Today’s trading action was condensed into the last 30 minutes of continuous trading, when several leading large-cap stocks suddenly reversed direction. The pressure from this group was intense, causing the VN-Index to plunge from a peak of 17.4 points (+1.43%) to just above the reference level, ending the session with a modest gain of 1.87 points (+0.15%).

The volatility can be attributed to VIC, which, after a stellar 4.6% surge yesterday, managed only a slight uptick during a very brief period today. By the session’s close, VIC had plummeted to a 4.23% loss, and in the final 15 minutes, it was pushed down to its floor price, ending unchanged. VHM also exhibited weakness but managed to hold relatively steady in the afternoon session. It closed with a loss of 3.17%, having dropped to 6.16% about five minutes before the end of continuous trading from a morning low of 3.7%.

The unfavorable performance of these two leading stocks was counterbalanced by gains in several other blue-chip stocks for most of the session. Despite VIC and VHM’s persistent declines, the VN-Index even climbed to an intraday high in the middle of the afternoon session. It was only when other pillars weakened that the VN-Index took such a rapid dive.

All top 10 stocks by market capitalization suffered significant setbacks, not just VIC and VHM. VCB, which was up 2.41% about two hours before the close, ended unchanged after being stable for the final few minutes. BID, the market’s third-largest stock after VCB and VIC, also fell about 0.83% from its peak, closing up a modest 0.28%. CTG gave back 1.58% from its high, ending up a slight 0.54%. TCB mirrored VCB, erasing its 1.89% gain in the final few minutes to close unchanged. FPT, the strongest pillar, rose 2.01% at the close, but this still represented a near 3% evaporation from its highest level…

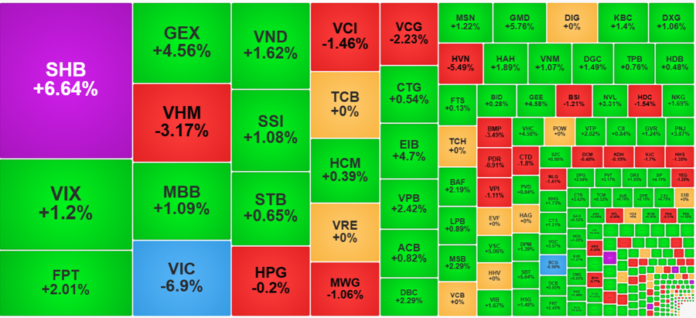

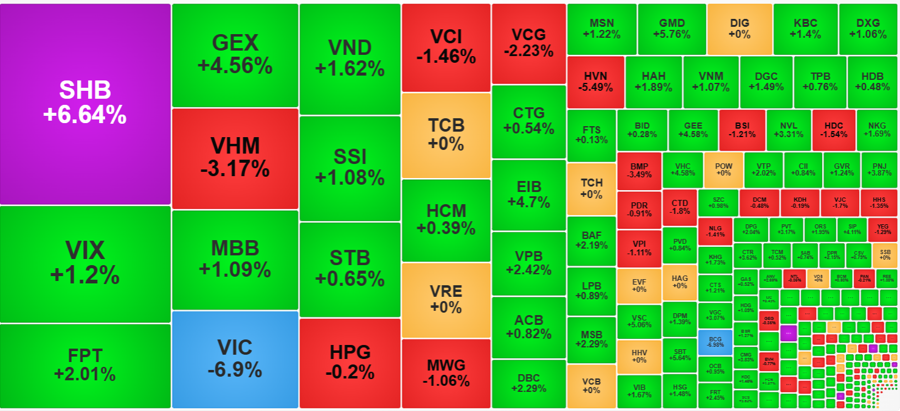

The VN30-Index closed up 0.25%, with 20 gainers and 6 losers, but this was a poor outcome compared to its intraday high of 1.48%. Statistics showed that 24 stocks fell from their morning close, and only SHB among the 30 stocks maintained its highest level. As many as 25 stocks fell by at least 1% from their peaks. SHB was very stable during this session, hitting its ceiling price early and sustaining it for an extended period with millions of buy orders. Unfortunately, SHB’s market capitalization is limited, contributing only 0.85 points to the VN-Index, while VIC alone wiped out 4.6 points.

Excluding the volatility of the pillar stocks, the market performed rather well today. Firstly, the breadth remained favorable, with 321 gainers and 136 losers. At 2:00 PM, when the VN-Index hit its intraday high, the breadth stood at 373 gainers and 101 losers. Thus, the index’s plunge did not trigger a significant sell-off in stocks but rather narrowed the breadth of gains.

Statistics from the HoSE showed that 56.6% of stocks had fallen by at least 1% from their daily highs. Despite this substantial number, the bullish sentiment prevailed, which is a positive sign. Furthermore, among the 321 gainers, 153 stocks rose more than 1%, including nearly 100 stocks that climbed over 2%. Evidently, stocks remain robust, except for the VN-Index and VN30-Index, which underperformed. The mid-cap and small-cap indices also reflected this strength, rising 1.52% and 1.13%, respectively.

Even within the VN30 basket, nine stocks exhibited considerable strength, climbing over 1%. Among the banks, while TCB and VCB faced evident pressure, SHB hit its ceiling, VPB rose 2.42%, VIB gained 1.67%, and MBB increased by 1.09%. Notable performers in the securities sector included VIX, which climbed 1.2% with a liquidity of 1,164 billion VND, VND with a gain of 1.62%, and SSI with a rise of 1.08%. Real estate stocks such as KBC, DXG, and NVL also witnessed robust trading volumes and substantial price increases. Additionally, DBC, GEX, GMD, HAH, DGC, BAF, GEE, and NKG were actively traded.

On the downside, aside from VIC and VHM, only a few stocks stood out. VCI unexpectedly plummeted 1.46% in the ATC session, despite its impressive performance earlier. MWG, VCG, HVN, BSI, HDC, BMP, and VPI were other stocks that declined by over 1%, each with a liquidity of hundreds of billion VND. However, the remaining stocks mostly experienced minor declines or traded with minimal volume.

The pillar-driven volatility significantly impacted the VN-Index but has not yet caused substantial disruptions in individual stocks. This suggests that money is still being selectively invested and supported. The matched order liquidity on the two listed exchanges today reached 22.35 trillion VND, a nearly 35% increase from yesterday and the highest level in the last three sessions.

The Stock Market Soars: Over 80 Billion Bank Shares Surge as Vietnam Breathes a Sigh of Relief with the US Tariff Delay

On the morning of April 10, all 27 banking codes with over 80 billion shares reached the ceiling price. The industry’s liquidity was extremely low, with a series of “white” codes on the sell side and a surplus of tens of millions of units on the buy side.

Market Beat 24/02: VN-Index Surges Past 1,300 Points as Trading Volume Improves

The market closed with strong gains, seeing the VN-Index climb 7.81 points (+0.6%), to finish at 1,304.56; while the HNX-Index rose 0.92 points (+0.39%) to 238.49. It was a relatively balanced session, with 377 advancing stocks against 373 declining ones. The large-cap VN30 basket tilted positively, as 21 stocks added value, 6 declined, and 3 were unchanged, ending the day in the green.

The Foreigners’ Sell-Off: A Mid-March Meltdown?

“In contrast, VHM stocks witnessed a significant net buying position with a substantial investment of 124 billion VND, while VCI stocks also experienced robust net buying, totaling 99 billion VND.”