23 domestic commercial banks have lowered their interest rates, including: Bản Việt (BVBank), Hàng Hải (MSB), Việt Nam Thương Tín (Vietbank), Sài Gòn Công Thương (SaiGonBank), Quốc Tế (VIB), Bảo Việt (BAOVIET Bank), Kiên Long (KienlongBank), Bắc Á (Bac A Bank), Việt Á (VietABank), Thịnh Vượng và Phát Triển (PGBank), Xuất Nhập Khẩu (Eximbank), Lộc Phát (LPBank), Nam Á (Nam A Bank), Sài Gòn Hà Nội (SHB), Quốc Dân (NCB), Ngoại Thương Công Nghệ Số (VCBNeo), Đầu Tư và Phát Triển (BIDV), Kỹ Thương Việt Nam (Techcombank), Công Nghệ Số Vikki (Vikki Bank), Việt Nam Hiện Đại (MBV), Công Thương Việt Nam (VietinBank), Phương Đông (OCB), and An Bình (ABBank).

Notably, Eximbank has made six interest rate cuts for select programs between February 25th and March 14th, 2025. For counter deposits, the “Gửi dài an tâm” program has seen a reduction of 0.6-0.8%/year for terms of 15-36 months. Savings deposits have also been reduced by 0.1-0.2%/year for terms of 12-24 months for regular customers, and by 0.2%/year for terms of 6-12 months for customers over 50 years old. For online deposits, Eximbank has adjusted term deposits downward by 0.1%/year for terms below 6 months and by 0.2-0.8% for terms ranging from 6 to 36 months.

During this same period, KienlongBank lowered its savings rates three times. For online deposits, the bank reduced rates by 0.4 – 1% for terms of 1-60 months. For counter deposits, rates were lowered by 0.2-0.3% for terms of 13-60 months.

PGBank, between March 3rd and 12th, also lowered its savings rates twice, with reductions ranging from 0.1% to 0.2%.

Most recently, on March 15th, ABBank decreased its rates by 0.1%/year for terms ranging from 2 to 60 months.

On March 14th, VietinBank reduced its rates by 0.1%/year for terms of 1 to less than 6 months.

On the same day, OCB lowered rates by 0.05-0.25%/year for online deposits with terms of 1 to 11 months for customers with balances of 100 million VND or more. They also reduced rates by 0.1-0.25%/year for online deposits with terms of 1 to 11 months for customers with balances exceeding 100 million VND.

On March 12th, MBV cut rates by 0.2%/year for terms of 1 to 3 and 18 to 36 months, applicable to both online and counter deposits.

Vikki Bank, also on March 12th, lowered its rates by 0.1-0.5%/year for terms of 1 to 15 months, applicable to both online and counter deposits.

On March 10th, 2025, BIDV reduced its rates by 0.1%/year for terms of 1 to less than 6 months.

Techcombank, also on March 10th, 2025, lowered rates by 0.1%-0.2%/year. Specifically, regular savings deposits were reduced by 0.15% for terms of 1 to 36 months, applicable to both regular and Inspire (club member) customers.

On March 6th, VCBNeo cut rates by 0.15% for terms of 6 months or more, applicable to all counter and online deposit products.

NCB, on March 5th, decreased its rates by 0.1% for terms of 1 to 60 months, applicable to both counter and online deposits.

SHB, also on March 5th, reduced rates by 0.1% for terms of 6 to 11 months, 13, and 15 months; by 0.2% for terms of 12 to 18 months; and by 0.3% for terms of 24 and 36 months, applicable to both counter and online deposits.

Also, on March 5th, NamABank lowered online deposit rates by 0.3% for terms of 1, 3 to 5 months, by 0.4% for a term of 2 months, and by 0.1% for terms of 6 to 36 months. For counter deposits, the bank reduced rates by 0.1% for a term of 1 month and by 0.2% for terms of 2 to 5 months.

On March 3rd, VietABank cut rates by 0.1% for terms of 12 to 36 months, applicable to both counter and online deposits.

LPBank decreased rates by 0.1% for terms of 1 to 60 months for counter deposits and by 0.1% for terms of 18 to 60 months for online deposits.

On March 1st, BacABank lowered its rates by 0.1% for terms of 1 to 11 months and by 0.2% for terms of 12 to 36 months for counter deposits.

On February 28th, BaovietBank reduced rates by 0.1% for terms of 12 to 13 months, by 0.2% for a term of 15 months, and by 0.3% for terms of 18 to 36 months for counter deposits.

