|

HSC’s Q1 2025 Financial Results

Source: VietstockFinance

|

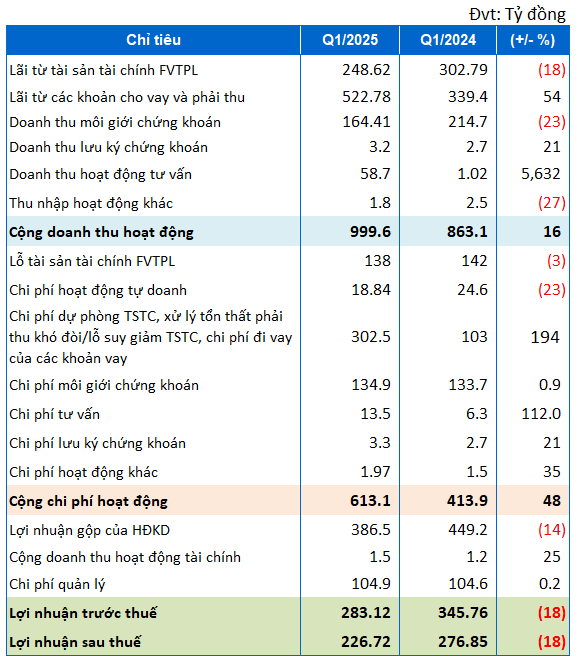

In the first quarter, the securities brokerage segment recorded revenue of over VND 164 billion, a 23% decrease compared to the same period last year. In lending activities, interest income from loans and receivables reached VND 523 billion, a 54% increase year-on-year. Margin loan balance at the end of Q1 was nearly VND 20,390 billion, slightly down from VND 20,428 billion at the beginning of the year.

In terms of proprietary trading, net revenue for Q1 was VND 111 billion, a 31% decrease compared to the same period in 2024. This decrease was due to a 18% reduction in profit from financial assets measured at FVTPL, amounting to nearly VND 250 billion.

The consulting segment performed well, with revenue of nearly VND 59 billion, a more than 57.5-fold increase year-on-year.

On the expense side, brokerage expenses and borrowing costs for loans were the two most notable items. Brokerage expenses accounted for nearly VND 135 billion, a slight 1% increase year-on-year, while borrowing costs tripled to over VND 300 billion compared to the same period last year.

After deducting expenses, HSC reported pre-tax profit for Q1 2025 of VND 283 billion, an 18% decrease compared to Q1 2024. Net income was nearly VND 227 billion, also down by 18%.

As of March 31, 2025, HSC’s total assets amounted to VND 30.4 trillion, with equity reaching VND 10.3 trillion.

The margin lending service segment has been the main contributor to HSC’s revenue. The company’s loan balance has consistently remained close to the regulatory limit (200% of equity). As of Q1 2025, margin debt stood at VND 20.4 trillion, slightly down from the beginning of the year and representing 197% of equity.

| HSC’s Loan Balance by Quarter |

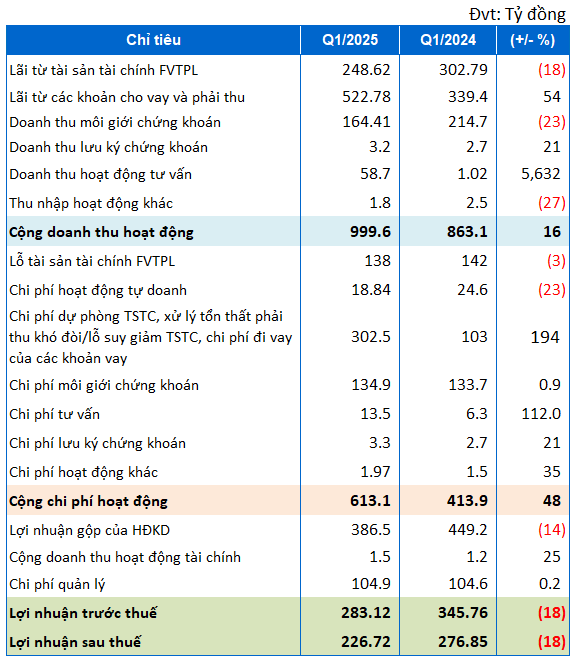

The company’s short-term borrowings at the end of the period were VND 19.5 trillion, accounting for 97% of total liabilities. Domestic loans carried an interest rate of 4.3% to 8% per annum, while the foreign loan bore an interest rate of SORF + 2.262 – 2.65% per annum (SORF is the representative interest rate for short-term secured borrowings in the US financial market).

