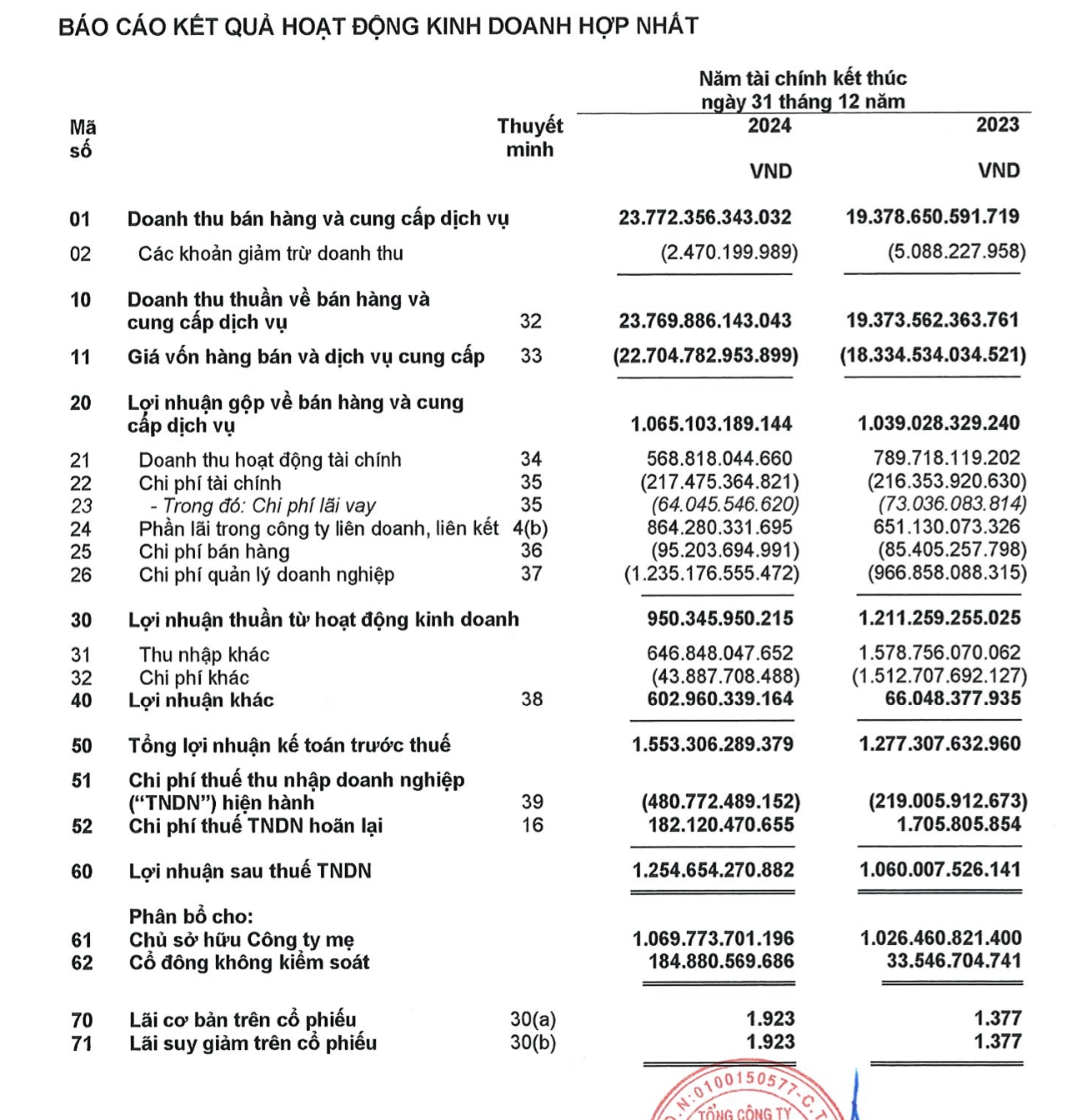

Net profit reached VND 1,254 billion, an increase of 18.3% from the previous year.

Previously, according to the self-prepared 2024 financial report, PTSC achieved revenue of over VND 23,880 billion and net profit of VND 1,411 billion.

Thus, PTSC’s net profit decreased by about VND 157 billion after the audit.

