FPT Telecommunications Corporation (FPT Telecom – FOX code) has just announced the documents for the 2025 Annual General Meeting of Shareholders, expected to take place on April 10th. At the meeting, FPT Telecom plans to present important content to its shareholders, including the 2025 business plan and dividends…

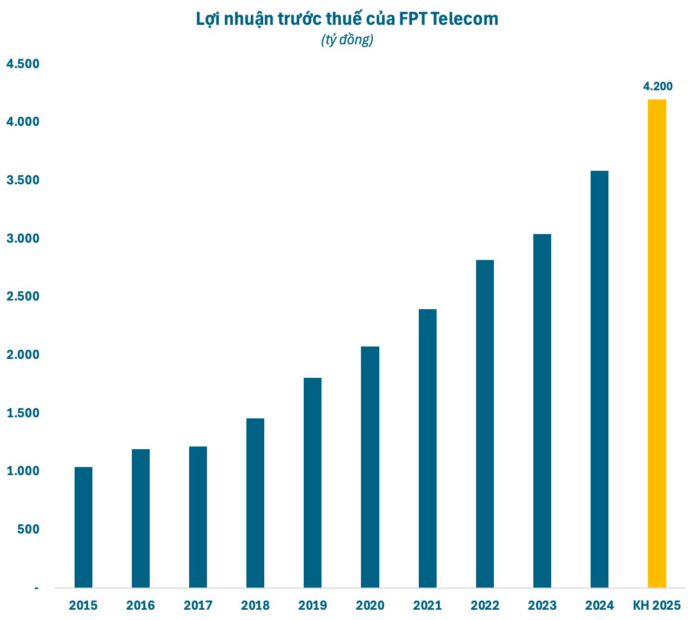

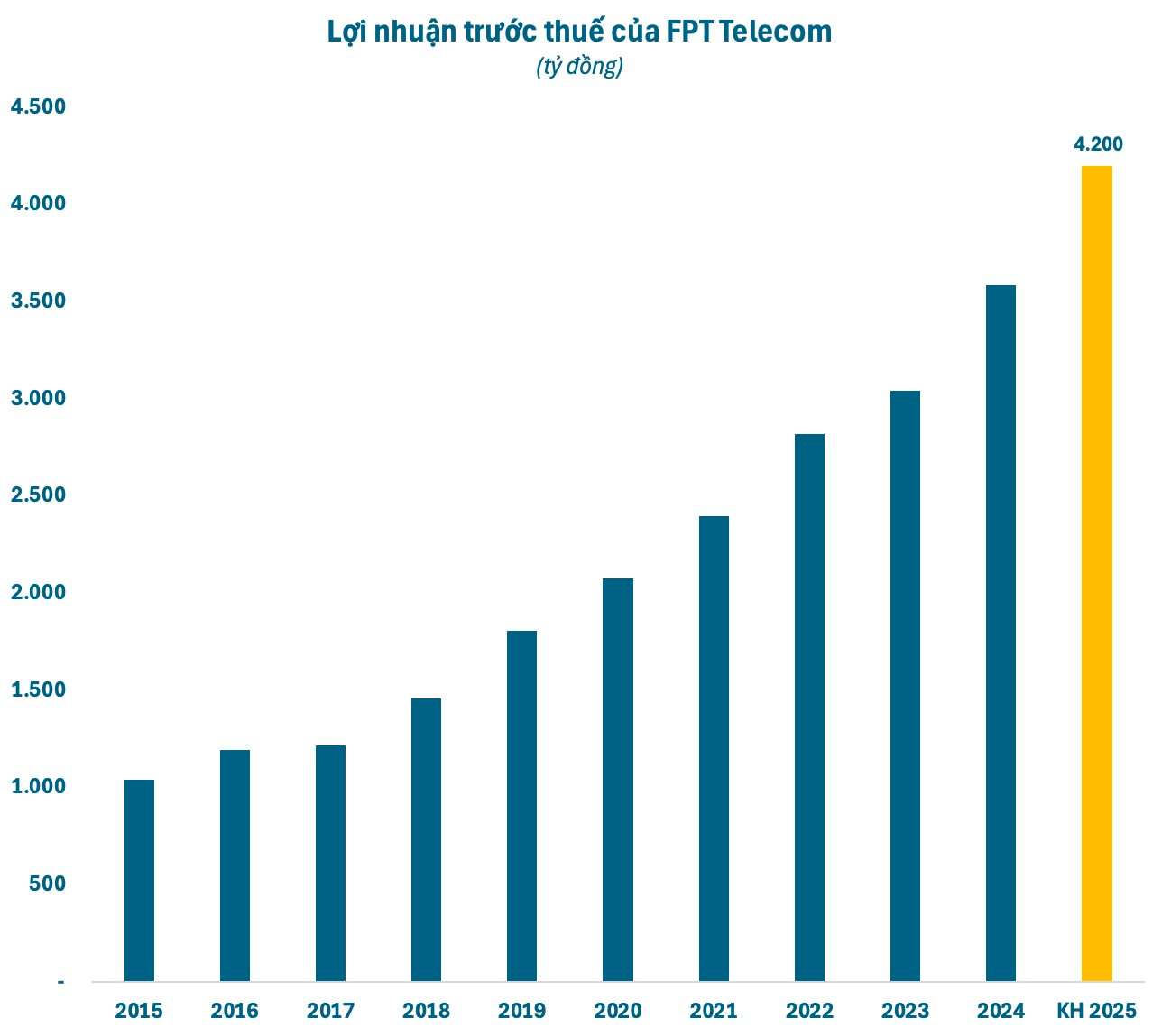

Accordingly, the FPT Telecom Board of Directors aims to present the 2025 business plan with revenue and pre-tax profit targets of VND 19,900 billion and VND 4,200 billion, respectively, an increase of 13% and 17.1% compared to the previous year. The 2025 dividend is expected to be no less than VND 2,000 per share. If the set plan is achieved, the company will break its revenue and profit records set in 2024.

