Conveniently located in the Southeastern region and bordering Ho Chi Minh City, Dong Nai plays a pivotal role in connecting vital transportation routes and serves as a strategic hub in the key economic region of Southern Vietnam.

The province is administratively divided into 11 units at the district level, including two cities: Bien Hoa and Long Khanh, and nine districts: Long Thanh, Nhon Trach, Trang Bom, Thong Nhat, Cam My, Vinh Cuu, Xuan Loc, Dinh Quan, and Tan Phu.

Dong Nai’s geographical advantages, ongoing expansion of transportation infrastructure, rapid urban development, and the robust growth of industrial parks, particularly with the anticipated opening of the Long Thanh Airport project’s first phase in 2026, have unlocked significant potential for the local real estate market.

With its vast land resources, Dong Nai is reaping the benefits of a strong investment shift to the outskirts as land scarcity and affordable housing shortages in Ho Chi Minh City challenge the financial capabilities of most residents. Consequently, Dong Nai has attracted numerous investors and businesses interested in developing urban area projects, residential areas, and villas. This influx has caused property prices in many areas of the province to surge in recent years.

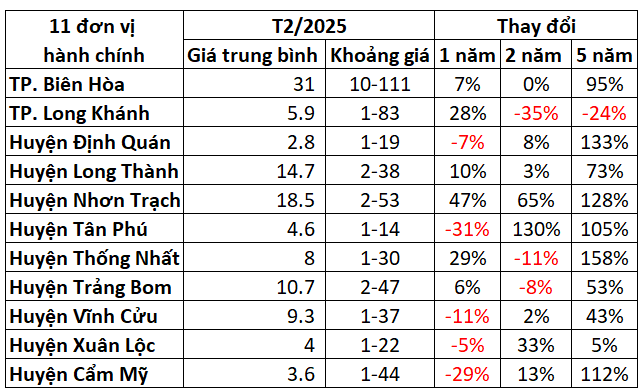

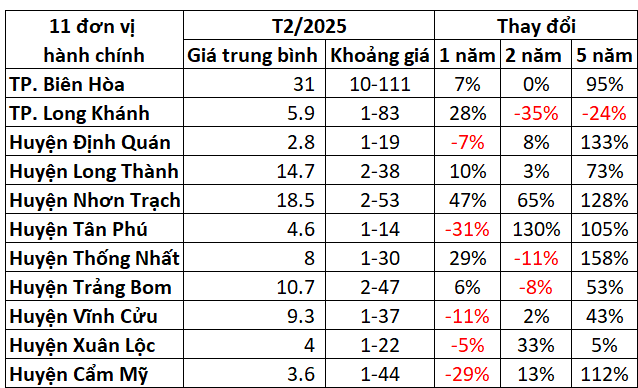

According to statistics, over a five-year period from February 2020 to February 2025, 10 out of 11 administrative units at the district level in Dong Nai experienced land price increases. Notably, Dinh Quan, Nhon Trach, Tan Phu, Thong Nhat, and Cam My districts witnessed price hikes of up to several times their original value. In contrast, Long Khanh city experienced an average decrease of 24%.

Source: Author’s compilation

|

However, in the past year (from February 2024 to February 2025), Dong Nai’s land prices have cooled down, with five administrative units at the district level witnessing a decrease in land prices. Tan Phu district experienced the most significant drop, with prices falling by 31%.

From real estate brokers to ride-hailing and pawnshop services

Exploring the reasons behind this shift, the author surveyed the area of Tan Phu town (in Tan Phu district) and found that real estate buying and selling activities had diminished, with consulting points and notary offices deserted.

Mr. Cuong (32 years old), a local broker with years of experience, shared that while there is still ample supply, the demand for land in the district has significantly diminished. Although investors are visiting to inspect the land, they are not committing to purchases, even with the considerable price drops. A land lot previously worth 1 billion VND is now priced at 700 million VND.

A land lot in Tan Phu district, advertised by a broker, has seen its price drop from 1 billion VND to nearly 700 million VND.

|

Explaining the situation, the broker suggested that land prices in the area have yet to align with their true value. Previously, buyers from all over the country would purchase large plots of land measuring thousands of square meters, convert them to residential use, give them project names, embellish their potential, and then subdivide and resell them to local residents at a profit.

