The latest rankings from Decision Lab showcase the top-performing banks in Vietnam for 2025, highlighting those that have demonstrated superior brand health and significant improvements over the past year.

Based on extensive consumer interviews and a nine-year data set, the report ranks brands according to the YouGov BrandIndex, which takes into account factors such as Impression, Quality, Value, Satisfaction, Recommendation, and Reputation.

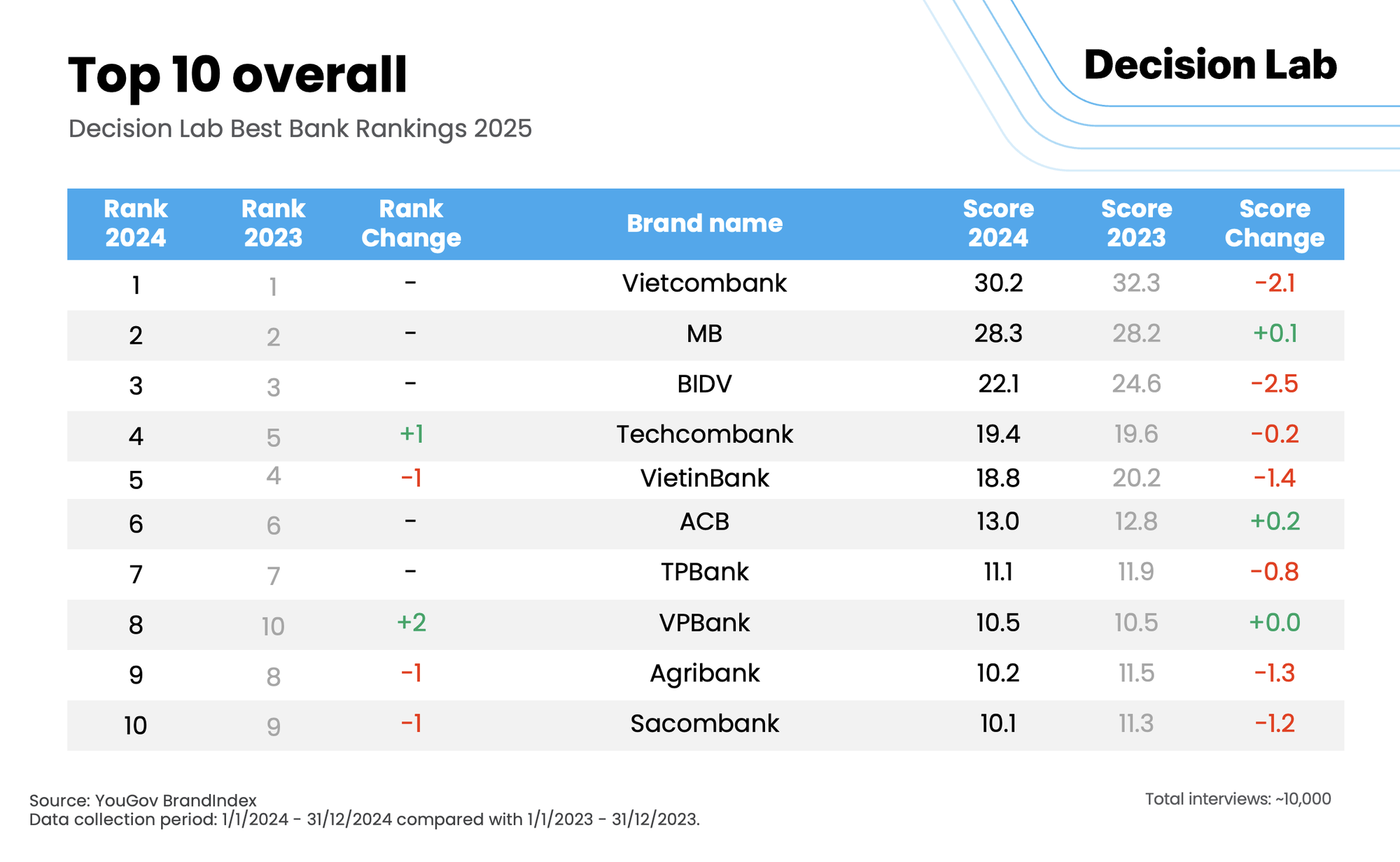

Vietcombank (30.2 points) retains its top position from last year, followed by MB (28.3 points) and BIDV (22.1 points), indicating their strong brand presence and customer trust amidst a challenging market environment.

“This year’s slight dip in scores across the industry could be attributed to tighter marketing budgets. MB, last year’s impressive gainer, has maintained its position, reflecting the sector’s stable yet slower growth trajectory,” notes Decision Lab.

While the overall market remains stable, some banks have made notable advancements. Techcombank (19.4 points) climbs one spot to fourth place, joining the top four banks in Vietnam, surpassing VietinBank.

VPBank stands out as the only bank in the Top 10 to climb two spots, overtaking Agribank (10.2 points) and Sacombank (10.1 points). Decision Lab attributes this leap to VPBank’s successful product enhancements, customer engagement strategies, and solidification of its position among the largest private banks in the country.

