In essence, accrued interest is the interest income that banks recognize in their income statements but have not yet actually collected. This interest income is expected from income-generating assets, mainly loans. According to the accrual accounting principle, banks record accrued interest as soon as it is earned, instead of waiting until the actual cash is received. Accrued interest is only recognized for loans that are classified as Group 1 – Standard Loans.

The recognition of accrued interest increases accounting income, but if the interest is not ultimately collected, banks are forced to reverse the accrued interest and reclassify the loan. The consolidated financial statements for 2024 showed that the banking industry’s ratio of accrued interest to total assets had decreased significantly by the end of the fourth quarter, reflecting adjustments made after the Circular 06.2024 on debt restructuring and moratorium expired. While some banks have strong financial positions, others have shown signs of strain when reversing accrued interest, highlighting challenges in asset management.

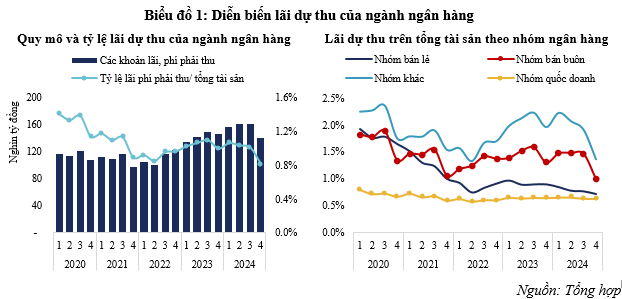

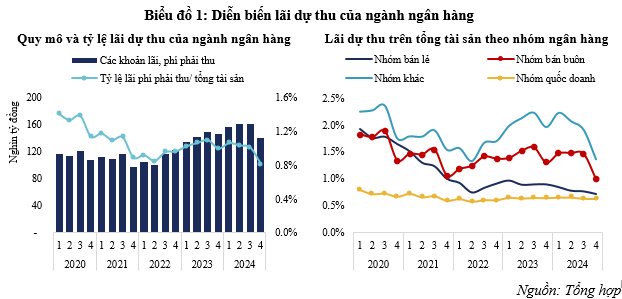

Trends in Accrued Interest for the Banking Industry

From the beginning of 2025, banks will no longer be allowed to restructure loan maturities and maintain loan groups according to Circular 02.2023 and Circular 06.2024. This marks the end of the debt restructuring and moratorium policies previously implemented by the State Bank. As a result, banks are required to make adequate provisions for non-performing loans and accurately reflect the status of loans, instead of prolonging the support mechanism as before.

Analyzing the financial statements of 27 listed commercial banks reveals significant changes in the trends of accrued interest as a percentage of total assets. From the middle of 2022 and earlier, there was a consistent downward trend in the ratio of accrued interest to total assets year over year. This can be attributed to the shift towards retail lending over the past several years, as retail loans typically have lower accrued interest rates, leading to an overall decrease in the industry’s accrued interest ratio. However, since the end of 2022, when banks started shifting their focus back to corporate lending, there has been a corresponding increase in accrued interest. This is a concern as most of the disbursements to enterprises are medium and long-term loans, raising questions about the quality of banks’ profits. Moreover, as the circulars on loan extensions lose their validity, some loans will be reclassified, and the accrued interest on these loans will no longer be recognized. This was evident in the fourth quarter when the total accrued interest decreased by nearly VND 21,000 billion compared to the previous quarter.

There is a noticeable differentiation in the trends of accrued interest-to-total assets ratio among different groups of banks. State-owned banks maintained a significantly lower ratio compared to private banks, indicating better control over accrued interest. During the 2020–2021 period, this ratio fluctuated between 0.7% and 0.8% of the industry’s total assets, before decreasing to around 0.6% from 2022 onwards. On the other hand, private banks, especially small-scale banks, exhibited more significant fluctuations, with their ratios sometimes surging above the industry average. This raises questions about the quality of interest income within this group.

Retail-focused banks showed a marked improvement from 2020 to 2024, as their accrued interest-to-total assets ratio decreased from nearly 2.0% at the beginning of 2020 to 0.7% at the end of 2024. In contrast, wholesale banks exhibited larger fluctuations, with a significant drop in the fourth quarter, indicating that these banks tend to focus on managing accrued interest towards the end of the year. Notably, Q4 2024 marked an adjustment for wholesale banks, as the scale of accrued interest decreased by nearly VND 17,500 billion compared to the previous quarter and was almost VND 4,800 billion lower than at the end of 2023. By reducing accrued interest and achieving a 20% growth rate in total assets, this group of banks significantly lowered their accrued interest-to-total assets ratio by the end of 2024.

It is worth noting that most of the decline in accrued interest came from banks focusing on corporate lending and other small-scale banks, with a very sharp drop. Meanwhile, the two groups of banks focusing on retail lending and state-owned banks maintained almost unchanged accrued interest balances.

