Hanoi Iron and Steel Corporation (HPG) has just announced the documents for the 2025 Annual General Meeting of Shareholders. The meeting is expected to take place at 8:30 AM on April 17, 2025, at the Grand Ballroom, 1st floor – Melia Hanoi Hotel, 44B Ly Thuong Kiet, Tran Hung Dao ward, Hoan Kiem district, Hanoi city.

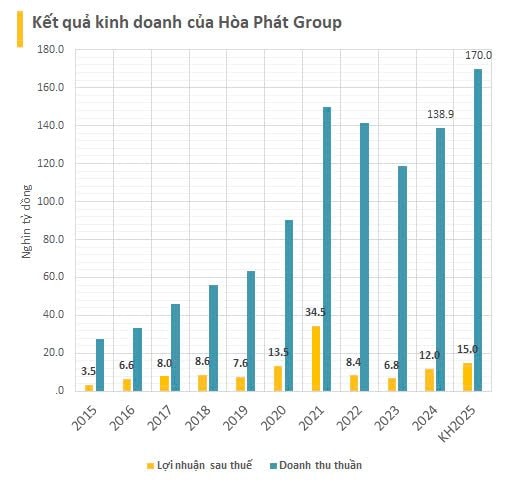

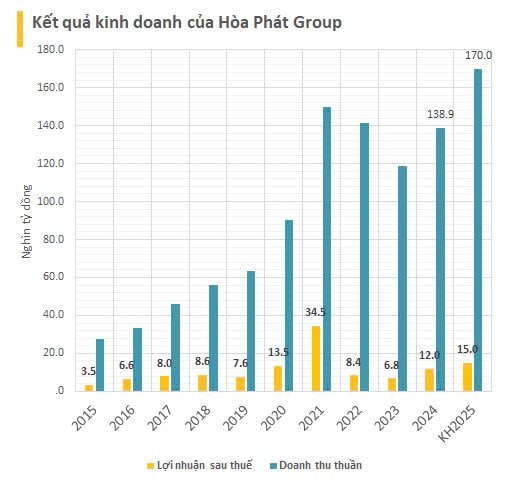

In 2024, Hoa Phat’s profit after tax reached VND 12,020 billion, and after allocating to various funds, the remaining profit was VND 10,950 billion.

The Board of Directors proposes to pay a 2024 dividend of 20% (5% in cash and 15% in shares). The source of dividend payment will be from undistributed profit after tax. The payment will be made within six months from the date of approval by the General Meeting of Shareholders.

With nearly 6.4 billion shares currently in circulation, Hoa Phat expects to spend approximately VND 3,198 billion on cash dividends.

For 2025, Hoa Phat plans to achieve a revenue of VND 170,000 billion, an increase of about 21% compared to the revenue in 2024. If this plan is realized, it will be the highest revenue ever for Hoa Phat.

The company targets a profit after tax of VND 15,000 billion, an increase of nearly 25% compared to 2024. The expected dividend ratio for 2025 is 20%.

In 2024, HPG disbursed over VND 35,000 billion for the Dung Quat 2 project. According to Agribank Securities’ report, based on information from the company, Phase 1 of the project is expected to commence operations this year and produce 1.4 million tons of HRC steel, a 47% increase compared to 2024.

Phase 2 is anticipated to be completed by the end of 2025 or early 2026, and the project is expected to operate at maximum capacity in 2028, producing 5.6 million tons of HRC/year.

The Dung Quat Phase 2 project is expected to contribute up to VND 80,000 billion in annual revenue for the company, an increase of about 50-60% compared to previous years.

Hoa Phat’s business results are expected to improve due to the recovery in demand from the domestic real estate market and the acceleration of key public investment projects.

Additionally, the Ministry of Industry and Trade’s temporary anti-dumping measures on HRC steel from China on February 21, 2025, are expected to boost consumption for the output of Dung Quat 2.

Market Beat 24/02: VN-Index Surges Past 1,300 Points as Trading Volume Improves

The market closed with strong gains, seeing the VN-Index climb 7.81 points (+0.6%), to finish at 1,304.56; while the HNX-Index rose 0.92 points (+0.39%) to 238.49. It was a relatively balanced session, with 377 advancing stocks against 373 declining ones. The large-cap VN30 basket tilted positively, as 21 stocks added value, 6 declined, and 3 were unchanged, ending the day in the green.

The Mobile World: Nguyen Duc Tai’s Retail Empire Generates $18 Million in Daily Revenue, Launches Nearly 100 Bach Hoa Xanh Stores in the First Two Months of the Year

In an ambitious expansion drive, Bach Hoa Xanh inaugurated nearly a hundred stores in the first two months of 2025, with over 50% of these new retail outlets strategically located in the central provinces of Vietnam.

FPT Telecom (FOX) Aims for Record-High 2025 Profits, Targets 5,000 VND Cash Dividend per Share

FPT Telecom is taking a dynamic approach to capital expansion with a proposed 50% stock dividend. This strategic move will increase the company’s charter capital from 4,925 billion to approximately 7,388 billion VND. This stock issuance is a supplementary measure to the company’s cash dividend policy, demonstrating FPT Telecom’s commitment to rewarding its shareholders and fostering sustainable growth.

VNM ETF: New Buy on NAB, VCB Stock Soars

For the period of March 10–17, 2025, the VanEck Vectors Vietnam ETF (VNM ETF) witnessed minimal fluctuations in its portfolio. Only two stocks experienced upward movement, including NAB, which was added to the portfolio following the first quarterly review of 2025 for the MarketVector Vietnam Local Index, the reference index for the VNM ETF.