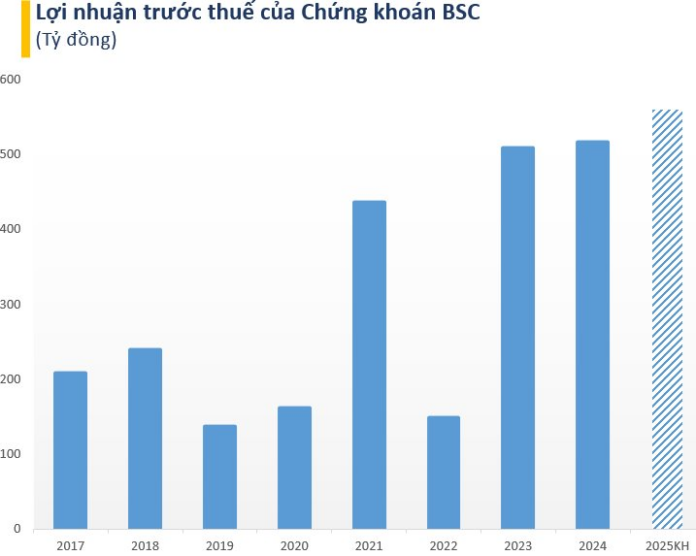

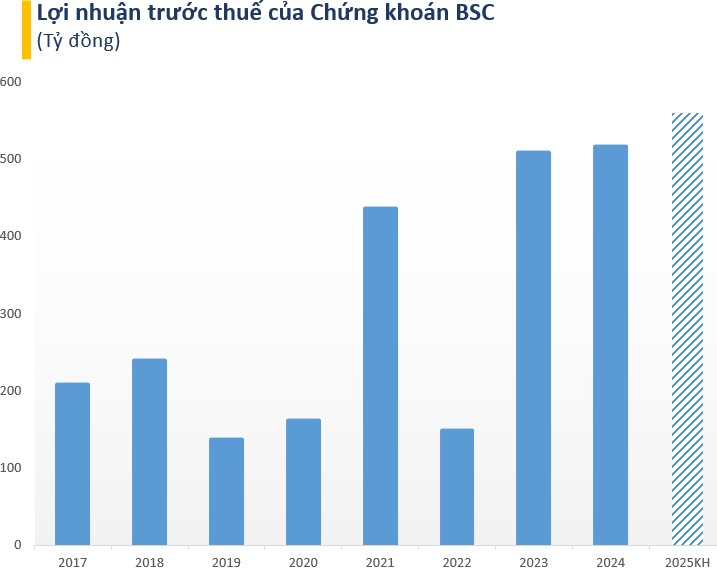

On April 18th, BIDV Securities Joint Stock Company (code: BSI) successfully organized its 2025 Annual General Meeting of Shareholders. BSC sets a pre-tax profit target of VND 560 billion for 2025, a 9% increase from last year’s record. The company also aims for a capital adequacy ratio of 260%.

Based on the assessment of Vietnam’s macroeconomic prospects and stock market in 2025, BSC has identified six key objectives for the year to maintain the company’s sustainable development: Enhancing financial capacity, Comprehensive growth, Expanding profitable assets, Digital transformation, Improving human resource and monetary policies, and Efficient risk management.

The management board acknowledges the favorable factors impacting the securities industry this year, including the macroeconomic recovery and low-interest-rate environment, which facilitate capital inflow into the stock market, and the prospect of market upgrade. The momentum also comes from the “institutional, human, and structural” revolution, which is laying a solid foundation for economic development and enhancing the stock market’s attractiveness.

Some challenges are also identified, such as the uncertain risk of US trade and tariff policies towards Vietnam, intensifying market share competition, and pressure on exchange rate appreciation in the context of low-interest rates, hindering the re-entry of foreign capital into the market.

Regarding 2024’s business results, BSC recorded operating revenue of VND 1,411 billion, a 12% increase from 2023. Pre-tax profit reached a record high of nearly VND 516 billion, a 1.3% increase compared to the previous year.

Regarding the profit distribution plan, the meeting approved the 2024 dividend payment in stocks to increase charter capital, with a ratio of 10% (meaning that for every 10 shares held, shareholders will receive 1 new issued share). BSC’s charter capital after issuance is expected to be nearly VND 2,454 billion.

In 2025, shareholders continue to approve the dividend payment plan with a ratio of 10% of the par value of shares. The payment will be made in cash or stocks, and the Board of Directors is authorized to decide the appropriate form.

Discussion:

1. What is BSC’s view on the new US tariff policy, and how will it impact the Vietnamese economy and stock market? Specifically, how does this policy affect BSC’s operations, and how will the company respond?

