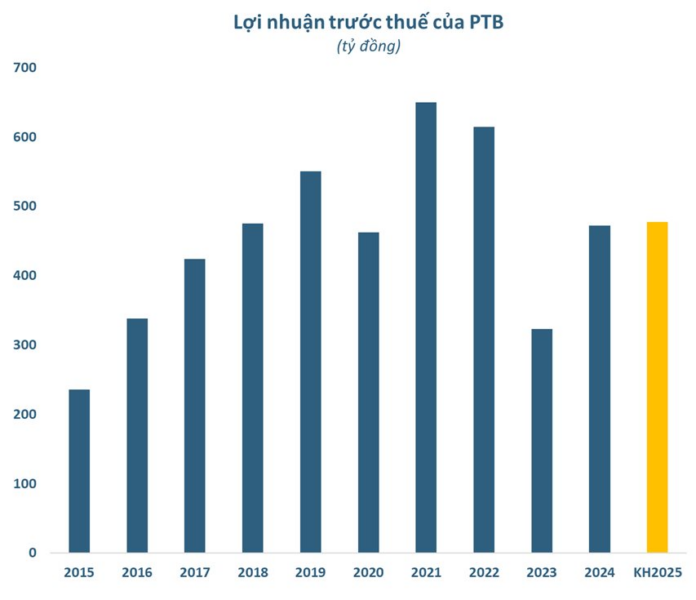

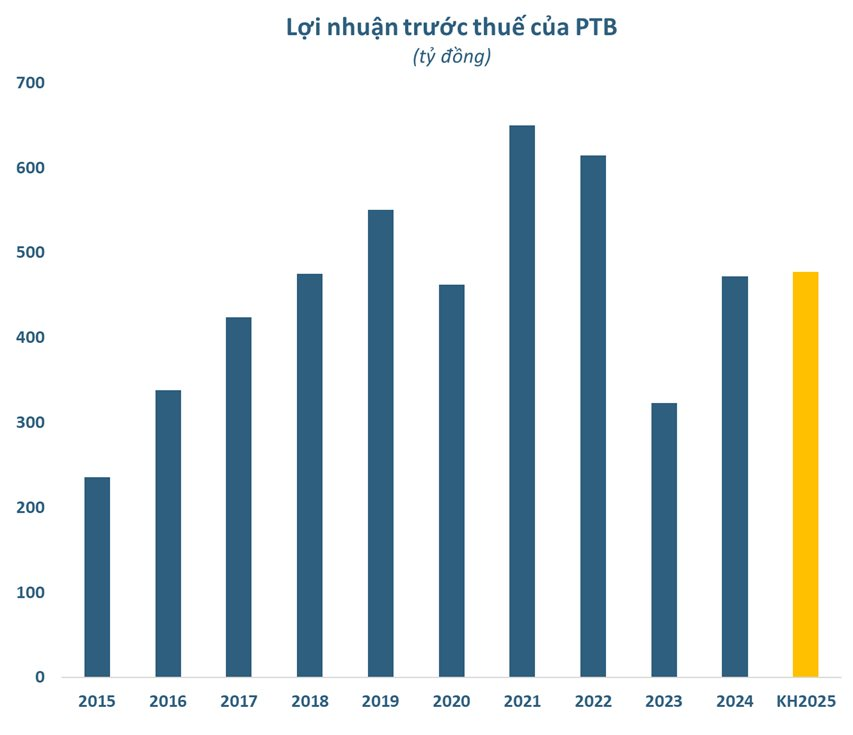

On April 15th, Phu Tai Joint Stock Company (code PTB) held its 2025 Annual General Meeting of Shareholders. According to updates from Vietcap, the shareholders approved the business plan with consolidated revenue of VND 6,670 billion, unchanged from the previous year, and a pre-tax profit target of VND 477 billion, a slight increase of 1%.

