Residents Rush to Stock Up on USD

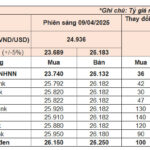

On April 10th, the State Bank of Vietnam set the daily reference exchange rate at 24,964 VND per USD, an increase of 28 VND from the previous day. This allows commercial banks to trade within the range of 23,715 to 26,212 VND per USD.

The buying and selling rates listed by the State Bank of Vietnam’s trading center increased by 36 and 40 VND, respectively, reaching 23,740-26,092 VND per USD.

The value of the USD has been on a steady rise since the beginning of the year, and it recently peaked above the 26,000 VND mark due to news of potential US tariffs. Bank exchange rates for the USD today range from 25,580 to 25,970 VND, slightly lower than yesterday’s morning rates. On the black market, the USD is trading at 26,120-26,230 VND.

Despite the ban on foreign currency trading, gold and currency exchange shops continue to operate as usual.

Ha Trung Street, bustling with USD buyers and sellers on April 10th (photo: PV).

Posing as a foreign currency buyer in the Ha Trung area of Hoan Kiem, Hanoi, Tien Phong reporters observed a constant stream of customers entering local gold shops.

At QT Gold Shop, customers selling foreign currency were served immediately at the counter outside, while those looking to buy were directed inside. The staff informed buyers that they only accepted cash and quoted a selling rate of 26,220 VND per USD on April 10th. After collecting Vietnamese dong from a customer, the employee counted the money using a machine and asked the buyer to wait while they fetched the USD. Within 30 seconds, the employee returned with the USD.

In just 5 minutes, four customers came to purchase USD. For those buying 20,000 USD or more, the shop offered to deliver the cash to their homes.

Mr. Minh Duc, a resident of Cau Giay, Hanoi, shared: “Whenever I need USD, I go to Ha Trung Street because it’s convenient. If I go to a bank, I have to explain the purpose of my purchase, and even with a valid reason, I can only buy a small amount. On this street, customers can buy as much as they want. I’m buying USD because of the global instability, the surge in gold prices, and the lack of appealing investment options elsewhere. I’m hoping for a significant jump in the USD rate in the next few months.”

At another gold shop on the same street, I was quoted a rate of 26,230 VND per USD, just 10 VND higher than the previous shop.

Exchange Rate Pressures Persist

Vietcombank Securities Company (VCBS) predicts that in the short term, with uncertainties and no final decision on retaliatory tariffs, exchange rates will fluctuate more. Concerns about tariff-related risks may lead to slower foreign investment registration and disbursement.

Additionally, export activities, particularly to the US market, could face delays or setbacks. Meanwhile, Vietnam’s foreign exchange reserves are currently limited.

VCBS specifically highlights the potential for exchange rate pressures in the short term, especially during the wait for news on the final US tariff decision. However, the analysts remain optimistic that monetary policy can be managed to support businesses and promote sustainable growth.

Mr. Nguyen Hoai Linh, Head of Research at Vietcombank Fund Management Company (VCBF), attributes the high USD rate to Vietnam’s trade surplus in the first quarter, with import growth outpacing export growth.

According to Mr. Linh, the State Treasury has increased its foreign currency purchases to repay foreign debts in the first quarter, estimated at around $1.5 billion. This surge in

The Dollar Dips: Central Bank’s Intervention Causes a Stir as Gold Soars

The US dollar suffered a slump both domestically and internationally. In contrast, gold prices soared to record highs.

“Gelex’s AGM: We Won’t Participate in Eximbank’s Management but Are Willing to Join the Board if Needed”

According to Mr. Nguyen Trong Hien, Chairman of the Board of Directors, in the first quarter of 2025, Gelex’s revenue grew by 16% compared to the same period in 2024. The company also achieved impressive pre-tax profits of VND 600 billion, a significant increase of 58% from the first quarter of 2024.

![[IR AWARDS] June 2025 Disclosure Calendar: Mark Your Dates](https://xe.today/wp-content/uploads/2025/06/HinhT6_01-218x150.png)