However, buyers have become more discerning, and many of the previous tactics are no longer effective. Moreover, most investors are engaged in land flipping, and with the current market conditions, they are struggling to offload their properties. Genuine homebuyers constitute a small portion of the market, resulting in the stagnation of the Tan Phu real estate market over the past two years.

“It’s intense out there. Only distressed sales (where the owner is in debt to a bank or external lender and needs to sell to repay the loan) are easy to sell at the moment. Everything else is at a standstill, and there’s no more business to be done. I can only manage to close a few deals a month, a far cry from the land fever of 2020-2022, when there was no day off. During that time, a land lot could appreciate by 300 million VND in a single month. Now, simply getting inquiries from potential buyers is a blessing, and the pace has slowed considerably.”

“I’ve had to take on various side hustles like ride-hailing and opening a pawnshop to make ends meet because brokering isn’t cutting it these days. Most brokerage companies have shut down, and there’s no sign of them reopening” – Mr. Cuong lamented.

Real estate expert Pham Trong Phu, CEO of Titanium Property, advises that those looking to invest in land should thoroughly understand the dynamics of each area and only proceed if they have disposable funds. He particularly cautions against leveraging during land fever, as the property’s value might not reflect its true worth.

Even with the completion of the Dau Giay-Tan Phu-Lien Khuong expressway, Mr. Phu believes that land price increases in the area will be challenging. He attributes land price increases to three factors: population, genuine housing demand, and local economic development. In his assessment, Tan Phu lags in these aspects.

Will province merger news cause land prices to rise?

Regarding province mergers, Mr. Phu confirmed that he had heard about this, specifically mentioning the potential merger of Binh Duong, Ba Ria-Vung Tau, and a portion of Nhon Trach district into Ho Chi Minh City, which would then be renamed.

The expert suggested that a merger would bring about two primary changes: infrastructure and administrative units. Notably, the provinces merging with Ho Chi Minh City would benefit from its vast development potential and its status as a leading economic contributor to the country. Consequently, Ho Chi Minh City would expedite infrastructure development, ensuring seamless connectivity with the merged provinces. Additionally, all merged areas would be administratively referred to as Ho Chi Minh City, a factor that could drive up land prices.

“With the merger, Ho Chi Minh City will have the opportunity to develop eco-tourism, ports, and industrial parks, moving beyond its current focus on economic zones. Fueled by these expectations, land speculators are already shouting, ‘It’s all going to be Ho Chi Minh City!’ and driving up prices.” – Mr. Phu commented.

In reality, notary and land registration offices are bustling with activity. The expert acknowledged that there are genuine transactions, and some areas might experience localized fever.

Sharing a similar perspective, Mr. Dinh Minh Tuan, Southern Region Director of Batdongsan.com.vn, stated that province mergers aim to leverage the strengths of the involved provinces. He viewed this development positively, predicting that it would not lead to widespread land fever but rather sustainable growth. The products would also be more robust, attracting additional investors and residents seeking genuine housing. However, he asserted that the market would not experience the same kind of sudden, explosive growth witnessed in the past.

Citing data from Batdongsan.com.vn, Mr. Tuan noted that while search demand has increased, real estate prices are only beginning to shift, remaining within manageable levels. Based on the website’s search data, the increase is approximately 5-7% higher than usual, which does not indicate a widespread land fever.

Mr. Tuan emphasized that some individuals have exploited the province merger news to inflate land prices. He observed that some land plots that had shown no price movement over the past 2-3 years are now being marketed at higher prices due to this information. Ultimately, market liquidity determines whether growth will be sustainable.

From a different perspective, economist Dinh The Hien argued that while province mergers might lead to land price increases, the impact would be localized. He explained that large investor groups had already positioned themselves in anticipation of this news and are now using it to generate hype and offload their holdings. Logically, land prices should only increase when there is a significant improvement in the economy.

Considering the broader context, from agricultural land in remote areas to real estate in major cities, property prices are already high. Therefore, attempting to profit from short-term price fluctuations in this market environment is challenging. Any price surges are likely instigated by a small group of speculators.

“If the three provinces merge, there will be a chosen administrative center, which will reduce demand in the other two provinces significantly.” – Mr. Hien stated.

Proceed with caution

In light of the province merger news, Mr. Tuan advised investors to recognize that mergers aim to harness the growth potential of the involved provinces for long-term benefits rather than immediate price increases. Essentially, the nature of real estate remains unchanged.