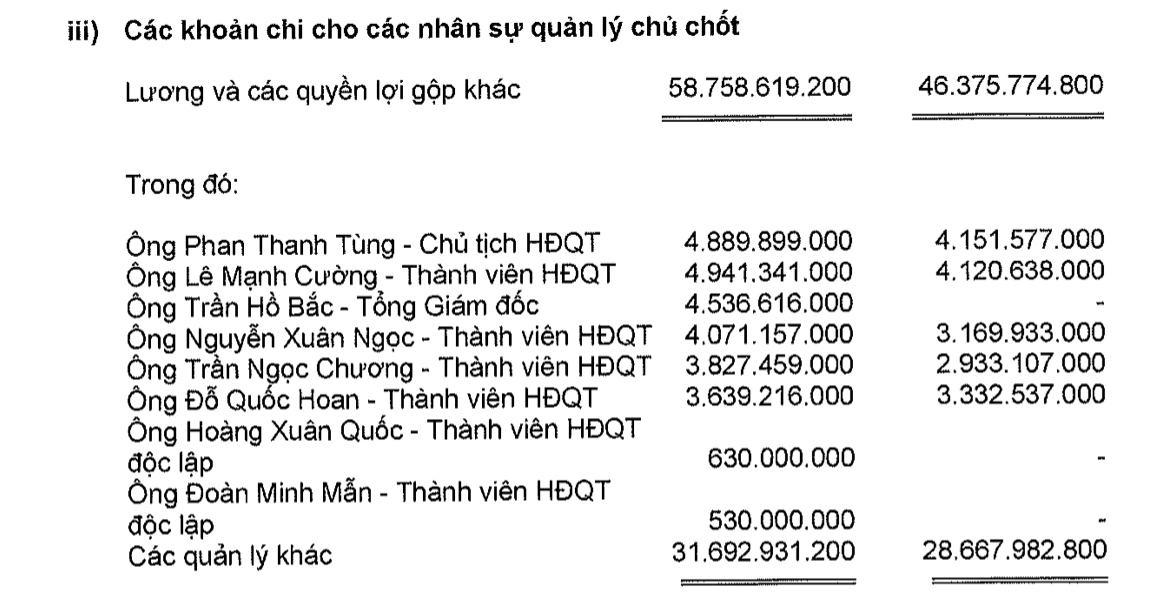

With double-digit business result growth, the total salary and benefits for PTSC’s key management personnel amounted to VND 58 billion, a 27% increase over the previous year.

Specifically, Mr. Phan Thanh Tung, Chairman of the Board of Directors, was paid nearly VND 4.9 billion, slightly lower than the former CEO and Board member, Mr. Le Manh Cuong.

Mr. Tran Ho Bac, who was promoted from Deputy General Director to General Director, replacing Mr. Le Manh Cuong, as of December 6, 2024, received VND 4.5 billion.

Other Board members earned between VND 3.6 and 4 billion, while the two independent Board members received VND 530-630 million.

As of December 31, 2024, total assets reached approximately VND 34,076 billion, a 29% increase compared to the beginning of the year. Cash, cash equivalents, and short-term financial investments (bank deposits with terms) amounted to VND 15,308 billion, accounting for 45% of total assets.

PTSC disclosed that the VND 3,886 billion term deposits earn interest rates ranging from 2.8% to 5.6% per annum. Among these, VND 186 billion was deposited at Vietnam Modern Commercial Joint Stock Bank (MBV), formerly known as Oceanbank, which is currently suspended from trading.

On October 17, 2024, the State Bank of Vietnam transferred Oceanbank to Military Commercial Joint Stock Bank (MBBank), which was subsequently renamed MBV. The Board of Directors expects this deposit to be tradable again in the future when specific regulations are issued by the State Bank of Vietnam and MBBank.

As of the market close on March 25, 2025, PVS shares were priced at VND 32,600 each, corresponding to a market capitalization of over VND 15,581 billion. The stock has declined by 21% in the past six months.

The Mobile World: Nguyen Duc Tai’s Retail Empire Generates $18 Million in Daily Revenue, Launches Nearly 100 Bach Hoa Xanh Stores in the First Two Months of the Year

In the first two months of 2025, Bach Hoa Xanh expanded aggressively, opening nearly a hundred stores with over 50% of these new locations strategically situated in the central provinces.

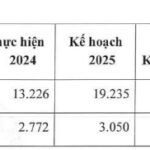

Unlocking Profits: How Diversified Plastics and Construction Industries are Poised for a “Double Win” by 2025

The plastic industry witnessed significant revenue growth in the final quarter of 2024, yet profits were mixed. While the industry experienced an overall boost in revenue, several prominent businesses reported a decline in profits.