Illustrative image

Nam A Bank (Code: NAB) has just announced information about the trading of its insiders’ stocks. Accordingly, Mr. Hoang Viet Cuong, Vice President of Nam A Bank, registered to sell 1.8 million NAB shares for personal financial needs.

The transaction is expected to be executed by matching and/or matching orders from April 11 to May 9, 2025.

Currently, Mr. Cuong holds more than 5.7 million NAB shares, accounting for 0.417% of the charter capital. If the transaction is successful, he will reduce his holdings to over 3.9 million shares, equivalent to 0.286% of Nam A Bank’s capital.

As of April 9, NAB shares closed at VND 15,600/share. With this price, Mr. Cuong is estimated to collect about VND 28 billion if he sells all the registered shares.

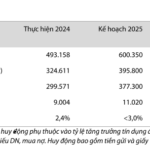

Previously, Nam A Bank announced its Q1 profit at VND 1,214 billion, up 21.52% over the same period in 2024. As of March 31, 2025, the bank’s total assets reached nearly VND 263,000 billion, up more than 7% compared to the beginning of the year. Credit activities reached nearly VND 178,000 billion, up 6% over the beginning of the year, while capital mobilization reached nearly VND 204,000 billion, up nearly 14% over the same period in 2024.

In terms of asset quality, Group 2 debt (before CIC) has decreased significantly from 1.27% at the beginning of 2025 to 0.61%, while bad debt ratio (from Group 3 to Group 5) stood at 2.23%. The bad debt coverage ratio was at nearly 54%.

At the recent 2025 Annual General Meeting of Shareholders, Nam A Bank’s shareholders approved the 2025 business plan with a consolidated pre-tax profit target of VND 5,000 billion, up 10% compared to 2024. Thus, after 3 months, Nam A Bank has achieved 24% of its full-year profit plan.

VNM ETF: New Buy on NAB, VCB Stock Soars

For the period of March 10–17, 2025, the VanEck Vectors Vietnam ETF (VNM ETF) witnessed minimal fluctuations in its portfolio. Only two stocks experienced upward movement, including NAB, which was added to the portfolio following the first quarterly review of 2025 for the MarketVector Vietnam Local Index, the reference index for the VNM ETF.

The Ultimate Guide to a Happy Holiday: Happy Lady Credit Card Offers up to 20% Cashback

Understanding the increased spending during the festive season and the upcoming Lunar New Year, Nam A Bank introduces an exclusive offer for its Happy Lady credit cardholders, with a focus on rewarding women. The promotion includes a generous cashback offer of up to 20%, along with a range of exciting benefits, ensuring a rewarding and advantageous experience for all cardholders.