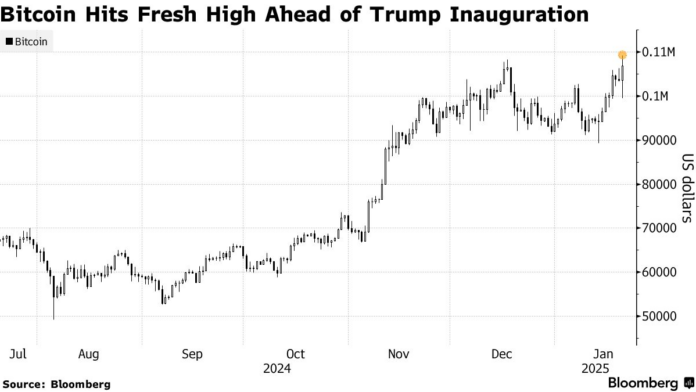

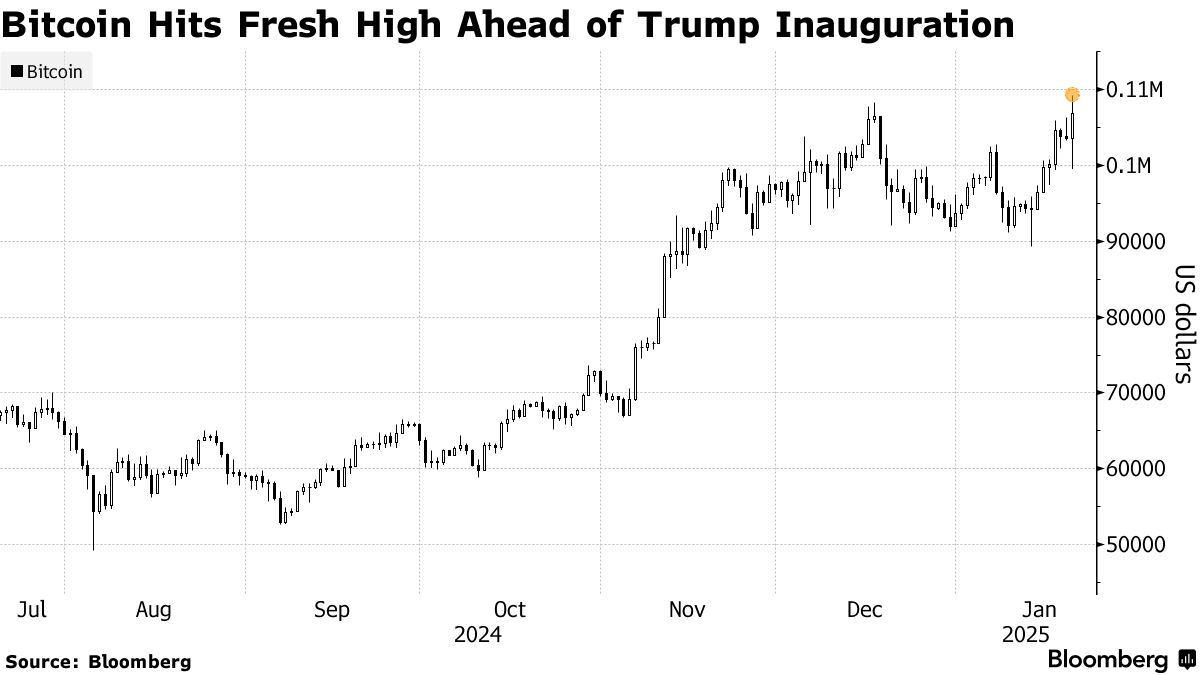

Bitcoin price surged 5.5% to $109,241 on January 20, 2025. The recent rally in Bitcoin over the past few months has been fueled by expectations of new policies from President-elect Trump, who is expected to take office at noon on the same day (local time). Trump has expressed his intention to establish a national Bitcoin reserve and may sign an executive order related to it right after the inauguration.