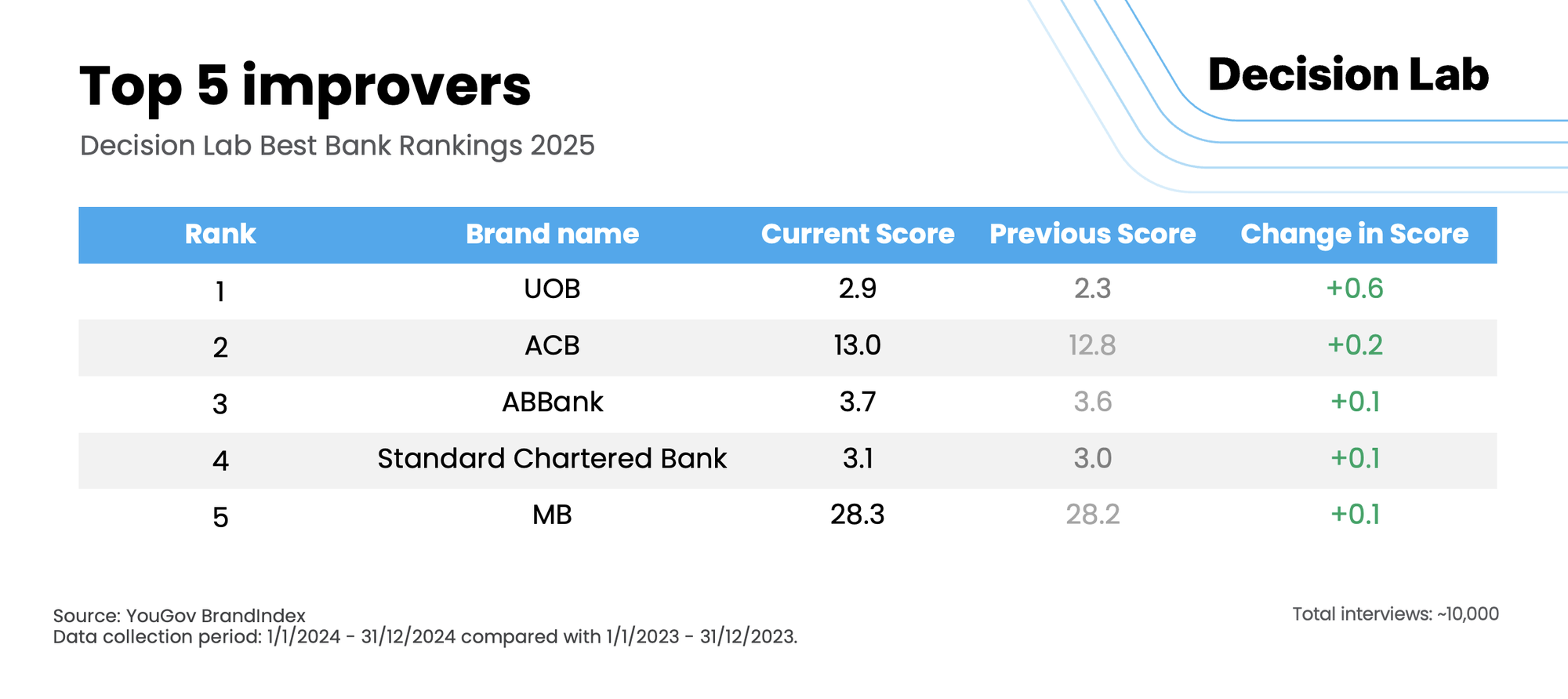

UOB, following its acquisition of Citibank’s retail banking business in Vietnam in 2023, has witnessed the most significant improvement in brand health, with a score increase of +0.6 points. This achievement underscores the successful integration of the acquired business and UOB’s ability to leverage its expanded customer base and expertise.

“UOB’s success also reflects a positive shift in consumer sentiment towards foreign banks,” the Decision Lab report states.

ACB, with a +0.2-point increase, takes second place in brand health improvement, even as many of its competitors experienced declines. ACB attributes this success to its focus on service quality and its commitment to sustainability initiatives.

