## Techcombank Aims for Majority Stake in TCGIns, Foraying into Non-Life Insurance

Aims for 68% Ownership in TCGIns

Techcombank’s Board of Directors has recently approved a plan to acquire shares in Non-Life Insurance JSC (TCGIns), turning it into a subsidiary. This move underscores the bank’s strategic expansion into the non-life insurance sector.

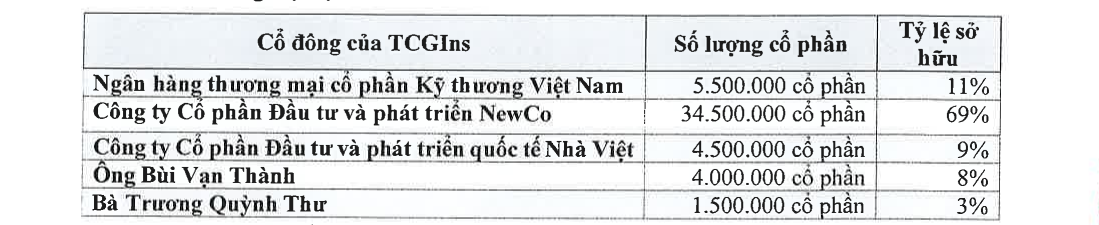

With a chartered capital of VND 500 billion, equivalent to 50 million shares, Techcombank currently holds 5.5 million shares, representing an 11% stake. The largest shareholder is NewCo Investment and Development JSC, with a 69% stake, followed by International Housing Development and Investment JSC (9%), Mr. Bui Van Thanh (8%), and Ms. Truong Quynh Thu (3%).

Techcombank intends to purchase 28.5 million shares from NewCo Investment and Development JSC, equivalent to a 57% stake, at VND 10,000 per share. Upon completion, Techcombank’s ownership in TCGIns will increase to 68%, totaling 34 million shares.

Techcombank’s Current Shareholder Structure

According to Techcombank’s projections, TCGIns will incur a loss of VND 14 billion in its first year of operation (2025) but is expected to turn a profit in subsequent years.

The bank’s management team believes that Vietnam’s non-life insurance market holds significant potential and opportunities for growth. Leveraging Techcombank’s strengths, TCGIns has already secured access to 600 corporate clients and 60,000 small and medium-sized enterprises within the first five months of operation, generating nearly VND 150 billion in insurance premiums.

Foraying into Life Insurance with TCLife

In addition to its foray into non-life insurance, Techcombank also has ambitious plans for the life insurance sector after its exclusive distribution agreement with Manulife ends in late 2024.

The bank intends to establish TCLife – Techcom Life Insurance JSC, with a chartered capital of VND 1,300 billion. Techcombank will hold an 80% stake, contributing VND 1,040 billion in capital.

TCLife will be jointly owned by two prominent shareholders, Techcombank and Vingroup, combining their strengths in financial prowess and extensive customer base. Techcombank brings 31 years of expertise in the financial industry, while Vingroup contributes its diverse ecosystem.

The bank forecasts that TCLife will operate at a loss for the first two years but expects to receive a net profit of VND 1,195 billion, equivalent to a 23.4% return on investment, in the fifth year of operation. Moreover, TCLife will contribute to increasing the net assets of its shareholders, including Techcombank. The insurance company’s total assets are projected to grow from VND 728 billion in the first year to VND 16,081 billion in the fifth year, representing a 22-fold increase.

Prudential Vietnam and HSBC Vietnam: Forging a Dynamic Bancassurance Alliance

Prudential Vietnam and HSBC Vietnam are proud to announce a strategic bancassurance partnership, combining their expertise to offer tailored financial solutions for the country’s burgeoning affluent market. This collaboration marks a significant step forward in providing comprehensive and innovative financial services to Vietnam’s high-net-worth individuals and families.

What are the 5 banks that have received a second credit limit increase?

On November 28, 2024, the State Bank of Vietnam (SBV) announced its decision to provide additional credit limits to banks that have utilized 80% of their previously allocated credit limits. This is the second time in 2024 that the SBV has taken such action, the first being in August 2024. With this move, the SBV demonstrates its unwavering commitment to achieving the ambitious 15% credit growth target for the year.

“Techcombank’s Noble ESG Vision: Championing Sustainability and Community Engagement.”

Ms. Thai Minh Diem Tu, Chief Marketing Officer of Techcombank, offers a fascinating insight into the bank’s sustainability journey, its strategic vision for mass participation sports, and the integral role of ESG in Vietnam’s future growth and development. In this exclusive interview with VET, she highlights the bank’s commitment to long-term environmental and social responsibility, and how their involvement in sports is about more than just sponsorship, it’s about community engagement and a healthier, more prosperous Vietnam.