Chairman of the Board of Directors, Ngo Van Dung: The US President’s tariff policy can significantly affect the Vietnamese economy, as about 30% of Vietnam’s export turnover is directed to the US market. The direct impact will be on exporting industries such as textiles, furniture, and logistics.

Apart from direct impacts, there are indirect effects that are difficult to quantify, such as risks related to labor, employment, domestic consumption, and exchange rates. These factors could lead to a shift in FDI out of Vietnam.

In fact, after the US announced its tariff policy, the VN-Index experienced a sharp decline before recovering. In the coming time, the market is expected to continue to fluctuate unpredictably if there are no positive negotiation results.

However, we remain optimistic due to several strong supporting factors. Among them, the expected market upgrade in the third quarter of this year is a significant highlight. The new KRX trading system, scheduled to go live on May 5, will also boost the market’s transparency and modernity.

In terms of specific actions, BSC has been implementing the following solutions:

Conducting impact analysis by industry and by specific enterprise. Based on this analysis, the company will re-evaluate stocks reasonably, providing consultants with a basis to support customers in restructuring their portfolios and selecting suitable enterprises with less negative impact, thereby retaining customers more effectively.

Optimizing proprietary trading: As proprietary trading currently accounts for about 30% of BSC’s total income, the company pays special attention to scientifically analyzing the impact of policies on stock prices, thereby proactively adjusting its investment portfolio to minimize risks and optimize profitability.

Enhancing internal management: BSC is also rigorously controlling internal risks and ensuring efficient and flexible operations in the context of global economic fluctuations.

2. What is BSC’s proprietary trading strategy going forward? Will the company continue to invest in bonds, given the significant increase in this item since the beginning of the year? What is the optimal direction for revenue and profit in the current context?

General Director Nguyen Duy Vien: Currently, BSC’s bond investment portfolio accounts for about 60-70% of equity. About 90% of this portfolio comprises bank bonds – those of leading financial institutions with high liquidity and low risk. We are confident that this is a very high-quality and safe investment portfolio.

In parallel with focusing on bank bonds, BSC is also selecting investments in leading listed companies in the stock market.

Regarding the strategy for optimizing revenue and profit, we prioritize risk management, especially in the context of the Vietnamese stock market’s complexity. Therefore, although the yield of bonds of leading enterprises is usually lower than that of C and D-rated enterprises, BSC accepts this profit level for safety and stability. The investment strategy will continue to focus on the bonds of large commercial banks and enterprises in group A.

3. In the past time, what has strategic shareholder Hana Bank supported BSC with? How has the application of technology at the company been implemented, and what notable results have been achieved?

General Director Nguyen Duy Vien: Currently, the general trend in the Vietnamese stock market is for securities companies to shift to technology-based brokerage.

However, BSC has some outstanding advantages:

First, as a subsidiary of BIDV – a bank with a modern information technology system and a vast customer network, BSC can deeply integrate into BIDV’s technology ecosystem, providing seamless and more convenient experiences for customers.

Second, our major shareholder, Hana Securities (a member of the Hana Financial Group from South Korea), is very strong in technology. In the past time, Hana has sent experts to Vietnam to evaluate and support BSC in transferring advanced products and technology solutions. Many of these products were handed over free of charge – a significant competitive advantage for BSC in today’s market.

The Big Cap Let Loose: VN-Index Loses Most of its Gains, Stocks Still Impressively Reverse

The trading session today witnessed a dramatic turnaround in the final 30 minutes of continuous trading, with leading large-cap stocks suddenly reversing course. The heavy selling pressure from these stocks dragged the VN-Index down from its intraday high of 17.4 points (+1.43%) to just above the breakeven point, eventually closing with a modest gain of 1.87 points (+0.15%).

The Stock Market Soars: Over 80 Billion Bank Shares Surge as Vietnam Breathes a Sigh of Relief with the US Tariff Delay

On the morning of April 10, all 27 banking codes with over 80 billion shares reached the ceiling price. The industry’s liquidity was extremely low, with a series of “white” codes on the sell side and a surplus of tens of millions of units on the buy side.

Market Beat 24/02: VN-Index Surges Past 1,300 Points as Trading Volume Improves

The market closed with strong gains, seeing the VN-Index climb 7.81 points (+0.6%), to finish at 1,304.56; while the HNX-Index rose 0.92 points (+0.39%) to 238.49. It was a relatively balanced session, with 377 advancing stocks against 373 declining ones. The large-cap VN30 basket tilted positively, as 21 stocks added value, 6 declined, and 3 were unchanged, ending the day in the green.