Vietcap informed that the business plan announced and approved at the meeting is 8% lower than the figure announced at the beginning of the year. The management attributed this adjustment to the impact of the 10% countervailing duty imposed on exports to the US.

Additionally, Phu Tai expects the export tax on wooden products to the US to be around 20%, while anticipating equivalent tax rates for stone products among competing exporting countries such as Thailand and India.

In the wood segment, the management of PTB shared that they have received orders for Q3 2024 and are continuing to take orders for Q4 2024. Notably, US customers are placing a significant number of orders for Q2 2024 and requesting expedited production within the 90-day temporary tax suspension under President Donald Trump’s policy. This reflects the urgency of buyers amid the uncertain outcome of tariff negotiations.

According to Vietcap, PTB’s wooden product exports to the US are currently subject to a 10% tax rate. Phu Tai, along with other companies in the industry, is negotiating cost-sharing with customers while continuing its market and product diversification strategy. However, market diversification is a long-term solution, as penetrating new markets is time-consuming and complex.

Phu Tai plans to commence exports of wood pellets from Q3 2025, targeting Asian markets (Japan, South Korea) and Europe. The management aims for a gross profit margin of approximately 10% and considers investing in a second factory if market demand is strong enough. Phu Tai currently holds the FSC certification, a standard trusted by European and American markets for wood product origin traceability.

In the stone segment, regarding natural stone products, Phu Tai has scaled back this segment in recent years due to market saturation and intense competition. However, from 2025 onwards, the management expects demand to improve thanks to increased public investment in Vietnam, particularly in large-scale projects such as the Long Thanh International Airport, the expansion of Noi Bai Terminal T2, and the North-South high-speed railway. As of now, PTB has delivered approximately 18% of the committed volume for the Noi Bai Terminal T2 project, with estimated total revenue of VND 40 billion.

Furthermore, the company’s management anticipates that the final tax rate for stone exports will be equivalent among competing countries like Thailand and India, thereby reducing the relative disadvantage for Vietnamese exporters.

In the real estate segment, the Phu Tai Residence project has approximately 80 apartments left, which are expected to be sold out by 2025. Phu Tai Central Life is scheduled for handover on September 30, 2025. The project comprises 320 apartments, targeting full sales before 2026, with 30-40% absorption expected in 2025.

The Phu Tai Dieu Tri project, spanning 15 hectares, includes 320 villas and townhouses, with construction and sales planned for completion by 2026. As for Phu Tai Van Ha, the 49-hectare land is currently in the process of site clearance. The management aims to complete the entire project by 2028.

