Illustrative image

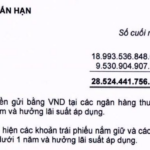

At the Forum on “Special Mechanisms and Capital Flows for the Real Estate Market” held on April 9 in Ho Chi Minh City, Mr. Nguyen Duc Lenh, Deputy Director of the State Bank’s Branch in Region 2, said that as of the end of February 2025, total credit outstanding for real estate in the city reached nearly VND 1.1 quadrillion, accounting for about 28% of the city’s total credit outstanding and up 1.15% compared to the end of 2024 (higher than the credit growth rate in the city in the first two months of the year).

Specifically, for housing loans, the credit institution system in Ho Chi Minh City also witnessed positive growth in the first two months of the year. In particular, housing credit grew by 0.51% in January 2025 and by 0.16% in February 2025.

According to Mr. Nguyen Duc Lenh, the above-mentioned growth in credit for the real estate sector, in general, and housing, in particular, has positively impacted the recovery of the real estate market and significantly contributed to the implementation of the national housing strategy.

Specifically, consumer credit for real estate, for the purpose of living, accounts for the highest proportion (66% of the total outstanding credit for real estate in the city), indicating that people have borrowing needs and have accessed credit from credit institutions quite well. Housing credit (including social housing, commercial housing, and other types of housing) reached over VND 600 trillion, up 7.39% over the same period, reinforcing this argument.

In addition, credit for real estate business and commercial services is currently growing well and faster than overall real estate credit growth. Notably, lending to industrial parks and export processing zones reached approximately VND 56,550 billion by the end of February 2025, up 33% over the same period in 2024. Lending for the construction, repair, investment, development, and operation of hotels, tourist areas, eco-tourism, and resorts reached VND 28,068 billion, up 44.4% over the same period.

“Real estate credit growth is in line with the expansion of commercial, service, and tourism activities, associated with production and business operations. This growth has positive effects and comprehensive implications, helping to boost the recovery of the real estate market and significantly contributing to the implementation of the national housing strategy,” emphasized Mr. Lenh.

Manh Duc

The New Face of Binh Duong Apartments: Unveiling the Province’s Latest Price Revolution with Rates Climbing to Nearly VND 70 Million per Square Meter

The ripple effect of rising prices in the Eastern area of Ho Chi Minh City is being felt in neighboring regions. While properties in Thu Duc City are priced at 75 – 120 million VND per square meter, just across the border in Binh Duong, prices are currently 30-50% lower. However, this price gap is expected to close in the near future, with Binh Duong potentially catching up.

The Birth of a Global Financial Hub: Proposing a 687-ha International Financial Center in Ho Chi Minh City

The Ho Chi Minh City Department of Finance has proposed two options for the development of a Financial Center, based on thorough surveys and consultations. The department has recommended the second option, encompassing an area of approximately 687 hectares, for the construction of an international financial hub.

Vingroup Launches Vinhomes Green City Project in Long An

On March 26, 2025, Vingroup inaugurated the construction of Vinhomes Green City – the first integrated township in its ecosystem in Long An. This groundbreaking ceremony marked the beginning of a potential investment opportunity, fostering prosperity and development in the entire region.