VIB Aims for Over 11,000 Billion VND in Profit, with Maximum 7% Cash Dividend

VIB’s 2025 Plan:

– Targets pre-tax profit of 11,020 billion VND, a 22% increase.

– Proposes a maximum 14% bonus share issuance for shareholders.

– Issues bonus shares for employees at a maximum rate of 0.26%.

– Plans to pay a cash dividend of up to 7%.

Vietnam International Bank (VIB) will be the first bank to hold its Annual General Meeting of Shareholders this year. The meeting will take place on the morning of March 27, 2025, at the Grand Ballroom of the JW Marriott Hotel & Suites Saigon, located at the intersection of Hai Ba Trung and Le Duan streets, Ben Nghe Ward, District 1, Ho Chi Minh City.

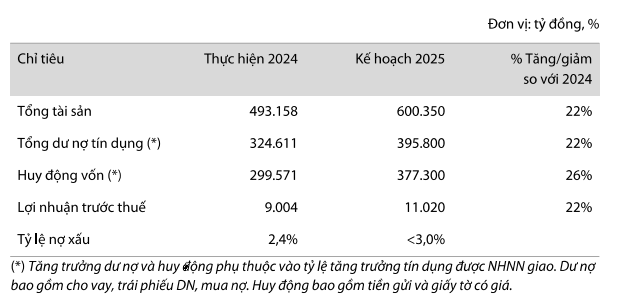

For 2025, VIB aims for total assets of 600,350 billion VND, a 22% increase from 2024. Total credit outstanding is expected to increase by 22%, reaching 395,800 billion VND. Capital mobilization is projected to rise by 26% to 377,300 billion VND. The bank targets a pre-tax profit of 11,020 billion VND, a 22% increase from the previous year. The bad debt ratio is to be maintained below 3%.

VIB’s 2025 Business Plan

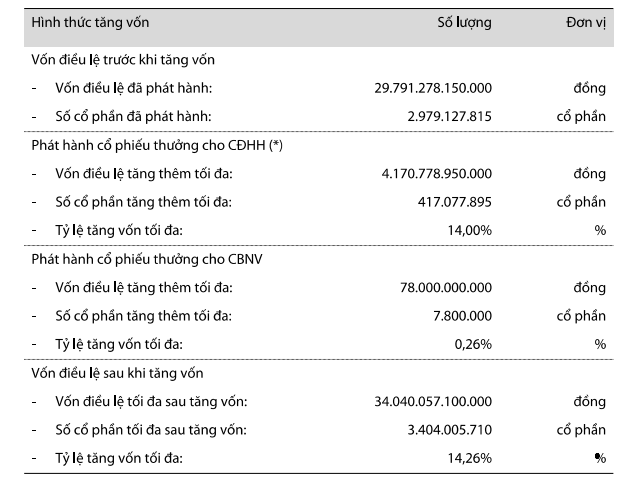

The Board of Directors proposes to shareholders a plan to issue shares to increase its charter capital. Specifically, VIB intends to issue a maximum of 417.07 million bonus shares to existing shareholders (equivalent to a 14% ratio) and 7.8 million bonus shares to employees.

The bonus shares for existing shareholders will not be restricted in terms of transferability. On the other hand, the bonus shares for employees will be restricted from transfer for one year from the end of the issuance.

Following the issuance, the bank’s charter capital is expected to increase by 4,249 billion VND, from 29,791 billion VND to 34,040 billion VND.

In addition to the plan to issue bonus shares, VIB also intends to continue paying cash dividends, with a maximum of 7% of charter capital, equivalent to approximately 2,085 billion VND.

VIB’s 2025 Capital Increase Plan

Nam A Bank Targets 5,000 Billion VND Profit in 2025, with 25% Stock Dividend

Nam A Bank’s 2025 Plan:

– Aims for a pre-tax profit of 5,000 billion VND, a 10% increase.

– Plans to pay dividends in stocks, with a ratio of 25%.

– Offers 85 million ESOP shares at a price of 10,000 VND per share.

– Proposes to issue convertible bonds privately, with a maximum value of 2,000 billion VND.

Nam A Bank (Nam A Bank – code: NAB) will be the next bank to hold its Annual General Meeting of Shareholders. The meeting is scheduled for 8:30 am on March 28 at Dalat Palace Heritage, 2 Tran Phu Street, Da Lat City, Lam Dong Province.

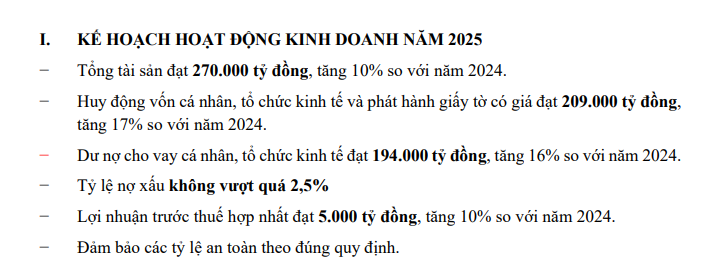

At the meeting, Nam A Bank’s management will present to shareholders the 2025 business plan, targeting a consolidated pre-tax profit of 5,000 billion VND, a 10% increase from 2024. Total assets are projected to reach 270,000 billion VND, a 10% increase, with individual and organizational credit outstanding at 194,000 billion VND, a 16% rise. Capital mobilization from individuals, organizations, and securities is expected to reach 209,000 billion VND, a 17% increase from the previous year. The bank aims to maintain the non-performing loan ratio below 2.5%, while adhering to the prescribed safety ratios.

Regarding the capital increase plan, Nam A Bank intends to issue 343.1 million new shares, equivalent to a 25% ratio, resulting in a charter capital increase of over 3,431 billion VND.

