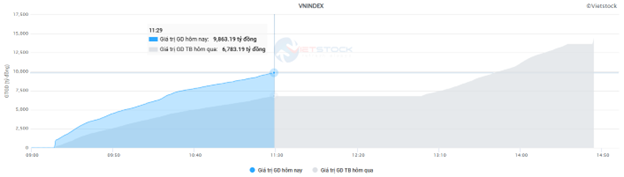

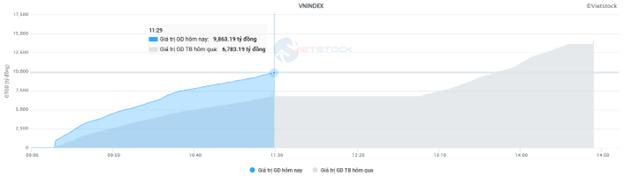

Liquidity in the market increased compared to the previous trading session, with the VN-Index matching volume reaching over 807 million shares, equivalent to a value of more than 18.5 trillion VND; HNX-Index reached nearly 60.1 million shares, equivalent to a value of more than 1.1 trillion VND.

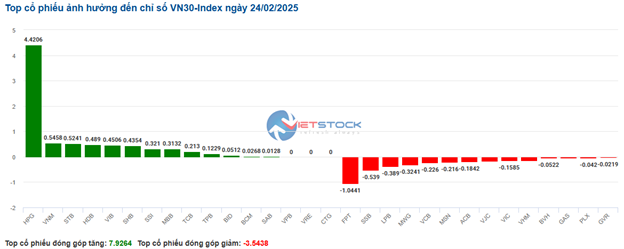

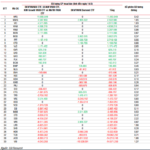

| Top 10 stocks with a strong impact on the VN-Index on February 24, 2025 |

VN-Index faced challenges in the early afternoon session as sellers emerged, putting pressure on the index. However, buyers quickly regained their footing, driving the index to close in positive territory. In terms of impact, HPG, VNM, VCB, and CTG were the most positive influences on the VN-Index, contributing over 4.2 points to the rise. On the other hand, FPT, FRT, HVN, and VTP continued to face selling pressure, but their impact was not significant.

HNX-Index followed a similar trajectory, with positive contributions from MBS (+2.81%), IDC (+1.79%), SHS (+2.11%), and PVS (+1.17%)…

|

Source: VietstockFinance

|

The essential consumer goods sector witnessed the strongest growth, with a 0.86% increase primarily driven by VNM (+3.91%), SAB (+1.16%), QNS (+0.8%), and KDC (+0.17%). This was followed by the financial and utilities sectors, which rose by 0.74% and 0.45%, respectively. Conversely, the telecommunications sector experienced the most significant decline in the market, falling by -3.19%, mainly due to VGI (-4.05%), CTR (-1.99%), FOX (-0.1%), and VNZ (-0.8%).

In terms of foreign trading activities, they continued to be net sellers on the HOSE exchange, offloading more than 304 billion VND, focusing on FPT (270.01 billion), HPG (151.89 billion), FRT (77.67 billion), and CTG (51.06 billion). On the HNX exchange, foreign investors were net buyers, purchasing slightly over 1 billion VND, mainly in SHS (16.52 billion), MBS (2.8 billion), IVS (1.72 billion), and VTZ (1.66 billion).

| Foreign Trading Activities: Net Buying and Selling |

Morning Session: Market Continues to Diverge

Investor sentiment remained indecisive, unable to surpass the familiar resistance level of 1,300 points. At the midday break, the VN-Index paused just below the reference mark, at 1,297.78 points, while the HNX-Index slipped 0.24% to 237 points. The market breadth tilted towards sellers, with 398 declining stocks versus 268 advancing ones.

The indices fluctuated within a range on high trading volume. The VN-Index recorded a matched volume of over 444 million units, equivalent to a value of nearly 10 trillion VND, a more than 45% increase compared to the previous week’s closing session. The HNX-Index posted a matched volume of over 31 million units, with a value of over 580 billion VND.

Source: VietstockFinance

|

In terms of impact, HPG stood out as a bright spot, contributing half of the nearly 4-point gain among the top 10 stocks providing the most substantial support to the VN-Index. Conversely, the pressure to adjust came mainly from FPT, GVR, and VPB, collectively exerting a negative impact of more than 1 point on the index.

Sector indices were gradually turning red. Notably, the telecommunications and information technology sectors witnessed the most significant declines, as large-cap stocks in these industries faced intense selling pressure, such as VGI (-4.05%), CTR (-1.58%), SGT (-2.19%), MFS (-2.56%), FPT (-1.06%), and CMG (-1.12%).

