In his latest post on Truth Social on April 9th, President Donald Trump announced a delay in tariffs on several countries.

“Based on the fact that over 75 countries have contacted us about negotiations and not retaliating, I am delaying the tariffs for 90 days, and will reduce them to 10% during this period,” Mr. Trump wrote. He stated that this decision would take immediate effect.

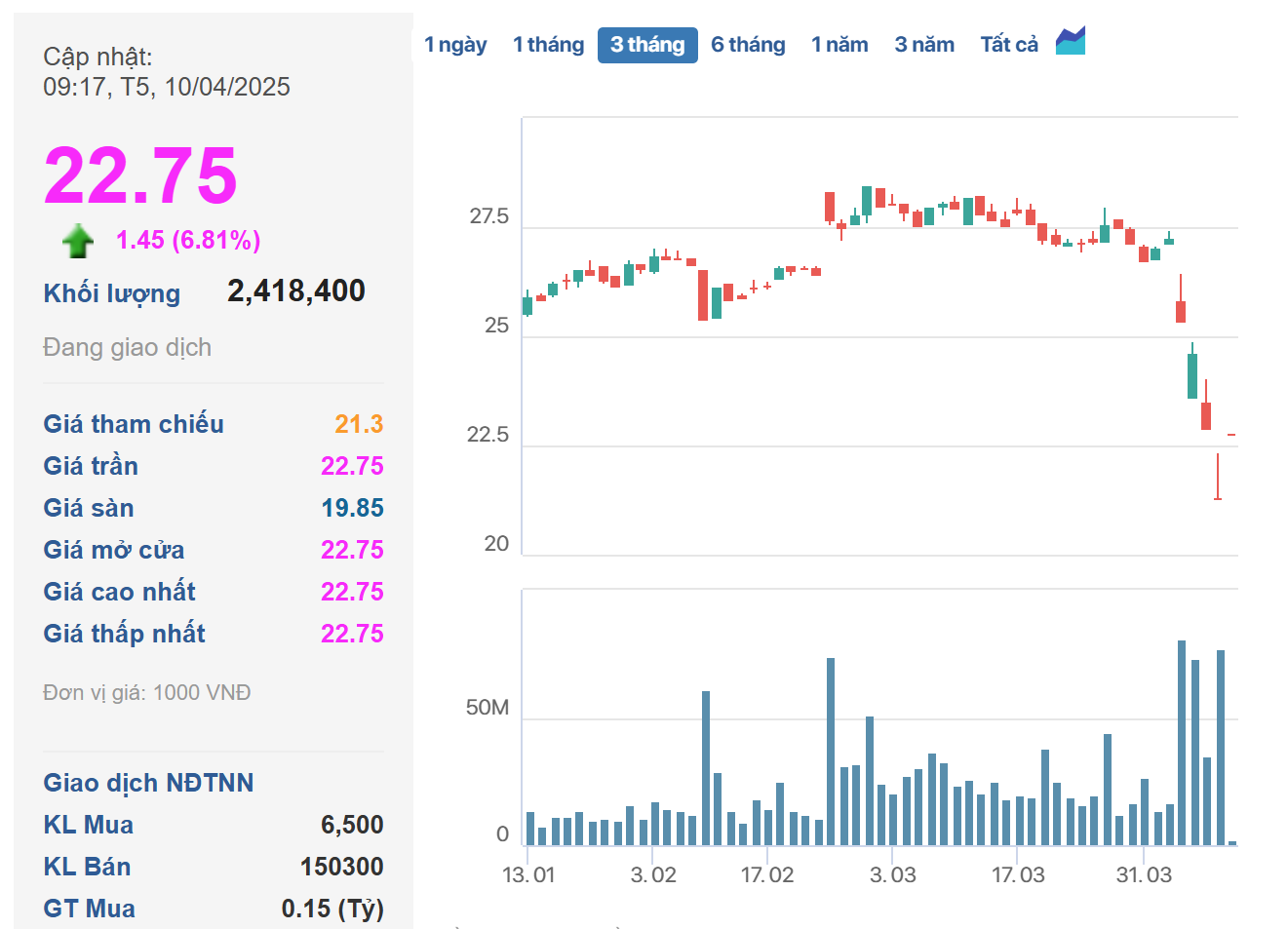

Following this news, the Vietnamese stock market surged at the opening bell, with numerous stocks reaching the maximum daily increase, including shares of Hoa Phat Group Joint Stock Company (HPG). Specifically, Hoa Phat’s shares rose 7% to the ceiling price of 22,750 VND per share.

Yesterday, Mai Phương Thúy, a beauty queen, shared on her personal Facebook page that she had purchased one million shares of Hoa Phat Group (HPG) at the floor price.

Her exact words were: “I bought one million HPG shares at the floor price, and it took me a whole day…”

It’s unclear what exactly happened, but her post could be interpreted as saying that she bought one million HPG shares during the April 9th session. On that day, HPG shares fell to the floor price of 21,300 VND per share, marking the second consecutive session of floor price decline and the fourth consecutive session of sharp decline after President Donald Trump’s announcement of retaliatory tariffs.

Assuming the floor price, the amount of money Mai Phương Thúy spent to buy one million HPG shares was 21.3 billion VND.

With HPG’s ceiling price today, the one million shares that Mai Phương Thúy bought yesterday are now worth 22.75 billion VND. She made a profit of 1.45 billion VND overnight.

Recently, Hoa Phat announced a change in its 2024 dividend payment plan.

Specifically, according to a document released at the end of March, the HPG Board of Directors proposed a 2024 dividend payment plan with a total ratio of 20%, including 5% in cash and 15% in stocks.

However, in the latest adjustment, Hoa Phat plans to pay the 2024 dividend entirely in stocks, with a ratio of 20%. If approved, the company expects to issue nearly 1.3 billion new shares.

The company attributed the adjustment to the recent developments in the Trump administration’s retaliatory import tax policy and a cautious approach to ensure cash flow.

The Seafood Savior: A Chairman’s Vow to Rescue Shareholders

“While Nam Viet has a presence in the US market, it does not consider it a primary focus. Instead, the company’s key markets lie in China, the Middle East, Brazil, Asia, Mexico, and other regions. These markets form the backbone of Nam Viet’s business, with a strong emphasis on international expansion and a diverse customer base.”

Market Beat 24/02: VN-Index Surges Past 1,300 Points as Trading Volume Improves

The market closed with strong gains, seeing the VN-Index climb 7.81 points (+0.6%), to finish at 1,304.56; while the HNX-Index rose 0.92 points (+0.39%) to 238.49. It was a relatively balanced session, with 377 advancing stocks against 373 declining ones. The large-cap VN30 basket tilted positively, as 21 stocks added value, 6 declined, and 3 were unchanged, ending the day in the green.

FPT Telecom (FOX) Aims for Record-High 2025 Profits, Targets 5,000 VND Cash Dividend per Share

FPT Telecom is taking a dynamic approach to capital expansion with a proposed 50% stock dividend. This strategic move will increase the company’s charter capital from 4,925 billion to approximately 7,388 billion VND. This stock issuance is a supplementary measure to the company’s cash dividend policy, demonstrating FPT Telecom’s commitment to rewarding its shareholders and fostering sustainable growth.