From February 28th to March 6th, VIB adjusted counter deposit rates downward, reducing rates by 0.1% for terms of 6 to 11 months for customers with deposit balances ranging from 10 to 300 million VND. For balances of 300 million VND or more, the reduction applied to all terms ranging from 1 to 36 months. For online deposits, VIB lowered rates by 0.1%-0.2% for terms of 1 to 36 months.

On February 27th, SaigonBank cut rates by 0.2% for terms of 12 to 36 months, applicable to counter, online, and personal payment deposits.

VietBank, on February 26th, lowered counter deposit rates by 0.2% for terms of 1 to 4 months and 12 months, and by 0.3% for terms of 5 to 9 months. For online deposits, VietBank reduced rates by 0.1%-0.4% for terms of 4 to 5 months, by 0.2% for terms of 1 to 3 months, and by 0.4% for a term of 2 months.

On February 25th, BVBank decreased counter deposit rates by 0.1%-0.4% for terms of 6 to 60 months. For online deposits, the bank lowered rates by 0.1% for terms of 6 to 8 months, by 0.25% for terms of 9 to 12 months, by 0.35% for terms of 15 to 18 months, and by 0.4% for a term of 24 months.

Also, on February 25th, MSB adjusted counter deposit rates downward by 0.2% for terms of 13 to 36 months. Similar reductions were applied to online deposits with terms of 1 to 5 months and 12 to 36 months.

Earlier, on February 24th, Prime Minister Phạm Minh Chính signed Official Dispatch No. 19/CĐ-TTg, which was sent to the Governor of the State Bank of Vietnam, instructing the continuation of implementing measures to reduce lending interest rates, alleviate difficulties for customers, and support individuals and businesses in their production and business development, thereby promoting growth.

In response to the Government and Prime Minister’s instructions, the State Bank of Vietnam held a teleconference on the afternoon of February 25th with credit institutions to communicate and issue directives to the entire system regarding stabilizing deposit rates and reducing lending rates. They also issued Document No. 1328/NHNN-CSTT to direct the State Bank’s provincial/municipal branches, credit institutions, and foreign bank branches in Vietnam on stabilizing deposit rates and reducing lending rates.

At the regular Government press conference for February 2025 (held on March 5th), SBV Vice Governor Đào Minh Tú stated that the SBV’s primary goal at this time is to maintain low and stable interest rates to actively support businesses and individuals. To that end, the SBV has instructed commercial banks to adjust their interest rates downward, reducing deposit rates while also introducing appropriate preferential credit packages.

The Vice Governor affirmed that going forward, the SBV will closely monitor interest rates to ensure that commercial banks have the necessary autonomy while also sharing the burden with businesses by reducing costs and lending rates across all terms. The SBV will proactively manage its tools to provide commercial banks with liquidity and capital sources, eliminating the need to increase mobilized capital. This will also be one of the tools that the SBV will actively manage through the end of the year.

Experts view this as a strong commitment to maintaining low-interest rates to support economic growth and achieve the target of at least 8% GDP growth. PGS, TS. Nguyễn Hữu Huân, from the University of Economics in Ho Chi Minh City, assessed that maintaining the current interest rate level is a success for the SBV. Meanwhile, VCBS experts considered this a resolute move, demonstrating the banking system’s alignment with the goal of economic stability and its support for businesses and individuals to access capital at more reasonable costs.

Looking ahead, VCBS expects lending rates to remain low to support businesses in line with the Government’s orientation. However, there will be differentiation among industries, enterprises, and risk appetites among commercial banks.

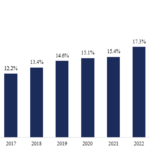

MBS Research also forecasts that the 12-month deposit rate of large commercial banks will fluctuate around 5 – 5.2% in 2025.

The Latest Credit Growth Figures: Unveiling the Banking System’s Performance

“The banking sector is off to a strong start this year, with credit growth outpacing that of the previous year. According to Vice Governor of the State Bank of Vietnam, Pham Thanh Ha, as of March 12, credit growth in the banking system had increased by 1.24% compared to the end of 2024, indicating a significant improvement.”

The Debt Burden’s Drag on Economic Growth

Debt is a pivotal tool in the modern financial system, stimulating consumption and investment while contributing to economic growth. When managed prudently, credit enables businesses to expand their production, enhance operational efficiency, and improve labor income, thereby creating a positive ripple effect on the economy. However, debt growth is not a panacea for perpetual expansion, as the burden of interest payments can become onerous.

Extraordinary General Meeting of Eximbank: Awaiting State Bank Approval to Relocate Head Office and Elect Three New Supervisory Board Members

On February 26, 2025, the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Eximbank, HOSE: EIB) held an extraordinary general meeting to elect new members to its Supervisory Board and amend the bank’s charter.