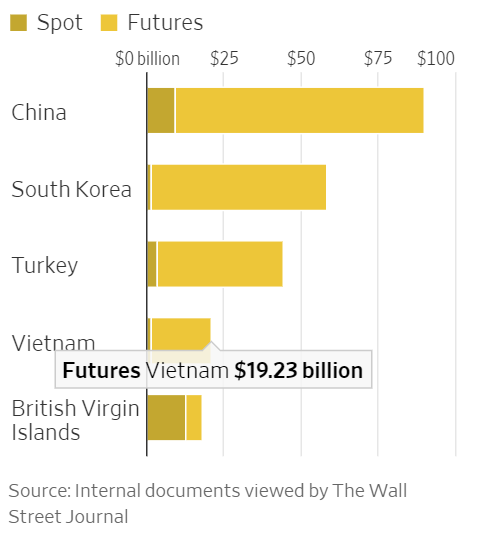

Bitcoin prices reached $29,050 as of the morning of August 5, a decrease of over 1% compared to the previous weekend. Ethereum, the second largest cryptocurrency, dropped over 2% to $1,828.

Ripple (XRP) continued its sharp decline from the previous week, with a descent of 13%.

The other cryptocurrencies in the top 10 are also in the red, with Dogecoin down 5.5%, Cardano down 6%, Solana down 10%, and Tron down 9%.

Trends of the top 10 cryptocurrencies

Source: CoinMarketCap

|

The US Department of Justice considers the possibility of prosecuting Binance

According to sources from Semafor, US officials are considering the possibility of prosecuting the cryptocurrency exchange Binance for fraud. However, Washington is also concerned about the impact of this action on consumers.

Federal prosecutors are concerned that the decision to prosecute Binance could lead to a mass withdrawal similar to what happened with the FTX exchange. As a result, consumers would lose money and create panic in the entire cryptocurrency market.

According to sources, prosecutors are considering alternative options, including fines or deferred prosecution agreements. This choice would be a compromise, holding Binance accountable for the alleged criminal behavior while minimizing the impact on customers.

In the US and many other countries around the world, virtual currency businesses operate in a legal gray area, and consumers do not receive the same protections as traditional banking systems. Both the US Department of Justice and Binance have not commented on the matter.

Binance and founder Changpeng Zhao have also faced allegations from the US Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). The SEC believes that Zhao and the company have run an unregistered exchange in the US, deliberately allowing US citizens to participate in a Binance offshore exchange.

Additionally, according to CoinDesk, Binance has almost reached a decision to close its Binance.US exchange to protect its parent company. However, Binance.US CEO Brian Shroder has prevented this decision. Binance.US was created to serve US customers and comply with Washington regulations.

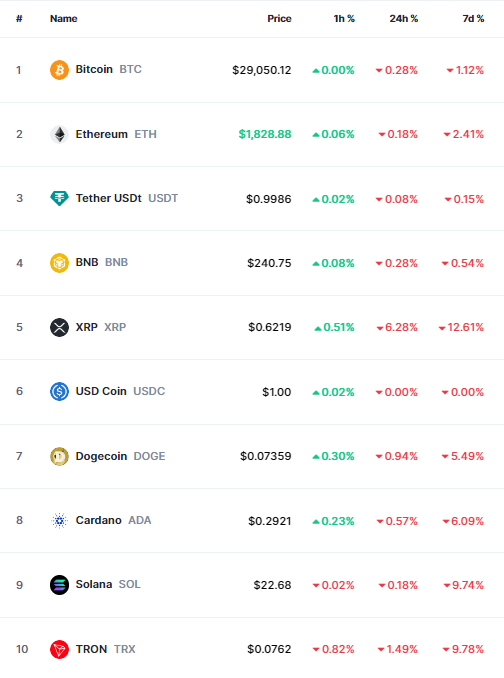

Vietnamese traders transacted nearly $21 billion on the Binance exchange in May

According to statistics from the Wall Street Journal (WSJ), Vietnamese traders rank fourth in trading volume on the Binance cryptocurrency exchange.

Specifically, Vietnamese traders transacted $20.84 billion (equivalent to 495 trillion VND) in May 2023, of which more than 90% were futures contracts.

Trading volume on the Binance exchange by country

Leading the list is China with over $90 billion, of which $81 billion is for futures contracts. South Korea and Turkey are next with $60 billion and $45 billion respectively.

China topping the rankings comes as a big surprise as the country officially banned cryptocurrency trading in 2021 and Binance also declared that it does not operate in the world’s second-largest economy. According to WSJ statistics, China accounts for nearly 20% of the trading volume on the Binance exchange.

The importance of China to Binance is still being discussed, despite the ban. Over 900,000 people are trading on Binance in China.

“China’s cryptocurrency market is still strong, with large trading volumes from both centralized and decentralized services,” said Kim Grauer, Director of Research at cryptocurrency research firm Chainalysis.

Despite the initial decline following the 2021 ban, China is the fourth largest market in terms of cryptocurrency trading activity, with a total of 5.6 million people trading cryptocurrencies, according to Chainalysis.

To bypass the ban, Binance redirects Chinese users to websites owned by the country before transferring them to the exchange. Many Chinese users also use VPNs to avoid censorship.