Under ideal conditions, debt serves as a crucial financial support, significantly contributing to the encouragement of consumption and investment. When credit becomes easily accessible, consumers tend to increase their spending, thereby stimulating production and creating more job opportunities. Simultaneously, businesses can leverage borrowed capital to expand their operations, invest in modern technology, and enhance their competitive advantage, driving sustainable growth. More importantly, the ripple effect of credit improves the efficiency of money circulation, boosts GDP growth, and facilitates the balanced development of various industries. As a result, critical sectors such as real estate, industry, trade, and services are presented with robust growth opportunities, contributing to the overall economic development.

However, if the increase in borrowing does not lead to a corresponding growth in income and output, it can exert inflationary pressure. Specifically, during the period from 2007 to 2009, despite Vietnam’s credit growth consistently surpassing 30% for several years, the economic growth rate only reached 7%, while inflation remained high, indicating low capital efficiency. In contrast, from 2012 onwards, due to tight credit control and flexible monetary policies, the economy has maintained a stable growth rate of between 6.5% and 7%, with credit growth ranging from 14% to 15%, and inflation under control. Given the significance of credit in Vietnam’s economic growth, the pressing question arises: Is stimulating finance to promote growth a sustainable path for the long term?

When Debt Becomes a Societal Burden

In economics, a country’s sustainable GDP growth typically relies on three fundamental factors: capital, labor, and technology. However, in the context of Asian economies, including Vietnam, economic growth predominantly hinges on increasing debt rather than enhancing labor productivity. In the initial stages, the utilization of debt has proven to be an effective tool for governments to coordinate capital allocation into key sectors to promote growth. The influx of borrowed capital into these sectors encourages higher consumer spending on goods, providing an impetus for businesses to expand their production to meet rising consumer demand, thus forming a cycle of sustainable growth.

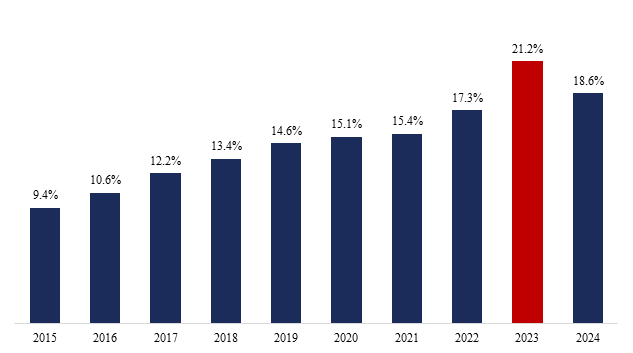

Chart 1: Ratio of Interest Income to Real GDP over the Years

* Interest income calculated based on interest income and similar income of 29 commercial banks

|

Nevertheless, data from 29 commercial banks reveals that Vietnam’s ratio of interest income to GDP has significantly increased over the years, indicating a rapid surge in debt compared to average income and GDP growth. Specifically, in 2023, this ratio peaked at 21.2% due to a sharp rise in interest rates, leading to a substantial increase in banks’ interest income. Although in 2024, the upward trend slowed down, decreasing to 18.6% due to interest rate adjustments in the economy, the long-term trend over the past decade persists. This raises concerns about the economy’s long-term debt repayment capability, particularly as the escalation of debt may exert significant financial pressure in the future.

In reality, with the current pace of debt growth, the mounting burden of interest payments does not bode well. As a significant portion of people’s income is diverted towards debt repayment instead of consumption spending, businesses become reluctant to expand their production due to waning consumer demand, thereby forming a protracted cycle of recession that adversely affects the economy. This becomes more evident as the past three years have witnessed a decline in consumer credit after nearly a decade of supporting sustainable economic growth. Therefore, while stimulating growth through increased borrowing remains a viable strategy, tighter control measures are imperative to ensure the optimal effectiveness of this capital flow. In the following section, we will delve deeper into the impact of debt on economic growth and consumption across different phases.

Simulating the Non-Linear Relationship between Debt and Economic Growth

To gain a deeper understanding of debt’s impact on economic growth and consumption, we can simulate a simple scenario through various stages. Initially, when credit is injected into the economy at low-interest rates, individuals and businesses have access to affordable capital, leading to increased consumption and investment. Subsequently, as total debt escalates rapidly and interest costs begin to soar, the effectiveness of credit diminishes, resulting in several repercussions. Finally, when the debt burden becomes overwhelming, the economy enters a phase of adjustment and debt repayment, leading to a downturn in spending and investment.

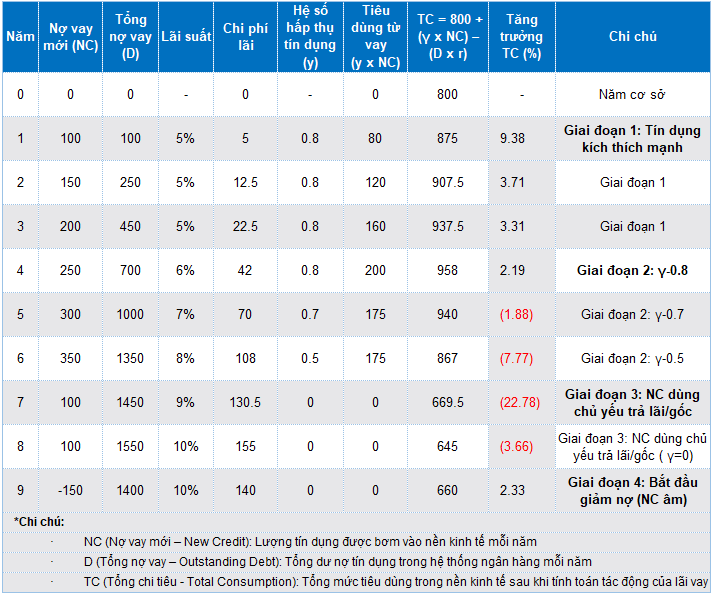

Table 1: Simulating the Impact of Credit on Consumption Growth across Stages

Source: Consolidated

|

For instance, in the first year, if a bank provides 100 units of capital with a credit absorption coefficient of 0.8, the economy could witness a consumption increase of up to 80 units. As total debt continues to expand to 150–200 units in subsequent years, consumption also rises accordingly, driving business revenue, creating employment opportunities, and stimulating production. This is the phase where credit is most effective, as capital is allocated efficiently, supporting sustainable economic growth without engendering negative consequences.

