Rentable Apartments: A Smart Investment for Young Professionals

In the past, apartments were often considered a “liability” as their value depreciated over time. However, with rising property prices and rental rates, apartments, especially those in projects near Ho Chi Minh City, have become a “wealth-building” opportunity for young people. They are seeking to own and rent them out, taking advantage of the increasing demand for rental properties.

Data from the Vietnam Real Estate Brokers Association (VARS) indicates that by the end of 2024, apartment prices continued to rise, setting new price levels. This trend has led to a corresponding increase in rental rates, with an average growth of 10-20% in 2024. While Ho Chi Minh City’s apartment prices remain high, resulting in lower rental yields, some neighboring areas like Binh Duong and Dong Nai are offering more attractive returns.

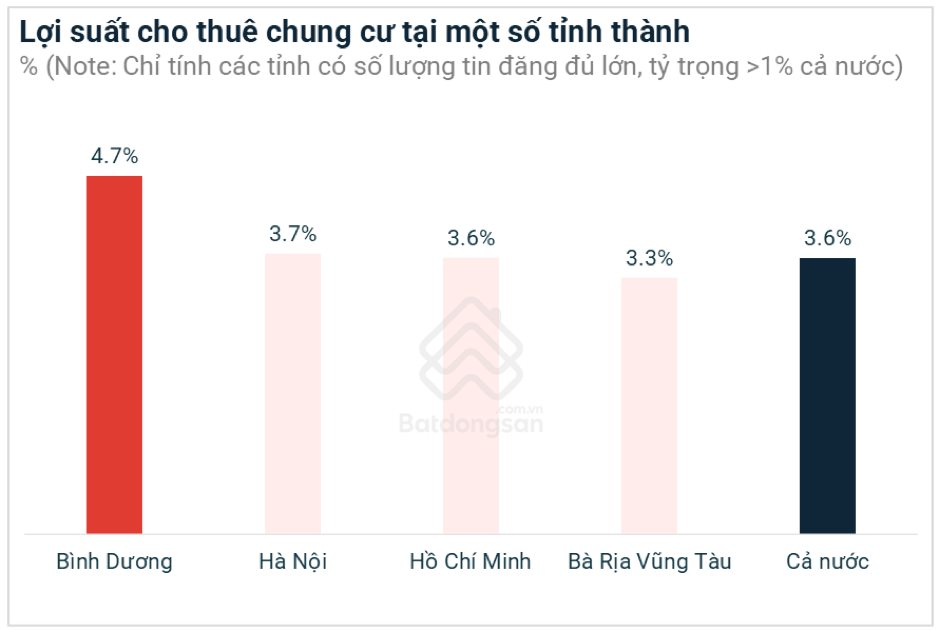

According to a report by Batdongsan.com.vn at the beginning of 2025, the average rental yield for apartments in Binh Duong is 4.7%, significantly higher than Hanoi’s 3.7% and Ho Chi Minh City’s 3.6%. Notably, some projects in Binh Duong have recorded rental yields of 6-7.5%/year, almost double that of Hanoi and Ho Chi Minh City.

Representatives from Batdongsan.com.vn attribute the high rental yields in Binh Duong to the reasonable purchase prices of high-end apartments in the area, coupled with high rental rates and stable occupancy levels. On average, a high-end apartment in Binh Duong (priced at approximately VND 45-50 million/m2) can be rented out for VND 12 million/month for a 1-bedroom unit, VND 15-16 million/month for a 2-bedroom unit, and VND 18-20 million/month for a 3-bedroom unit.

In contrast, in Ho Chi Minh City and Hanoi, an apartment priced at VND 45-50 million/m2 can only be rented out for about VND 7-12 million/month, depending on the number of bedrooms. Apartments priced from VND 80-90 million/m2 can fetch a rental income of around VND 15 million/month.