The industrial sector also painted a bleak picture, with profit-taking activities occurring across the board. Notable decliners with substantial volume included CII (-4.84%), HAH (-2.07%), VTP (-3.88%), BCG (-0.81%), GMD (-0.81%), PC1 (-1.26%), VSC (-%), VOS (-1.18%), and ACV (-1.9%)…

The standout performer in the morning session was the steel industry, which surged following the news of the Ministry of Industry and Trade’s temporary anti-dumping duties on hot-rolled steel imports from China. Numerous stocks in this sector witnessed impressive gains, including HPG (+4.54%), HSG (+1.99%), NKG (+2.49%), VGS (+5.57%), and TVN (+5.68%) … However, this momentum was not sufficient to keep the materials sector in positive territory, as several other stocks in the industry plunged, notably GVR (-1.08%), DPM (-1.21%), DGC (-0.73%), CSV (-2.05%), MSR (-9.83%), and NTP (-1.71%)…

On the flip side, the financial and essential consumer goods sectors were the only two groups to remain in positive territory, albeit modestly, rising less than 0.2%. This resilience was attributed to a few standout performers, including HDB (+1.3%), LPB (+1.24%), EIB (+1.24%), STB (+0.51%); VNM (+1.3%), MML (+1.79%), DBC (+1.07%), and VLC (+2.7%)…

10:40 am: Green and Red Alternating, Indecisiveness at the 1,300-point Threshold

Buying and selling forces in the market were relatively balanced, resulting in contrasting movements among the main indices. As of 10:30 am, the VN-Index rose 2.59 points, hovering around 1,299 points. Meanwhile, the HNX-Index slipped 0.22 points, trading near the 237-point level.

Stocks within the VN30 basket exhibited a mixed performance, with greens and reds evenly distributed. Specifically, HPG, VNM, STB, and HDB contributed 4.42 points, 0.54 points, 0.52 points, and 0.48 points, respectively, to the overall index. Conversely, FPT, SSB, LPB, and MWG remained under selling pressure, collectively deducting over 2.3 points from the VN30-Index.

Source: VietstockFinance

|

Healthcare stocks displayed robust growth, providing solid support to the broader market, despite some internal divergence. Specifically, on the buying side, DVN rose 1.1%, TRA climbed 3.16%, DMC jumped 3.26%, and DHD inched up 1.52%… Conversely, a few names faced selling pressure, including IMP, which fell 0.52%, DHT down 0.35%, DBD losing 0.51%, and TNH declining 2.35%…

Following closely, the materials sector also posted a decent gain, albeit with a mixed performance, as buyers slightly outnumbered sellers. Notable gainers included TVN, which rose 5.68%, PHR up 2.56%, ACG climbing 1.8%, HT1 inching up 0.38%, and VIF soaring 5.12%… However, reds persisted, with GVR slipping 0.46%, KSV plunging 9.89%, DGC down 0.73%, and MSR falling 6.41%…

From a technical perspective, HPG witnessed a sharp surge in price, accompanied by a significant increase in trading volume, surpassing the 20-day average, indicating heightened investor engagement. Additionally, the stock’s price broke through the SMA 100 and 200-day moving averages, while MACD and Stochastic Oscillator indicators signaled a buy opportunity, reinforcing the upward trajectory.

Currently, HPG is retesting the previous high achieved in December 2024 (approximately 27,600-28,200). If the price successfully breaches this level, coupled with improved liquidity, the uptrend is likely to gain further momentum.

Source: https://stockchart.vietstock.vn/

|

On the flip side, the telecommunications sector faced intense selling pressure, recording a decline of 3.31%. Large-cap stocks in the industry bore the brunt of the selling, including VGI, which dropped 4.53%, FOX down 0.21%, CTR falling 1.49%, and YEG slipping 0.63%…

Compared to the opening, buyers and sellers engaged in a tug-of-war, resulting in a balanced market. Over 940 stocks remained unchanged, while sellers slightly edged out buyers, with 315 declining stocks (including 5 at the lower limit) versus 308 advancing ones (33 of which hit the upper limit).

Source: VietstockFinance

|

Opening: Materials Stocks Shine from the Get-Go

At the opening bell on February 24, the VN-Index edged up slightly, surpassing the 1,298.57-point mark. Similarly, the HNX-Index inched higher, reaching 238.05 points.

Reds temporarily dominated the VN30 basket, with 7 gainers, 22 decliners, and 1 stock trading flat. Among the advancers, HPG, SSI, SHB, and VNM stood out with robust gains. Conversely, SSB, PLX, FPT, and VJC led the decliners.

As of 9:30 am, materials stocks took the lead, with the sector rising 1.14%. Notable performers included HPG, which jumped 6.05%, HSG climbing 3.13%, NKG surging 3.91%, VGS soaring 8.01%, and TVN skyrocketing 9.09%…

Trailing closely, the essential consumer goods sector posted a growth of nearly 0.5%, contributing to the market’s positive start. Standout performers included VNM, which rose 1

The Foreigners’ Sell-Off: Unraveling the Nearly 500 Billion Dong en-masse Sell-Off and the Stocks in the Eye of the Storm

The banking stock SHB witnessed a substantial net buying spree of 108 billion VND, with VCI also experiencing robust net buying of 65 billion VND.

A Word of Caution: Considering VN-Index’s Downward Trend, Investors Should Refrain from Buying

The ABS Securities team anticipates a volatile trading session ahead, with potential corrective pressures and market jitters lingering.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)