For the ESOP plan, Nam A Bank plans to issue 85 million shares, increasing its charter capital by 850 billion VND. The offer is targeted at the bank’s employees and its subsidiaries. The offering price is set at 10,000 VND per share, equal to the par value. ESOP shares will be restricted from transfer for 100% in the first year and 50% in the following year from the end of the offering.

At the meeting, Nam A Bank will also seek shareholder approval for a plan to issue convertible bonds privately. Specifically, the bank intends to issue a maximum of 2,000 billion VND in convertible bonds, with a maximum term of five years. As per the proposed plan, the issuance will be divided into two phases, with an expected value of 1,000 billion VND each. The first phase is scheduled for the third to fourth quarters of 2025, while the second phase will take place from the fourth quarter of 2025 to the first quarter of 2026.

Additionally, the 2025 Annual General Meeting of Shareholders will consider continuing the participation in handling People’s Credit Funds.

NCB: Aiming to Increase Charter Capital to Nearly 18,800 Billion VND

NCB’s 2025 Plan:

– Expected profit before restructuring plan is 59 billion VND.

– Plans to issue 700 million private placement shares, equivalent to 59.42%, increasing charter capital to 18,780 billion VND.

– Will elect 7 members to the Board of Directors and 5 members to the Supervisory Board for the new term 2025 – 2030.

The Annual General Meeting of Shareholders of National Citizen Bank (NCB – code: NVB) will be held on March 29 at the Ho Tay Grand Hall, 58 Tay Ho Street, Quang An Ward, Tay Ho District, Hanoi.

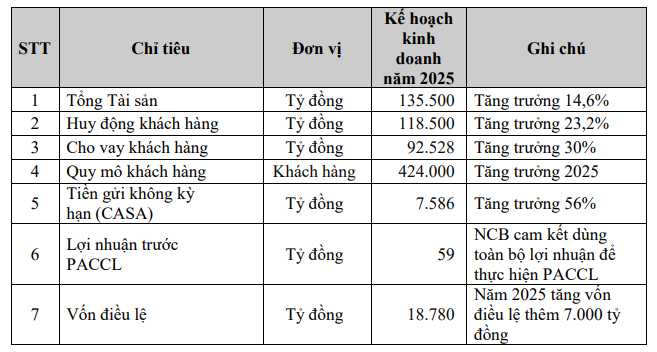

According to the meeting documents, in 2025, the bank targets a 14.6% increase in total assets, reaching 135,500 billion VND. Customer lending is projected to grow by 30%, reaching 92,528 billion VND, while customer deposits are expected to increase by 23.2%. The bank also aims to boost non-term deposits (CASA) by 56%.

In 2025, NCB forecasts a profit of 59 billion VND before the restructuring plan, and the bank commits to using all profits to continue implementing the restructuring plan.

NCB’s 2025 Business Plan

In 2024, NCB followed the approved restructuring plan. The reason for the negative profit in 2024 was due to the provisioning, write-off of accrued interest, and cost of capital related to the old credit portfolio as per the plan’s schedule.

As of now, the total handled and recovered principal amount (including the handling of stagnant assets turned into income-generating assets) reached 26,287 billion VND, equivalent to nearly 50% of the old credit balance. NCB’s credit quality has improved, and in the current total bad debt balance, the ratio of bad debts arising from new loans disbursed in 2024 is only 0.83%.

Due to the negative after-tax profit in 2024, the Board of Directors of NCB respectfully proposes to the General Meeting of Shareholders to approve the non-distribution of profits and the non-establishment of funds for 2024.

In 2025, NCB plans to issue 700 million private placement shares to increase its charter capital from 11,780 billion to 18,780 billion VND, equivalent to a 59.42% increase, with no limit on the number of professional investors.

All privately placed shares will be restricted from transfer for one year from the completion of the offering, except for special cases as prescribed by law. The expected timeline for the issuance/offering is from the second to the fourth quarter of 2025 (after obtaining approval for capital increase from the State Bank of Vietnam and receiving a notice of receipt of the private placement share registration dossier from the State Securities Commission).

The proceeds from the private placement share offering, expected to be 7,000 billion VND, will be used to supplement capital for business activities.

The General Meeting of Shareholders will also elect 7 members to the Board of Directors and 5 members to the Supervisory Board for the new term 2025 – 2030, in accordance with the new regulations of the Law on Credit Institutions.

The bank noted that the Board of Directors for the 2020-2025 term has undergone significant changes in personnel to streamline the management apparatus and meet the development requirements and business strategy of NCB.

The Ultimate Guide to a Happy Holiday: Happy Lady Credit Card Offers up to 20% Cashback

Understanding the increased spending during the festive season and the upcoming Lunar New Year, Nam A Bank introduces an exclusive offer for its Happy Lady credit cardholders, with a focus on rewarding women. The promotion includes a generous cashback offer of up to 20%, along with a range of exciting benefits, ensuring a rewarding and advantageous experience for all cardholders.

“Bank Stocks: A Safe Haven Amid Declining Liquidity”

The market was volatile during the afternoon session, but the VN-Index closed with a minor loss of 1.17 points. Impressively, the VN30-Index managed to stay in the green, thanks to the strength of the banking stocks within the blue-chip basket, outperforming the VN-Index. This group’s dominance was evident, as 7 out of the top 10 performers belonged to this sector.

What are the 5 banks that have received a second credit limit increase?

On November 28, 2024, the State Bank of Vietnam (SBV) announced its decision to provide additional credit limits to banks that have utilized 80% of their previously allocated credit limits. This is the second time in 2024 that the SBV has taken such action, the first being in August 2024. With this move, the SBV demonstrates its unwavering commitment to achieving the ambitious 15% credit growth target for the year.