In 2025, FPT Telecom plans to invest VND 3,840 billion, with regular projects accounting for VND 2,790 billion and the remaining VND 1,050 billion allocated to key projects such as the District 9 Data Center Project (VND 500 billion), the FTEL Tower Tan Thuan Project (VND 100 billion), the HN03 Data Center Project (VND 70 billion), the ALC submarine cable route project (VND 170 billion), and the SJC2 submarine cable route project (VND 210 billion).

In 2024, FPT Telecom recorded a gross revenue of VND 17,610 billion and a pre-tax profit of VND 3,588 billion, an increase of over 11% and 18% compared to 2023, respectively. These are the highest revenue and profit figures since the company’s inception. With these outstanding results, FPT Telecom has exceeded its 2024 plan.

Based on these results, the Board of Directors proposed a 2024 cash dividend of VND 5,000 per share (a ratio of 50%). The first tranche of VND 2,000 per share is expected to be paid on May 30th, based on the list of shareholders as of March 17th. The remaining dividend of VND 3,000 per share is expected to be paid after the AGM. With more than 492.5 million shares in circulation, FPT Telecom plans to spend nearly VND 2,500 billion on dividends for 2024.

In addition to cash dividends, FPT Telecom also plans to issue shares to increase its charter capital, with a proposed ratio of 50% (holding 10 shares will entitle shareholders to 5 new shares). After the issuance, the company’s charter capital will increase from VND 4,925 billion to nearly VND 7,388 billion. The issuance is expected to take place in 2025.

As of the end of 2024, FPT Telecom’s total assets reached VND 23,768 billion, an increase of 18% compared to the beginning of the year. Of this, cash (cash, cash equivalents, and short-term deposits) accounted for more than half, with a year-end balance of VND 12,056 billion. Compared to the beginning of 2024, the company’s cash balance has increased by nearly VND 3,000 billion.

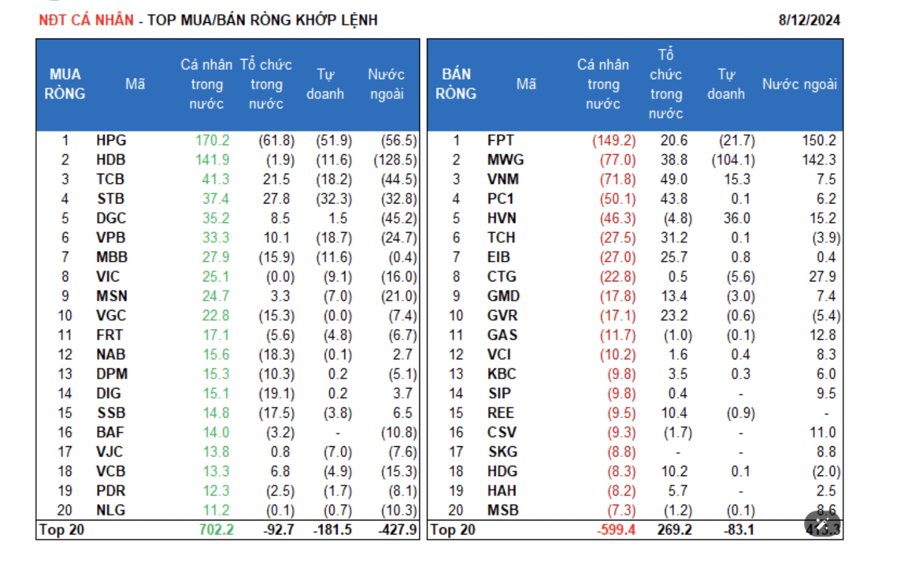

On the stock market, FOX shares are currently trading around VND 87,000 per share, with a market capitalization of approximately VND 43,000 billion. With this valuation, FPT Telecom is one of the largest telecommunications and technology companies on the stock exchange. The company has two major shareholders: the State Capital Investment Corporation (SCIC), holding 50.2% of the shares, and the FPT Group, holding 45.7%.

The Magic of Words: Crafting a Captivating Title

“Unleashing the Power of Dược Hải Dương: An Ambitious HOSE Listing with an 8-Million Share Offering”

For 2025, Hai Duong Medical Supplies JSC (Hai Duong Pharma) is targeting a 26% increase in revenue, with a slight dip in profits, according to the company’s AGM documents. The company also plans to propose a bonus share issuance and a roadmap for listing on the Ho Chi Minh Stock Exchange (HOSE).

The Ben Thanh Service Aims for Robust Growth After a Year of Setbacks

Ben Thanh Service Joint Stock Company (BTSC, HNX: BSC), a member of the Benthanh Group, has released the documentation for its upcoming 2025 Annual General Meeting. BSC is set to propose to the assembly significant growth targets for revenue and profit compared to the previous year’s performance.