Binh Duong boasts the highest rental yields in the country. Source: Batdongsan.com.vn

Analyzing the investment choices of young people, a veteran investor in Ho Chi Minh City believes that this demographic typically targets apartments priced between VND 2-2.4 billion, which can be rented out for approximately VND 7-9 million/month. In comparison, a house in an alleyway of a similar price would only rent for VND 6-7 million/month. Considering the preferences of renters, they are more likely to choose an apartment in a better living environment over an alleyway house, especially for families with young children.

Young Professionals Embrace Installment Plans for Apartments: A Smart Move for Wealth Building and Long-Term Rentals

Recognizing the growing demand for rental apartments, many young professionals aged 28-35 with stable incomes have taken advantage of favorable policies offered by developers to purchase apartments through installment plans. This strategy allows them to generate rental income while building their asset portfolio for the future.

In Binh Duong, for example, some apartment projects priced between VND 2-3 billion/unit have seen a high proportion of young buyers, ranging from 60-70%. One such project is the high-end The Emerald 68 by the Le Phong Group and Coteccons, which recently launched its third sales phase with units priced at VND 1.9 billion each. The project has attracted buyers from Ho Chi Minh City, with diverse intentions, including occupying, renting, or waiting for price appreciation before reselling. Notably, the developer is offering special incentives for buyers during this phase, making it more accessible for young people with stable incomes to own an apartment with an installment plan requiring less than VND 1 billion upfront to move in immediately.

Apartments in areas bordering Ho Chi Minh City offer higher rental yields despite lower selling prices.

Specifically, buyers of The Emerald 68 apartments only need to pay an initial 10%, or VND 190 million, to sign the purchase contract. They can then pay 20% upon receiving the house (within 18 months) and 50% (approximately VND 1 billion) to move in, with the remaining balance payable over the next 13 months. Buyers also benefit from a 24-month interest-free and no-principal payment period. This policy enhances investment returns by minimizing the initial payment and extending the payment period to 33 months.

With its flexible payment plan, The Emerald 68 has provided young people with an opportunity to own a home amid rising property prices. They are embracing installment plans, viewing apartments as both a wealth-building asset and a long-term rental income generator. Additionally, its prime location on National Highway 13, just 800m from Thu Duc City, enhances the commercial value of the apartments, making them more appealing for both renters and potential future buyers.

Sharing their insights, Savills experts believe that now is a good time to invest in rental apartments. Over the next 3-5 years, the supply of inner-city apartments in Ho Chi Minh City will remain limited due to land scarcity and legal hurdles. As such, investors can consider renting out their units for a while before selling them later. Apartment investment still offers decent returns, along with the added benefit of rental income.

According to Mr. Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokers Association, in the past, many people believed that apartments were a non-profitable investment, often resulting in losses. However, investing in apartments and renting them out has become a popular trend in major cities, offering the dual benefits of consistent monthly rental income, which is higher than bank savings rates, and potential capital appreciation.

Mr. Dinh also highlights the positive outlook for the apartment market, given the recovery of production and business activities, which is driving strong housing demand in urban areas. With stable incomes, young people can now consider purchasing apartments with reasonable and safe installment plans.

Notably, some large developers have introduced policies that allow young people to buy homes with installment plans comparable to rental costs. By committing to a maximum interest rate cap, buyers can avoid the risks associated with floating interest rates.

However, in the context of a challenging real estate market, those purchasing apartments as a long-term investment need to consider various factors. Price, area, and living environment are crucial aspects to contemplate before making a buying decision.

The Reign of Land Investment Has Ended: Exploring Alternative Investment Avenues in the Current Climate

As of Q3 2024, apartment prices in Hanoi had surged, witnessing a remarkable 64% increase compared to Q2 2019. This surge outpaces Ho Chi Minh City’s growth, doubling its rate of increase. The average primary selling price is now approaching 60 million VND per square meter. Economic experts attribute this shift to the apartment segment, dethroning land as the once-undisputed investment king.

What $15 Billion Dong Can Get You in Hanoi’s Real Estate Market?

With a budget of 15 billion VND, homebuyers have the opportunity to invest in a luxurious high-rise condominium with a spacious floor plan or a landed property in several prime locations within Hanoi’s inner districts.