For investors considering entering the market, Mr. Tuan emphasized the importance of due diligence, such as assessing whether a land lot is experiencing an unusually rapid price increase and whether that increase is justified by the creation of tangible value. In the short term, a province merger is unlikely to generate value that would significantly impact a land lot’s worth.

Legal considerations are also crucial when purchasing real estate, an aspect often overlooked during land fever. Lastly, liquidity is a critical factor, as properties in areas surrounding Ho Chi Minh City tend to have low liquidity, and prices are returning to pre-fever levels. Ultimately, the intended use of the property should be a key consideration, favoring locations with convenient access.

Economist Dinh The Hien refrained from offering advice to short-term investors, whom he likened to “scents” who detect where prices are rising and enter the market for a few months.

However, for those genuinely interested in long-term investment and seeking new opportunities, Mr. Hien recommended maintaining a calm and cautious approach regarding the notion that province mergers will lead to price increases. He asserted that there is no solid economic rationale to support this belief.

Prospects for the Dong Nai and Southern Vietnam real estate markets

According to Mr. Tuan, the 2-3 billion VND price range is highly sought-after in Dong Nai, particularly in areas close to transportation infrastructure and those with potential for future development. In the future, the Long Thanh Airport is expected to contribute approximately 3-5% to the country’s GDP. The airport’s operation will create a substantial demand for housing and employment, positively impacting the local real estate market.

Nevertheless, the market is governed by supply and demand dynamics. Dong Nai has been stagnant for the past 2-3 years, recovering from the excessive investor enthusiasm witnessed between 2019 and 2021. There are no indications of rapid development, and the market lacks distinctive features.

Commenting on the prospects for the Southern Vietnam real estate market in the coming months, Mr. Tuan anticipated a stronger recovery in the latter half of 2025. He predicted that apartments (sought by approximately 40-50% of potential buyers) and low-rise housing around Ho Chi Minh City, such as in Long An, Binh Duong, and Dong Nai, would be the most desirable.

Regarding the future of the Dong Nai real estate market, Mr. Phu believed that the airport’s operation and the completion of surrounding infrastructure would positively impact prices but not to a significant extent, as many investors had already profited from the area 3-4 years ago.

In the event of province mergers, Mr. Phu expected the real estate market to experience an upswing, with some areas potentially witnessing price increases of up to 40%. Overall, the market could see a 15-20% rise, particularly in locations with large-scale residential and urban development projects by prominent investors, such as Long An, Tay Ninh, and Ba Ria-Vung Tau. Mr. Phu predicted that land plots would be the best-performing product in the upcoming period.

– 10:00 25/03/2025

The Capital’s Commitment: Commencing Construction on Two Affordable Housing Mega-Projects

The Hanoi People’s Committee has instructed relevant departments to expedite the development of two social housing projects, Tien Duong 1 and Tien Duong 2, in the Dong Anh district. Emphasizing the importance of efficient procedures, the committee has urged the implementation of a “green channel” approach to facilitate construction, aiming for a groundbreaking commencement in September.

The Ever-Climbing Prices and the Enduring Appeal of Nha Be Real Estate

House prices in Nhà Bè are experiencing a significant surge, thanks to the area’s rapid development and the completion of key infrastructure projects. This has resulted in a thriving real estate market, with new property developments being eagerly snapped up.

The Industrial Array Pivot

Recognizing the challenging energy landscape ahead, the management of PC1 made a pivotal decision three years ago to diversify their strategy. With a keen eye on the post-COVID-19 world, they identified industrial real estate as a key long-term focus, alongside their ability to recover receivables from EVN. This strategic shift sets the company on a new path, one that holds promise in the face of challenges posed by Planning No. 8.

Waterpoint: A Signature Collaboration between Khai Hoan Land and Nam Long

Khải Minh Land, a prominent member of the Khải Hoàn Land Group (HOSE: KHG), is proud to announce its continued partnership with the renowned Nam Long Group. Together, we present an exciting investment opportunity with the Waterpoint project, offering a dynamic breakthrough in the realm of eco-urban real estate.

The Most Expensive Routes in Hanoi’s Dan Phuong District

The most expensive land in Dan Phuong District, Hanoi, is along National Highway 32 (from the border of Hoai Duc to the Tượng Đài Monument junction), with a price tag of 46 million VND per square meter, according to Hanoi’s new land price framework.