Nevertheless, when total debt increases faster than income growth, financial pressure begins to mount. Interest rates, a pivotal factor determining the cost of capital, gradually rise due to excessive money supply. For instance, if interest rates increase from 6% to 8% during the period from the fourth to the sixth year, the cost of borrowing becomes more expensive, reducing access to new loans. Consequently, both businesses and consumers have to allocate a significant portion of their income towards repaying existing debts, leading to a substantial decline in disposable income and, subsequently, a downturn in consumption and economic activity.

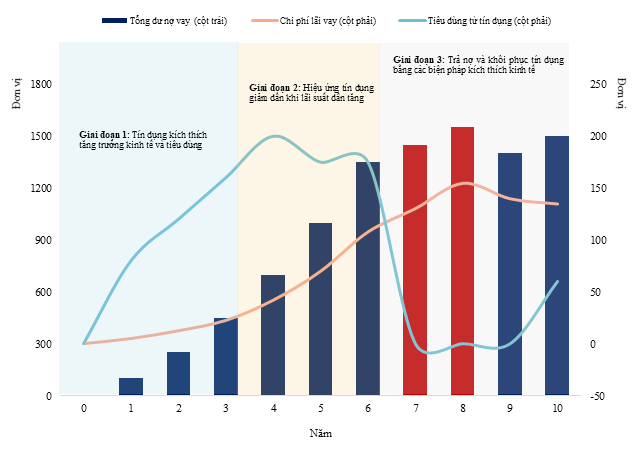

Chart 2: Simulating the Stages of Credit Impact on Consumption

*Chart based on data from the formula table.

|

The period from the seventh to the eighth year marks the time when the debt burden becomes most apparent. As individuals’ debt repayment capability diminishes, they are compelled to curtail personal spending, exerting a detrimental effect on GDP growth. Simultaneously, businesses also refrain from expanding their operations due to limited access to new loans or high borrowing costs. If this situation persists, it could trigger a wave of layoffs, resulting in rising unemployment rates and eroding confidence in the economy. Without timely intervention, the risk of default may spread, straining the banking system and pushing the economy towards a financial crisis.

After weathering the challenging phase of the credit downturn cycle, the economy gradually enters an adjustment stage, where old debts are addressed, and liquidity begins to improve. This recovery is often accompanied by adjustments in fiscal and monetary policies. Governments and central banks tend to implement growth-stimulating measures, such as lowering interest rates, aiding businesses in accessing affordable capital, and boosting public investment to invigorate the market. Consequently, GDP gradually recovers, unemployment rates decline, and confidence in the economy improves. However, to avert a recurrence of the risky credit cycle, regulatory authorities must tighten credit control, ensuring that capital is allocated prudently. This entails capping borrowing limits at safe thresholds, closely monitoring sectors prone to risks, such as real estate, and maintaining flexible monetary policies to foster long-term sustainable growth.

Debt is a potent financial instrument that can serve as a catalyst for growth when managed judiciously. However, it also harbors significant risks if misused. When credit is tightly controlled, it not only facilitates expanded investment and stimulates consumption but also lays the foundation for sustainable development. Conversely, when credit growth spirals out of control without commensurate regulatory measures, the economy may find itself in a vortex of indebtedness, liquidity strain, and the specter of recession. Ultimately, fostering consumption growth rooted in rising consumer income remains the bedrock of sustainable solutions, with enhancing labor productivity at the heart of the impending transformation that the government is steering towards with Resolution 57.

Lê Hoài Ân, CFA – Võ Nhật Anh, UEL

– 10:00 07/03/2025

The Prime Minister: Proactive and Agile in the Face of Global Economic Flux

As economic and trade policies evolve globally, the Prime Minister has urged for a proactive and agile approach. We must closely monitor these dynamic policy changes and respond with flexibility and feasibility for each market. To thrive in this evolving landscape, we should focus on fostering stronger partnerships with key players, reviewing tax policies, and strategically investing in high-tech sectors and innovation.

“HDBank Aims High: Targeting Profits of Over 20 Trillion VND by 2025 with Plans to Maintain Similar Dividend Payouts”

At the investor conference held on February 18, 2025, representatives from HDBank, one of Vietnam’s leading joint-stock commercial banks, presented an insightful overview of the country’s economic growth potential, along with the bank’s specific plans for the year 2025.

Governor of the State Bank: The Banking Sector is Ready to Support the Economy to Achieve 8% Growth and Beyond

In a volatile global economic landscape, Governor of the State Bank of Vietnam, Nguyen Thi Hong, has expressed her determination to contribute to achieving an ambitious 8% economic growth target, while also keeping inflation in check and ensuring stability in the currency market. The banking sector is projected to witness a credit growth of approximately 16%, yet it is imperative to devise synchronized strategies to mobilize and utilize capital more efficiently.

“Economic Growth: Navigating the Fine Line Between Credit Flows and Asset Bubble Risks”

It is undeniable that economic growth has become increasingly reliant on monetary policy, as the effectiveness and reach of fiscal policy have not yet met expectations. However, this dependence, if prolonged, could pose potential risks to the economy.