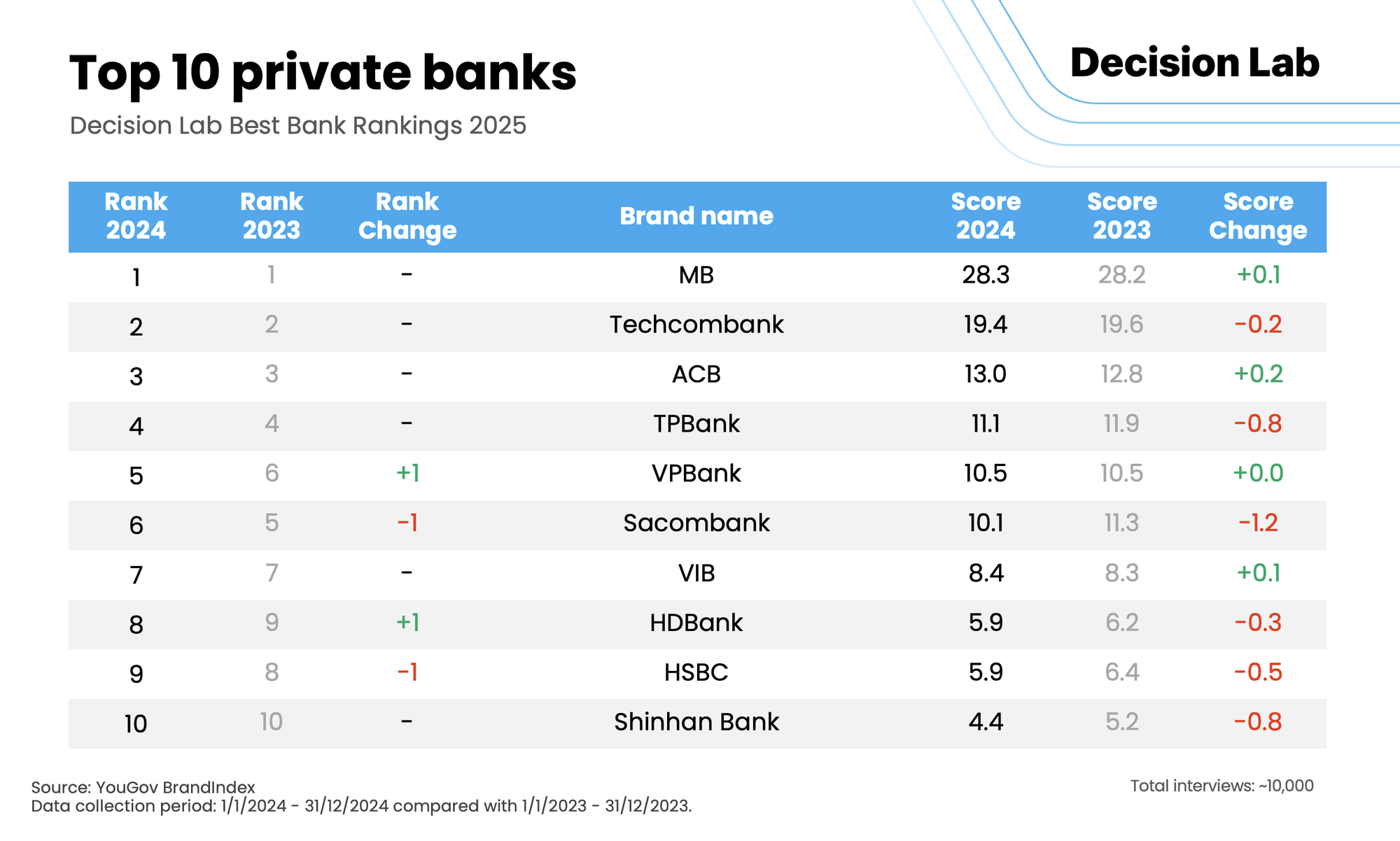

Among the joint-stock commercial banks, MB (28.3 points), Techcombank (19.4 points), and ACB (13.0 points) continue to lead the pack, underscoring their importance in the market and their ability to innovate and prioritize customer-centric strategies.

Additionally, VPBank (10.5 points) climbs one spot to secure a position in the top 5 private banks in Vietnam.

In the foreign bank category, HSBC (5.9 points) retains its leading position, followed by Shinhan Bank (4.4 points), Standard Chartered (3.1 points), and UOB (2.9 points), all of which maintain their stable rankings from the previous year.

“While the banking sector has demonstrated stability, it is also a critical time for banks to differentiate themselves. Success will favor those who embrace unique strategies and make the right moves,” comments Thue Quist Thomasen, CEO of Decision Lab.

“TPBank: Consistently Top-Rated in Domestic and International Rankings”

“Embarking on a journey of digital transformation, TPBank has reaped the rewards of its efforts to enhance customer experiences. Through a commitment to innovation, the bank has consistently ranked within the top 10 in both domestic and international rankings for Vietnam’s most reputable and best banks, as voted by customers. TPBank’s dedication to embracing technology has elevated every interaction, solidifying its position as a trusted and beloved financial institution.”

Super low-interest rates of only 5.99%/year: Excellent news for customers who choose La Villa – Tan An

Customers benefit from loan access of up to 60% of the property’s value, with interest rates as low as 5.99%/year and loan terms of up to 25 years, as part of the La Villa Green City development’s advantageous policies.

Manulife pioneers the use of technology to ensure customers’ full understanding and accurate purchases

Manulife Vietnam is thrilled to announce the official implementation of the information verification and contract issuance monitoring process for all M-Pro policyholders, effective from January 1, 2024. This comes after a successful pilot phase, demonstrating our commitment to ensuring accuracy and transparency in our insurance policies.