|

HSC’s Loan Disbursement Statement

Source: HSC’s Financial Statements

|

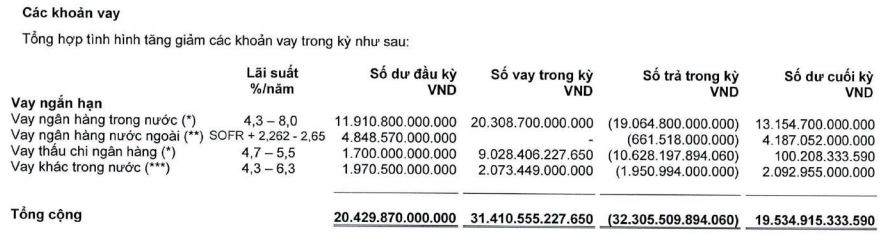

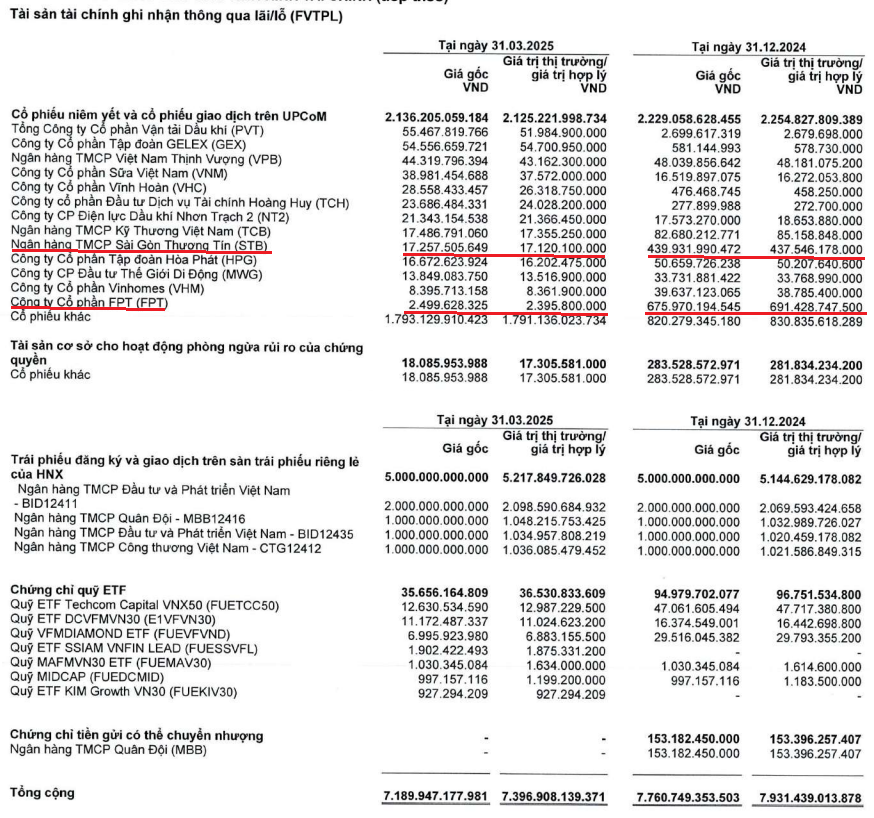

The balance of financial assets measured at FVTPL at the end of Q1 was nearly VND 7.4 trillion, a decrease of nearly 7% from the beginning of the year. The company invested VND 5,000 billion in bonds of large banks such as BIDV, MBBank, and VietinBank, and VND 2,136 billion in stocks (temporarily losing VND 10 billion at the end of Q1).

Notable stock holdings at the end of Q1 included PVT, GEX, VPB, VNM, VHC, and TCH…

At the end of the previous year, the company allocated a significant proportion to FPT and STB stocks, with investments of VND 676 billion and VND 440 billion, respectively. However, by the end of Q1 2025, the investment values had decreased to VND 2.5 billion and VND 17.2 billion, respectively.

|

HSC’s FVTPL Asset Portfolio

Source: HSC’s Financial Statements

|

– 11:16 21/04/2025

The Oil Magnate’s Misfortunes: A Tale of Tax Troubles, Mounting Losses, and Bank Loans

For the year 2024, NSH Petro witnessed a staggering 89% decline in revenue, amounting to just over VND 678 billion, a significant drop from the previous year’s performance. The company reported a staggering loss of nearly VND 790 billion in after-tax profits for 2024, a stark contrast to the VND 47 billion profit achieved in 2023.

The Big Three: A Trio of Talented Deputies Take the Helm at a Prominent Bank

With the appointment of three new leaders, the bank’s executive board now comprises a total of ten esteemed members.