index edged lower by 0.2 points (-0.08%), finishing at 239.19. The market breadth tilted towards decliners, with 408 tickers in the red versus 390 in the green. The large-cap segment mirrored this sentiment, as reflected in the VN30 basket, where 18 stocks retreated, seven advanced, and five remained unchanged.

Is the Uptrend Supported?

The VN-Index rebounded with a Hammer candlestick pattern, reflecting investors’ optimism as the index broke through the old peak of October 2024 (1,290-1,305 points). This bullish sentiment is further reinforced by the MACD indicator, which continues to trend upward, providing a buy signal. If the index sustains levels above this threshold, accompanied by high trading volume, the upward trajectory will be solidified.

Steady Growth Surge: Vietstock Daily’s Insight for 25/02/2025

The VN-Index has been on a remarkable run recently, with five consecutive sessions in the green, closely hugging the upper band of the Bollinger Bands. What’s more, the index is retesting the old peak from October 2024 (1,290-1,305 points) amid sustained trading volumes above the 20-day average, indicating consistent participation from investors. Should the VN-Index decisively breach this zone, the outlook would turn even more bullish. However, the Stochastic Oscillator, now deeply embedded in overbought territory, suggests that the risk of a correction will heighten if sell signals reemerge.

Market Beat: Caution Creeps In at the 1,300-Point Threshold

The market closed with the VN-Index down 0.2 points (-0.02%), settling at 1,302.96, while the HNX-Index gained 0.29 points (+0.12%), closing at 238.6. The market breadth tilted slightly in favor of advancers, with 411 gainers against 365 decliners. However, the large-cap stocks in the VN30 basket witnessed a dominance of red, as 18 stocks fell, 10 advanced, and 2 remained unchanged.