Venture investor Matt Higgins shared with CoinDesk that countries may start strategically reserving Bitcoin as early as 2025. According to his estimates, if 1 million Bitcoin are moved into national reserves, the circulating supply would decrease by 6.6%, potentially driving prices up by over 30%.

Trump’s team has also appointed key positions related to cryptocurrencies. David Sacks, former PayPal executive, will lead the White House task force on artificial intelligence and cryptocurrencies. Meanwhile, lawyer Paul Atkins, known for his pro-crypto stance, has been nominated to head the U.S. Securities and Exchange Commission (SEC).

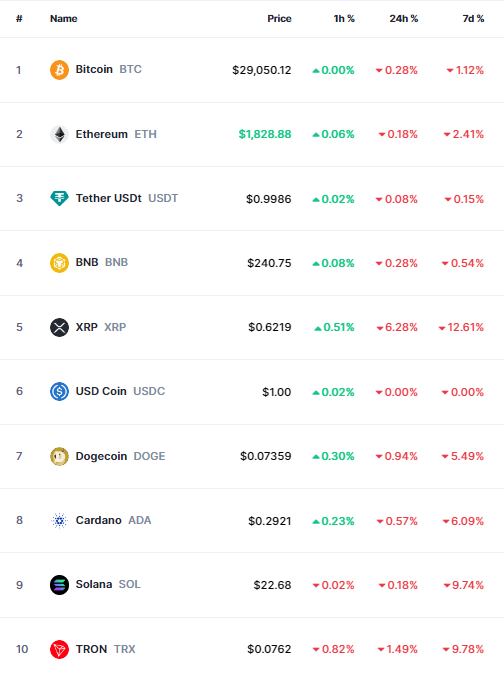

A notable market highlight is the launch of the TRUMP and MELANIA coins. According to data from CoinMarketCap, TRUMP started at around $6 USD when it launched on January 18, surged to $33 USD within 12 hours, and peaked at $75.35 USD yesterday before correcting to below $60 USD.

The MELANIA coin, named after the president-elect’s wife, also saw an impressive 24,000% increase to over $13 USD. This token is believed to have attracted some liquidity from TRUMP, which was the most traded digital asset on Binance last weekend.

Arca, a renowned NFT development company’s CTO, Jeff Dorman, believes TRUMP’s arrival is a positive signal for the crypto market. However, some analysts have warned that the active trading of these two coins could reflect market FOMO (fear of missing out), leading to a Bitcoin correction below $100,000 this morning.

Despite once calling Bitcoin a scam, Trump has now become a strong supporter of the digital asset industry. He pledges to make the US a global crypto hub through groundbreaking policies, including establishing a strategic Bitcoin reserve.

Thien Van (Bloomberg, CoinDesk)

– 17:01 01/20/2025

The Crypto Crash: Bitcoin Plunges Below $90,000 as Panic Selling Spreads

The crypto market kicked off 2025 on a pessimistic note, as expectations of Fed monetary policy easing began to fade.

The Art of the Crypto Deal: The Trumps Talk Binance Investment

The Wall Street Journal (WSJ) reports that representatives of the Trump family are in negotiations to acquire a financial stake in the US arm of the cryptocurrency exchange, Binance. This move would bring Trump into a business relationship with a company that pleaded guilty to violating anti-money laundering regulations in 2023.

The Great Crypto Sell-Off: Bitcoin Plunges Below $80,000

Bitcoin, the world’s leading cryptocurrency, has taken a tumble, falling below the $80,000 mark for the first time since November 10, 2024.

“Binance Founder Denies Negotiations with the Trump Family”

Changpeng Zhao, the founder and former CEO of Binance, the world’s largest cryptocurrency exchange, has publicly denied rumors suggesting that the Trump family is negotiating to purchase a stake in Binance’s American division. This denial comes just a day after the Wall Street Journal (WSJ) published an article on March 13th, sparking speculation and interest from the public.