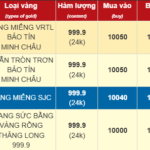

The afternoon of April 11th saw a drop in gold prices as prominent gold enterprises such as SJC and PNJ simultaneously reduced trading prices by approximately VND 1.2 million per tael compared to the morning session. The new prices stood at VND 102.2 million per tael for buying and VND 105.2 million per tael for selling.

Similarly, the buying and selling prices of 99.99% pure gold rings and jewelry were traded around VND 101.1 million and VND 104.4 million per tael, respectively, a decrease of VND 1 million per tael compared to the morning session.

According to industry insiders, domestic gold prices took a downturn as many people rushed to sell and take profits. Specifically, on the morning of April 11th, and early afternoon, a large number of customers flocked to the SJC headquarters in District 3, Ho Chi Minh City, resulting in queues as people primarily sought to sell their gold.

Gold expert Tran Duy Phuong shared that many individuals opted to sell their gold to lock in profits as domestic gold prices surpassed the VND 106 million per tael mark, far exceeding earlier predictions. Not only did this situation occur at SJC, but some gold shops also temporarily halted purchases due to the high volume of sellers or a lack of cash on hand to make payments, thus causing a rapid decline in gold prices.

Customers queue at SJC on April 11th, awaiting their turn to transact.

The selling pressure resulted from the rapid and substantial increase in gold prices over the previous days. In fact, within just two days, the price of SJC gold bullion and gold rings had surged by a total of VND 6 million per tael. Those who had purchased gold at the VND 100 million per tael level the previous week would have made a profit if they sold in the morning session.

Due to the swift and significant fluctuations in gold prices, businesses widened the buying-selling spread to up to VND 3 million per tael.

The surge in domestic gold prices mirrored global trends. In the international market, gold prices remained stable at around USD 3,218 per ounce during the afternoon of April 11th, Vietnam time. In contrast, SJC gold bullion and gold ring prices cooled off due to profit-taking by domestic investors.

Global gold prices defied all forecasts and reached unprecedented highs. Within just two days, gold prices soared by approximately USD 200 per ounce before climbing to a historic peak.

At present, global gold prices, when converted using the listed exchange rate, hover around VND 100.5 million per tael.

Many people locked in profits as gold prices reached new highs.

The Dollar Dips: Central Bank’s Intervention Causes a Stir as Gold Soars

The US dollar suffered a slump both domestically and internationally. In contrast, gold prices soared to record highs.