Accrued Interest Trends at Banks in 2024

Differences in credit strategies, customer quality, and risk management approaches also lead to variations in the accrued interest-to-total assets ratio. Banks with stringent risk management policies tend to maintain a lower ratio, while others may have higher ratios due to the nature of their loan portfolios or asset management strategies. Within the state-owned bank group, VCB has the lowest accrued interest-to-total assets ratio, consistently at 0.5% for several years, and further decreasing to 0.43% in Q4 2024. BID and CTG used to have similar ratios, but by the end of 2024, BID recorded 0.84% while CTG stood at 0.56%. With the advantage of lower lending rates, this group can be more selective in their borrowers, targeting those with strong financial positions and stable cash flows. Additionally, their cautious risk management policies contribute to maintaining a lower accrued interest ratio.

Wholesale banks, which focus on corporate clients, generally have higher accrued interest ratios than retail banks, as corporate loans typically involve larger numbers of interest-bearing days. Nonetheless, the ratio has been decreasing, and by the end of 2024, most banks in this group managed to keep it below 1%, except for MSB and SHB, which recorded 1.53% and 1.62%, respectively. During the year, SHB focused on recovering accrued interest, evident by the significant reduction from VND 19.7 trillion in Q3 2024 to VND 12.1 trillion at the end of 2024. On the other hand, retail banks have lower accrued interest ratios due to their stringent risk management practices for diversified and small-scale loan portfolios. Notably, STB significantly lowered its ratio from 3.55% in 2020 to 0.7% in 2024, reflecting a substantial improvement in credit quality control. The year 2024 also marked the eighth year of Sacombank’s 10-year restructuring plan, during which over 80% of non-performing loans and distressed assets have been resolved.

Accrued interest is particularly volatile in small-scale commercial banks, and there are even significant fluctuations among banks within this group, making it challenging to forecast profits accurately. EIB and ABB have consistently maintained their accrued interest-to-total assets ratios below 1% for the past five years. In contrast, other banks in this group have exhibited wider variations, ranging from 1.2% to 2.0%. Banks with accrued interest-to-total assets ratios above 2.2% include BAB, NVB in 2023, and VAB. High accrued interest ratios raise questions about the quality of profits and other potential risks associated with actual interest collection. There are also risks related to the retrieval of accrued interest that has already been recognized as income in previous years.

Specifically, in the fourth quarter, when the circular on debt restructuring expired, banks were required to fully reflect expenses and reclassify loan groups, and some banks revealed weaknesses in their financial statements.

VAB is another bank with a high accrued interest ratio. According to the Government Inspectorate’s conclusion in July 2023, VAB violated regulations on loan classification during the 2013-2017 restructuring period by keeping the loans of Vicoland Group and CTCP Dien Binh Thuy Lam Dong in Group 1 instead of Groups 4 or 5. This inappropriate classification of loan groups raises concerns about the reliability of the bank’s financial statements. As of the end of 2024, while VAB has reduced its accrued interest on the balance sheet by over VND 3,000 billion, its plan for further reduction remains unclear. Additionally, the bank’s off-balance sheet accrued interest that has not yet been collected has doubled compared to the end of 2023, reaching nearly VND 2,300 billion.

While the recognition of accrued interest adheres to the accrual accounting principle, when the proportion of accrued interest exceeds the industry average and exhibits unpredictable fluctuations, it may raise questions about the quality of a bank’s profits. Over-reliance on accrued interest to enhance financial statements can provide short-term gains, but in the long run, increasing pressure to reverse accrued interest will lead to a chain of impacts that diminish the bank’s competitiveness.

Le Hoai An, CFA – Nguyen Thi Ngoc An, HUB

– 08:14 24/03/2025

“Choosing Competition Over Compromise Pays Off: Cholimex Chili Sauce’s 15-Year Success Story of Consistent Growth, 50% Annual Dividends, and a Skyrocketing Stock Price to 330,000 VND – Quadruple the Price Once Offered by Masan”

This is Cholimex Food’s highest-ever financial result, marking a positive growth streak for 15 consecutive years.

The Latest Credit Growth Figures: Unveiling the Banking System’s Performance

“The banking sector is off to a strong start this year, with credit growth outpacing that of the previous year. According to Vice Governor of the State Bank of Vietnam, Pham Thanh Ha, as of March 12, credit growth in the banking system had increased by 1.24% compared to the end of 2024, indicating a significant improvement.”

The Magic of Chemicals, the Dullness of Fertilizers

The chemical businesses continued their remarkable breakthrough in Q4 of 2024, mirroring the previous quarter’s performance. In contrast, fertilizer companies experienced significant setbacks, despite a few notable exceptions that achieved substantial profit growth.