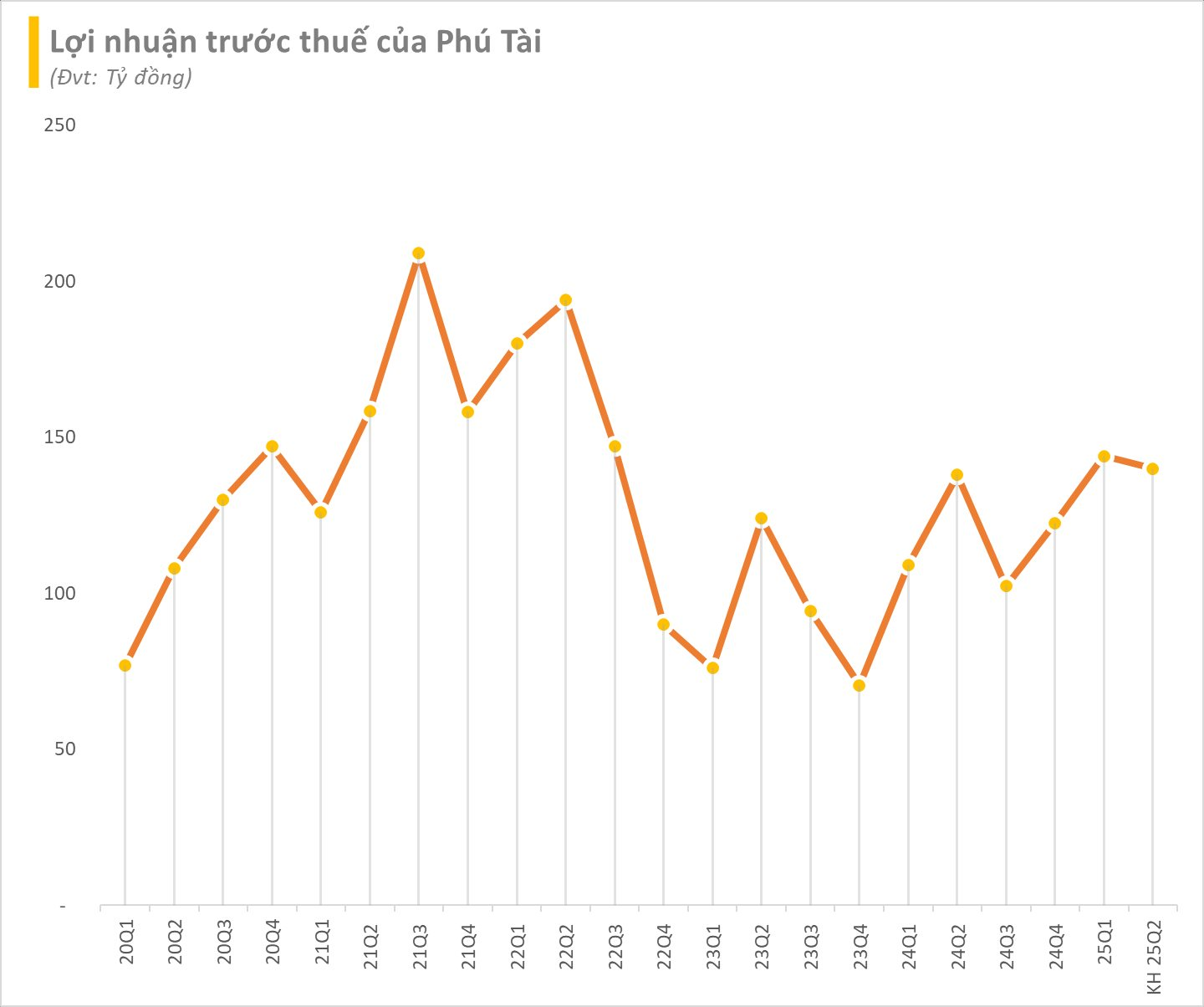

For the first three months of the year, Phu Tai recorded a revenue of VND 1,635 billion, a 12% increase compared to the same period last year. After expenses, the company’s pre-tax profit reached VND 144 billion, a significant 32% rise compared to Q1 2024.

For Q2 2025, the company sets consolidated revenue and pre-tax profit targets of VND 1,743 billion and VND 140 billion, respectively, representing a 9% and 15% increase compared to the same period last year.

During this General Meeting, shareholders also approved the resignation of Mr. Le Vy from the position of Chairman of the Board due to his advanced age. The meeting appointed Mr. Le Van Thao, the former General Director, as the new Chairman of the Board. Mr. Nguyen Sy Hoe was promoted from Deputy General Director to General Director, succeeding Mr. Thao. Additionally, Mr. Le Anh Van was appointed as a member of the Board of Directors. Mr. Van currently serves as Deputy General Director and Head of the Business Department at PTB.

According to Vietcap, this decision was primarily due to Mr. Le Vy’s age (67 years old). It is part of an internal restructuring process aimed at maintaining stability in Phu Tai’s operations, and it does not reflect any significant changes in the company’s structure or business operations.

The Green Investment Line: International Standard Sustainable Solutions in Ha Nam

With hundreds of expatriate senior experts choosing it as their long-term residence, Villa Flamingo Golden Hill is emerging as a safe and sustainable investment choice that appreciates over time.