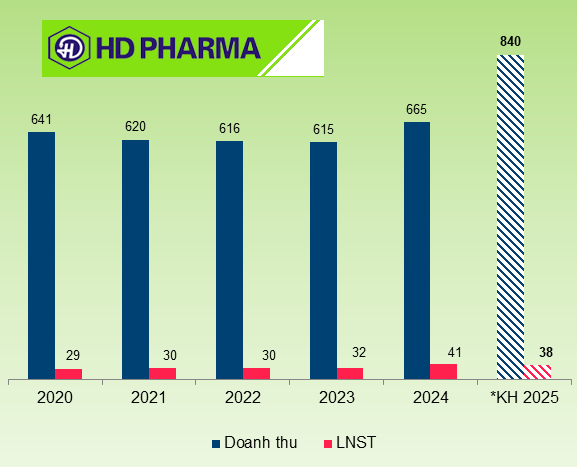

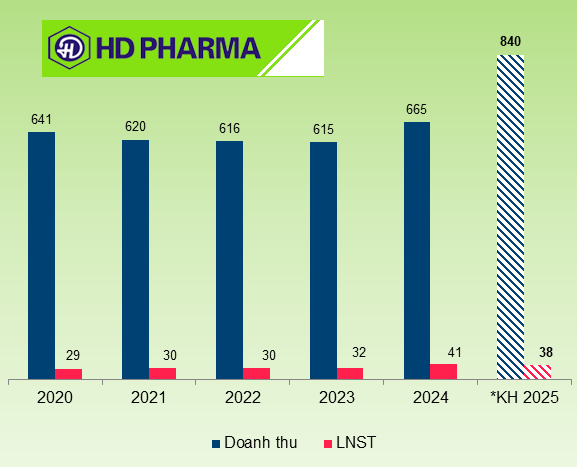

Specifically, DHD plans to present to the General Meeting the 2025 business plan with a revenue target of 840 billion VND, up 26% from the previous year. This includes 10 billion VND in internal revenue, with the remaining coming from sales to customers (249 billion VND from commercial operations and 581 billion VND from the company’s manufactured goods). However, the target net profit is only 38 billion VND, 7% lower than the previous year.

|

Business results and plans of DHD

Source: VietstockFinance

|

In 2024, despite achieving growth compared to the previous year, DHD only fulfilled 85% of its revenue plan and fell short of production targets. The company attributed this to the global and Vietnamese economies still facing challenges and a slow recovery, impacting purchasing power in both domestic and international markets. In addition, the company faced intense competition and the impact of an economic downturn, particularly among consumers of functional foods. Moreover, while products from the EU have been licensed, the number of registered products is not yet high enough, resulting in a lack of product variety in the market.

Regarding the 2024 net profit target, the company exceeded the plan by 28%. The 2025 net profit target of 38 billion VND is lower than the previous year’s performance but still 19% higher than the 2024 plan.

To achieve the 2025 plan, the company aims to improve various indicators, including optimizing operations and reducing costs, enhancing supply chain management, and boosting sales and advertising effectiveness. In addition, the company plans to develop three projects for the HDPharma factory in Cam Thuong (Hai Duong)

Regarding the profit distribution plan, the DHD Board of Directors proposes to pay dividends of 2.2% in cash for 2024 and 2%-6% for 2025. The expected remuneration for the Board of Directors is 3% of net profit (approximately 1.1 billion VND if the plan is met), and the rate for the Supervisory Board is 1% (380 million VND).

Notably, DHD intends to present a plan to issue bonus shares to increase charter capital for 2025. Specifically, the company plans to issue nearly 8.05 million shares to existing shareholders, with the issuance funds coming from the development investment fund (VND 45 billion) and undistributed post-tax profits (maximum VND 35.5 billion). The shares will be issued at a ratio of 28.8% (meaning that for every 1,000 shares owned, shareholders will receive 288 bonus shares). The issuance is expected to take place in the second and third quarters of 2025, after obtaining approval from the General Meeting of Shareholders and receiving notification from the SSC of complete issuance documents.

| Price movement of DHD shares since the beginning of 2025 |

Additionally, the DHD Board of Directors intends to propose the cancellation of the registration of share trading on UPCoM and the listing of all shares on the HOSE. The Board of Directors will be authorized to decide on the timing, location, and related matters of this plan.

The 2025 Annual General Meeting of Shareholders of DHD is expected to be held on the morning of April 3, 2025, in Hai Duong city, Hai Duong province.

– 08:08 20/03/2025

The Cash Dividend King: Six Years of 50% Payouts and Counting

Cholimex Food Joint Stock Company (UPCoM: CMF) has announced March 20, 2025, as the record date for an interim cash dividend of VND 5,000 per share for the fiscal year 2024. Shareholders will also be invited to attend the upcoming 2025 Annual General Meeting.